In a week marked by mixed performances among major U.S. stock indexes, growth stocks have continued to rally, with the S&P 500 and Nasdaq Composite hitting record highs despite the Russell 2000’s decline after weeks of outperformance. Amidst this backdrop, high-growth tech stocks remain a focal point for investors, as these companies often thrive in environments where innovation and rapid expansion are highly valued—key attributes that can be particularly appealing when market conditions favor growth over value.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our High Growth Tech and AI Stocks screener.

Let’s dive into some prime choices out of from the screener.

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Banijay Group N.V. operates in content production, distribution, online sports betting, and gaming across the USA, Europe, and internationally with a market cap of €3.64 billion.

Operations: Banijay Group N.V. generates revenue primarily through its Banijay Entertainment & Banijay Live segment, which accounts for €3.26 billion, and its Banijay Gaming segment, contributing €1.32 billion.

Banijay Group N.V. has demonstrated a robust financial trajectory, with earnings skyrocketing by 931.6% over the past year, significantly outpacing the entertainment industry’s growth of 5.3%. This momentum is expected to sustain as forecasts predict annual earnings growth of 38.1%, eclipsing the Dutch market’s projection of 15.8%. Despite a forecasted revenue increase of 8.4% per year falling slightly below the Dutch market average of 8.7%, Banijay’s strategic focus on content production and distribution is poised for success, underscored by upcoming major releases like “Marie-Antoinette” for Canal+ and “SAS Rogue Heroes” for BBC One in Q4 2024, which should bolster its competitive edge in high-demand media segments.

Simply Wall St Growth Rating: ★★★★★☆

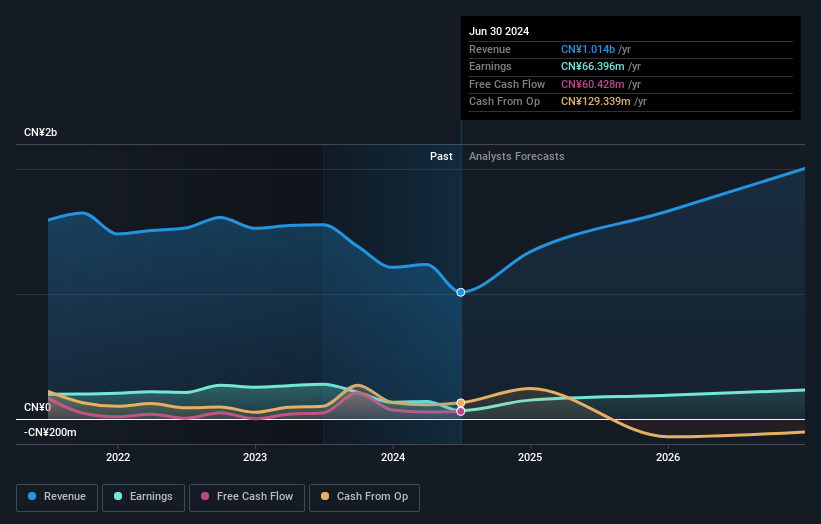

Overview: Beijing eGOVA Co., Ltd is a smart city core application and operation service provider in China with a market cap of CN¥12.06 billion.

Operations: The company focuses on providing smart city solutions, leveraging its expertise in core applications and operational services across China.

Despite recent setbacks with a significant drop in sales and net income as reported for the nine months ending September 2024, Beijing eGOVA Co. demonstrates potential with an ambitious revenue forecast growth of 31% per year, outpacing the Chinese market average of 13.8%. The company’s commitment to innovation is evident in its R&D investments, aligning with its strategy to pivot towards profitability within three years. This focus on development could position eGOVA favorably as it aims to harness emerging tech trends and meet evolving market demands.

