sanfel

Introduction

EVgo (NASDAQ:EVGO) is one of the leading companies in the distribution, operation and building infrastructure for electric vehicle charging solutions in the US. The company has over 1,000 fast charging points in over 35 states. EVgo is in constant development to meet the expected mass adoption of electric vehicles for commercial fleets, individual drivers and businesses.

Recently, EVgo the company has recorded a double-digit charging revenue after delivering record high results in the Q2. The management has been effective in capturing the continuous record demand for the EV charging points with continuous government support for clean energy. The company has increased its network to 66GWh according to the Q2 2024.

As an investor, note that despite the record impressive results in the Q2 2024, EVgo is still facing risks such as infrastructure installation and economic volatility in the country, also the sluggish EV growth. In this article, we are going to inform you why we rate EVgo stock as a Hold, as we are pending future profitability prospect and for more certainties.

Latest Earnings Report: Impressive sales, but still lack profitability

A number of positives were recorded in the second quarter of 2024. The most notable being that the company recorded a revenue of $66.6 million in Q2 of 2024 representing a growth by 32% high compared to 2023 Q2.

The company increased its charging network in the Q2 of 2024 up to 66 GWh, contributing to 164% year-over-year growth compared to previous second quarter at 24GWh. This is attributed to an increase of new customer accounts to a tune of 131,000 during the Q2 2024.

EVgo performed better than analysts expectations. For example, Q2 exceeded earnings per Share (EPS) estimates by 12%. EVgo indicates a positive trajectory with a forecasted growth of 26% annually on average in the next 3 years. However, the company made a net loss of US$ 29.6 million which is a 49% increase compared to Q2 2023. As a result, with a negative adjusted EBITDA of USD$8.0 million, investors will lose US$ 0.098 loss per share which is a deterioration from last year’s Q2 loss of US$ 0.082 per share.

EVgo has recorded positive results, but it is not yet profitable. Below are the fundamental reasons why the company has some unresolved challenges ahead, hence the hold rating in general.

Charging infrastructure continues to drag EVgo down

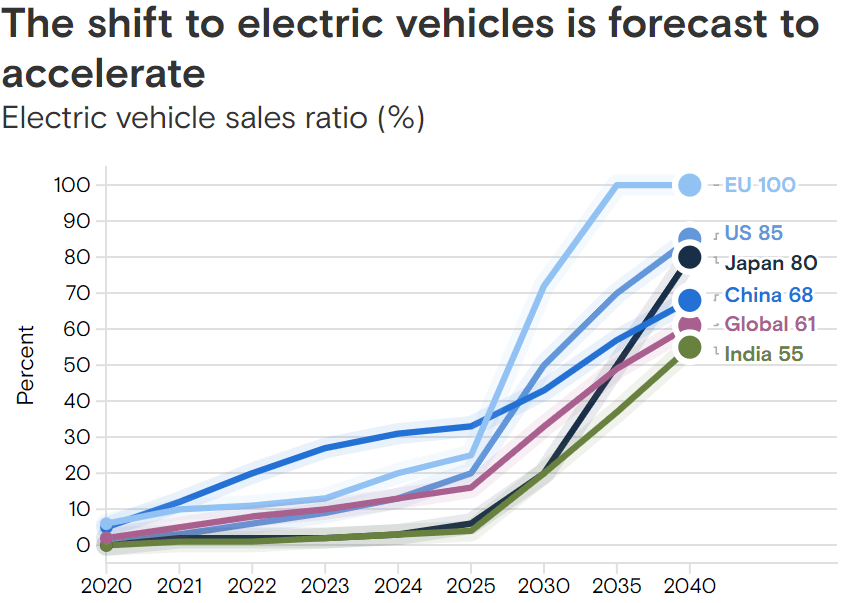

Goldman Sachs illustrates that the demand for EV is likely to take shape between 2025 and 2040. EVgo also is positioning itself to participate in the market but the charging infrastructure is getting exorbitant.

