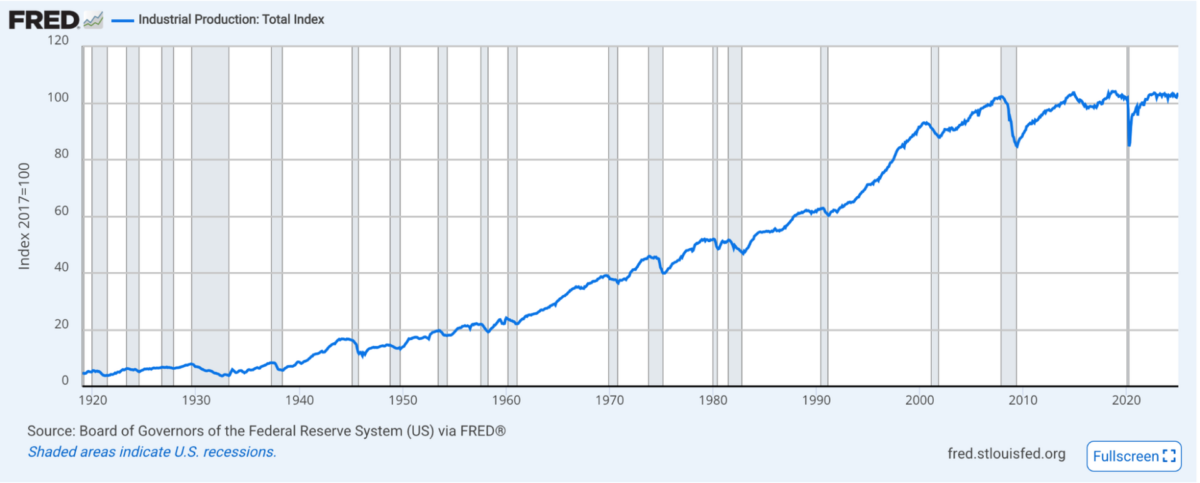

Industrial production in the United States has been in a rut since the Great Financial Crisis of 2008-2009. Despite periods of economic growth over the past 15 years, manufacturing output has struggled to regain its pre-crisis momentum. This stagnation presents a significant challenge for policymakers and business leaders alike.

This is JP Hampstead, co-host of the Bring It Home podcast with Craig Fuller. Welcome to the 14th edition of our newsletter, which asks if industrial policy is the way to get U.S. industrial production unstuck.

Since 2011, U.S. manufacturing productivity has hit a ceiling and even declined in some years. This stagnation isn’t mirrored in other sectors of the economy, with service industries picking up the slack in overall productivity growth. The situation is particularly concerning when compared to other advanced economies – countries like Germany, South Korea and France have managed to increase their manufacturing productivity over the same period.

Several factors contribute to the stagnation in U.S. industrial production. There has been significant underinvestment in machinery and equipment, with U.S. manufacturers demonstrating reluctance to adopt new technologies and to invest in capital infrastructure. This hesitation has resulted in many American factories relying on outdated machinery, which hampers efficiency and innovation. Furthermore, the widening gap between the most and least productive manufacturers has led to a concentration of industry power. Only a select few companies are pushing technological boundaries, while the majority fall behind.

For the past few decades, the U.S. manufacturing sector has placed limited emphasis on exports. In comparison to other advanced economies, U.S. exports constitute a smaller fraction of GDP, which restricts exposure to global markets and limits growth and innovation opportunities. Compounding these issues is a widening skills gap. The skills required by modern manufacturing processes are increasingly mismatched with those offered by the current workforce.

(Photo: Mixabest/Creative Commons)

In response to these challenges, there’s been a renewed interest in industrial policy – targeted government interventions designed to boost specific sectors or technologies. Once out of favor in many Western countries, industrial policy is making a comeback as policymakers grapple with economic challenges and geopolitical competition. The CHIPS Act, which is pouring hundreds of billions of dollars into electric vehicles, batteries, semiconductors and solar energy, is a prominent recent example.