Simply Wall St Growth Rating: ★★★★★☆

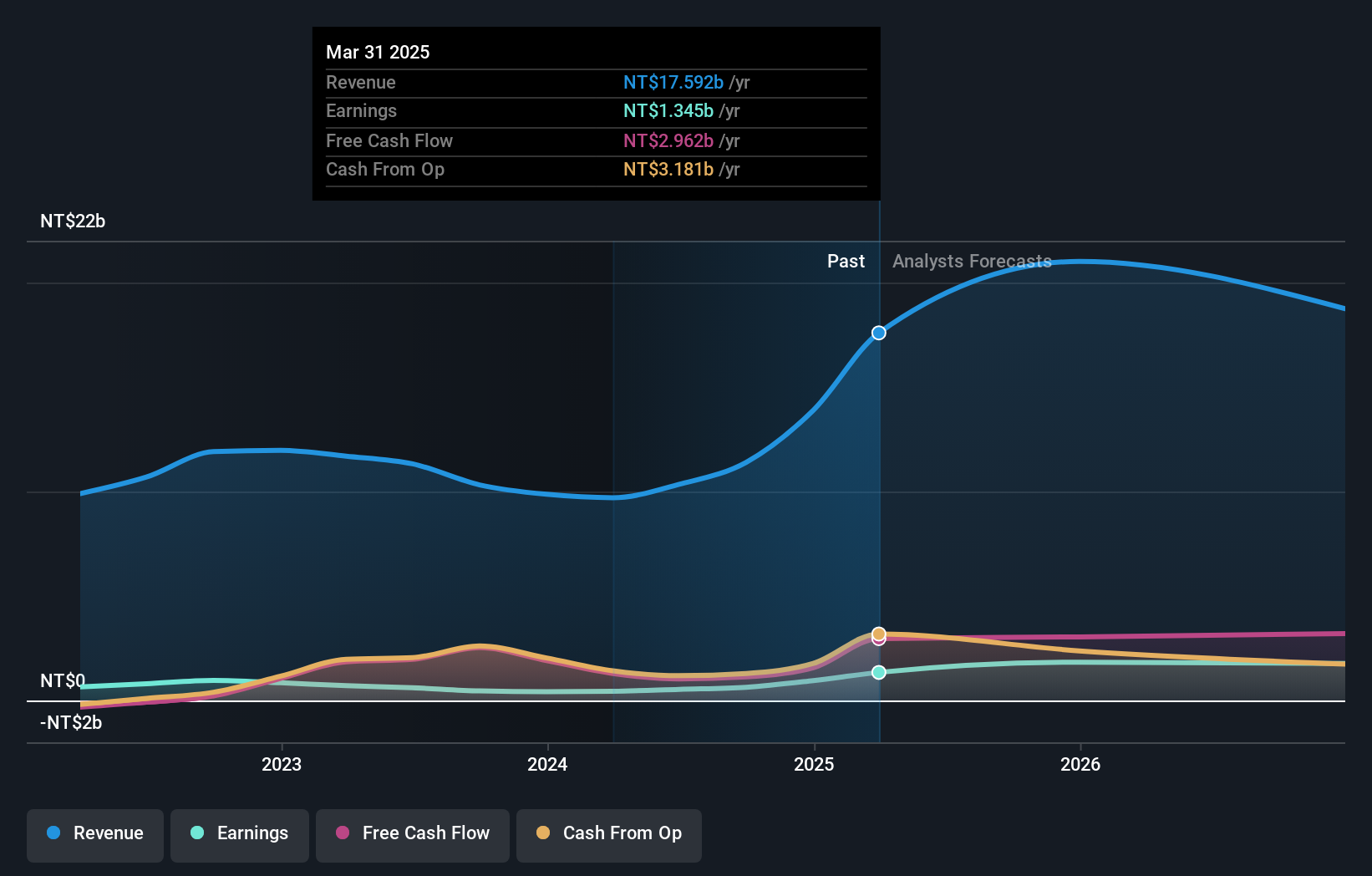

Overview: Posiflex Technology, Inc. manufactures and sells industrial computers and peripheral equipment in Taiwan, the United States, and internationally with a market cap of NT$25.32 billion.

Operations: Posiflex Technology generates revenue primarily from the United States and domestic business, with contributions of NT$7 billion and NT$2.51 billion, respectively. The company focuses on industrial computers and peripheral equipment across various international markets.

Posiflex Technology has demonstrated robust growth, with a 41.5% increase in sales and a 64.5% rise in net income for the nine months ending September 2024, reflecting strong operational execution. This performance is underpinned by significant R&D investments that are not just maintaining but enhancing its competitive edge in tech innovation. With earnings projected to grow by 24.4% annually, outstripping the Taiwan market’s 19.4%, Posiflex is effectively leveraging its technological advancements to expand its market footprint faster than many of its peers. Moreover, the company’s revenue growth forecast at 14.4% annually surpasses the market average of 12.1%, indicating a strategic alignment with broader industry trends and consumer demands which could sustain long-term growth trajectories.

Taking Advantage

- Access the full spectrum of 1280 High Growth Tech and AI Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St’s app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com