Goldman Sachs

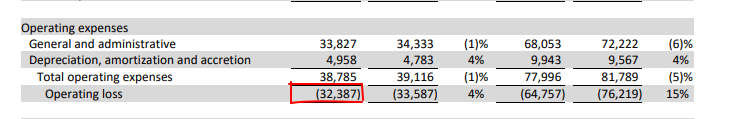

Despite the government’s best intentions to escalate the shift to EV, inconsistent and exorbitant electricity rates are a challenge. For example, EVgo reported an operating loss of US$ 32,387.

EVgo

The projected increase of EV demand between 2025 to 2030 is attributed to the current hard-to predict and hefty fees, which make operating charging stations in specific locations an issue. EVgo is operates 3,440 stalls which is an increase of 37%. However, peers companies like Tesla dominates US superchargers at 58% of the 21, 676 fast chargers. It answers why EVro still lags behind.

For example, it would cost a EVgo $100,000 to install chargers per every location in Maine. The companies are resolving to apply for government incentives under National electric infrastructure program to install chargers. The installation is expensive that the government has dedicated $5 billion to support installation of charging network in the US at intervals of 50-miles along highways. In issuing incentives, the US government is minimizing the 40% of EV buyers who want to go back to ICE.

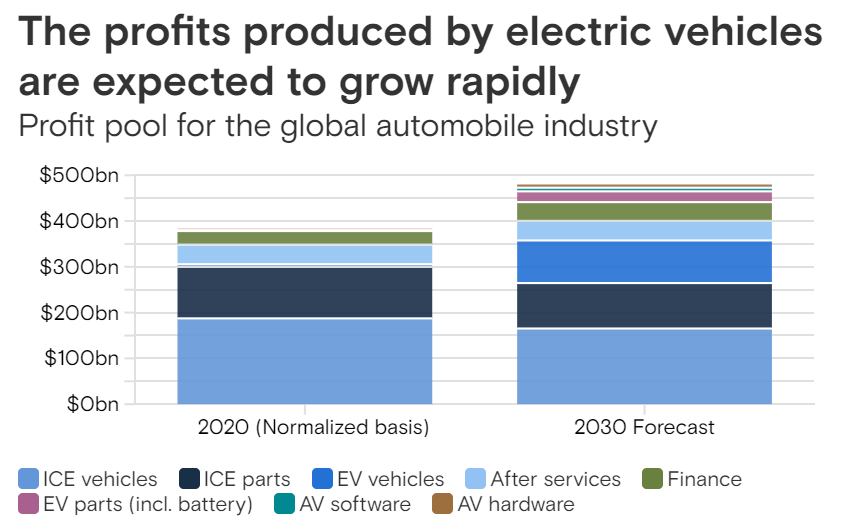

In my opinion, this informs an investor that EV solution companies will start generating reasonable profits between 2025 to 2040. The charging solution companies are still at investment development stage.

The EV automobile industry is under transformation…

Between 2020 and 2030, major transformations will have to take shape and investors will start gaining. There will be an imminent vehicle electrification and autonomous driving. Investors are expected to realize good returns beginning 2026 when EV sales will soar from current US EV sales around 2 million units to 47 million units by 2040.