But industrial policy has a long history in the United States. After World War II, initiatives like the Apollo space program and the work of the Defense Advanced Research Projects Agency successfully stimulated innovation in key sectors. Then, the end of the Cold War and a growing skepticism toward government bloat and inefficiency in the 1980s began a decadeslong privatization and “free market” push that drove industrial policy out of the national conversation.

Now a new wave of industrial policy is emerging. The aggressive support that Beijing has extended to its manufacturing sector has prompted the United States to consider implementing a more active industrial policy to maintain its competitive edge. National security concerns have also become increasingly pertinent, with the COVID-19 pandemic and rising geopolitical tensions underscoring the critical importance of having robust domestic manufacturing capabilities for essential goods. Lastly, there is a strong emphasis on maintaining technological leadership, especially in emerging fields such as artificial intelligence and quantum computing, to ensure both economic vitality and national security. These combined pressures are shaping the renewed interest and strategic approach in U.S. industrial policy.

While industrial policy holds promise for revitalizing U.S. manufacturing, its success is not guaranteed. To maximize the chances of positive outcomes, policymakers and industry leaders must prioritize several strategies. There’s still a need to focus on innovation by supporting research and development in key technologies. This involves fostering collaboration among universities, government labs and private industry to drive technological advancement. Additionally, addressing the skills gap is crucial, which can be achieved through targeted training programs and partnerships with educational institutions that prepare the workforce for the demands of modern manufacturing.

Infrastructure modernization is another essential component, requiring improvements in transportation networks, energy systems and digital infrastructure to support advanced manufacturing. Encouraging reshoring is also vital; providing incentives for companies to bring production back to the U.S., especially in critical industries, can strengthen the domestic industrial base. Supporting the growth of small and medium-size enterprises is important, as these firms often drive technological advancements and spur productivity.

To compete more effectively in global markets, strategies to promote exports need to be developed, enabling U.S. manufacturers to expand their reach and influence. Ensuring policy coherence across different government agencies and levels of governance is imperative to maximize the impact of industrial policy efforts. This coordinated approach ensures that initiatives are aligned and resources are used efficiently to foster the resurgence of U.S. manufacturing. Through a combination of innovation, investment and strategic policy, the U.S. could reclaim its position as a global manufacturing powerhouse.

Quotable

“America cannot afford to auction off its industrial base.”

– Then-Sen. JD Vance, 2023

Infographic

U.S. industrial production has only grown approximately 1.5% since the summer of 2007. (Chart: St. Louis Federal Reserve)

News from around the web

Eaton Increasing Transformer Manufacturing with South Carolina Investment

Power management company Eaton said it is helping address the critical shortage of transformers, along with record demand for its solutions from utility, large commercial, industrial and data center customers, with a $340 million investment to increase U.S. production of its three-phase transformers essential to reliable electrical power.

Production and hiring at Eaton’s new Jonesville, South Carolina, facility is expected to begin in 2027. Eaton will also continue to manufacture three-phase transformers at two Wisconsin facilities.

Key Tronic to invest $28 million into Springdale site, add more than 400 jobs

Spokane Valley, Washington-based electronics manufacturer Key Tronic Corp. will invest $28 million to relocate its Fayetteville, Arkansas, plant to a 290,540-square-foot industrial building in Springdale, Arkansas, according to a Thursday news release.

The move is expected to increase its U.S. production capacity by about 40% and create more than 400 jobs over five years as the company expands production to meet customer demand and mitigate tariff impacts.

Isuzu to invest $280M for new production base in South Carolina

Isuzu’s total investment in the plant (including land, building, tooling and equipment) is expected to equal approximately $280 million. The plant will have a production capacity of 50,000 units by 2030 and will initially produce Isuzu N-Series Gas, N-Series Electric and F-Series Diesel trucks. Initial assembly operations will begin in 2027 and will further expand in 2028, at which time the plant is expected to employ more than 700 people.