Goldman Sachs

… but EVgo depends on the EV adoption

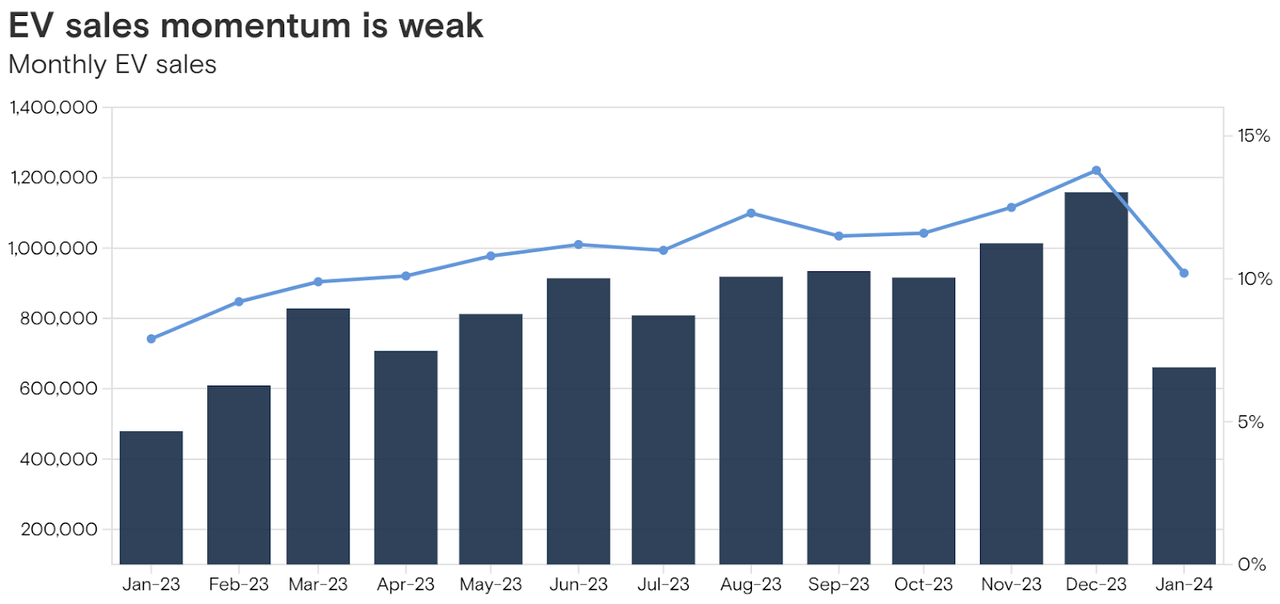

EV sales momentum has declined globally, with plug-in hybrids and hybrids proving more competitive. At the same time, the demand for EVs is expected to grow gradually with the significant implementation of carbon neutrality.

EVgo acknowledges that its reliance on EV adoption results in unfavorable disruptions and conditions in the credit and capital market. The hurdle shifts to the inability to access additional financing and commercially reasonable terms to install superchargers.

As EV adoption accelerates, the shortage of superchargers slows down EV buyers. Limited superchargers are attributed to the uncertainties around inaccessible credit and unfavorable additional financing terms. Access to favorable credit forms a basis for rapid charging infrastructure installation. These issues influence customers to have second thoughts about shifting from ICE to pure EV.

On the other hand, the company is facing stiff competition

EVgo’s competitive advantage is below its peers. The company faces stiff competition from its peers like Tesla, and ChargePoint which are way ahead in terms of superchargers.

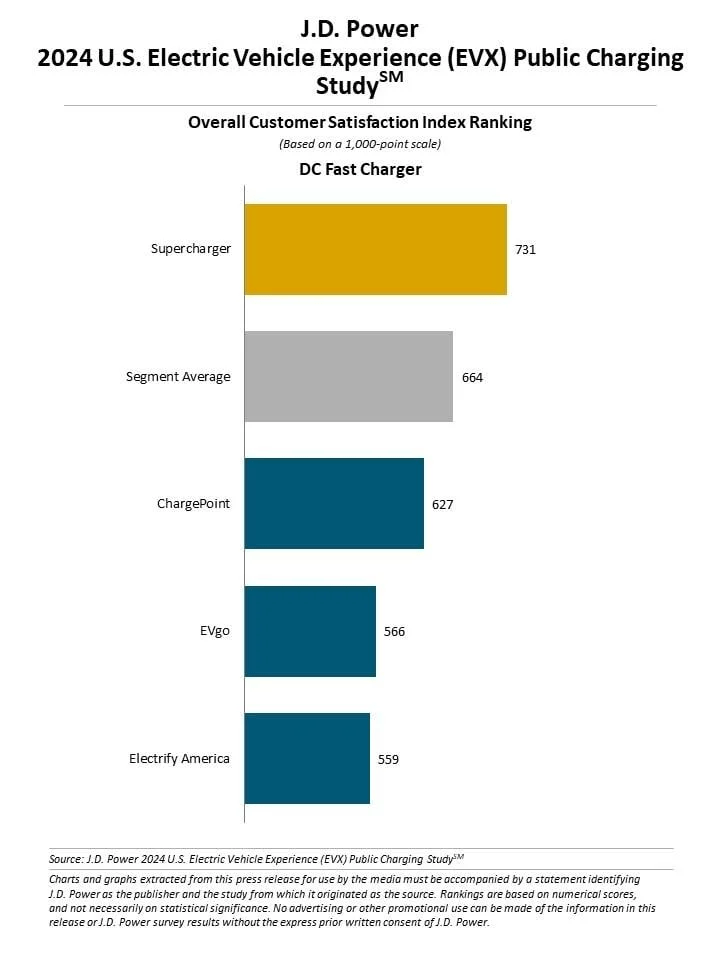

Tesla’s supercharger network ranks as the top option over its peers. The Electric Vehicle Experience (EVX) 2024 score shows Tesla is leading with 45,000 charging stations for other EV brands. The gap between the competitors is caused by Tesla’s ease of charging and payments. Overall, Tesla and non-Tesla owners find Tesla superchargers most satisfying.

However, close competitor ChargePoint with approximately 158 million chargers in 14 countries. ChargePoint has a market capitalization of $1.79 billion, a competitive advantage over EVgo’s $1.11 billion.

Ford Authority

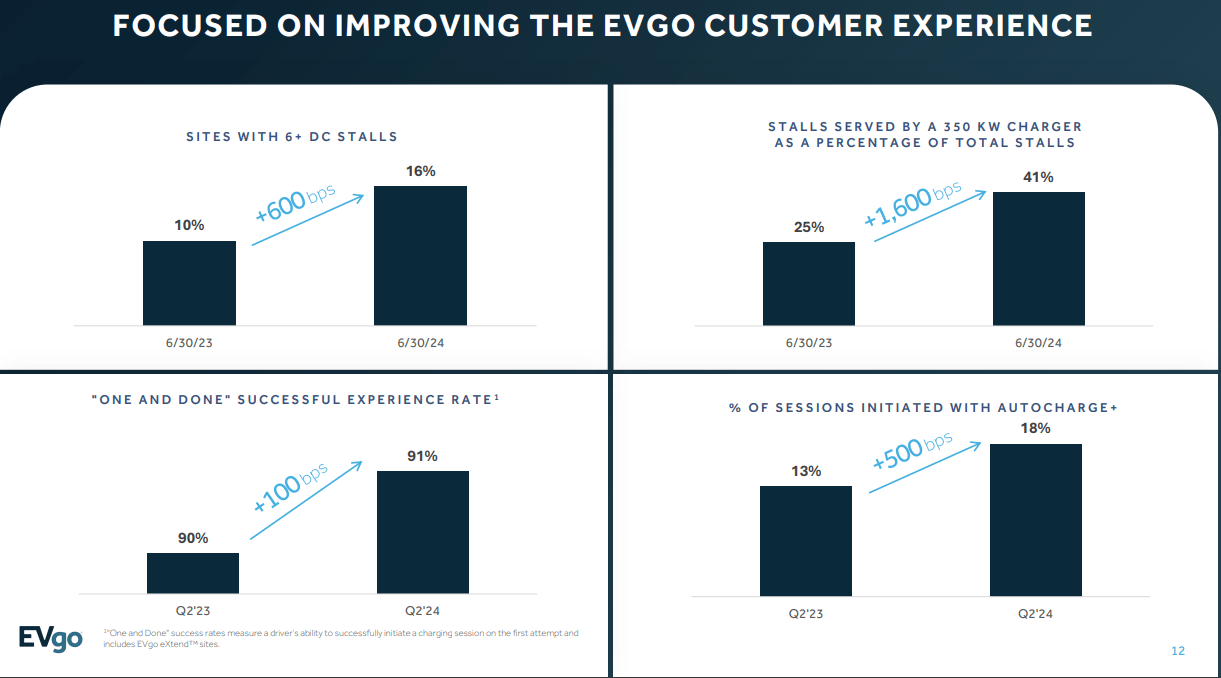

EVgo is working on its competitive advantage by installing an enhanced fast-charging network across the US through its EVgo ReNew. These updates strengthen EVgo’s competitive advantage as an EV charging provider. The CEO and president of EVgo, Mr. Dennis Kish, confirms that EVgo is undergoing equipment replacement and software updates to meet customer demands.

EVgo

Valuation

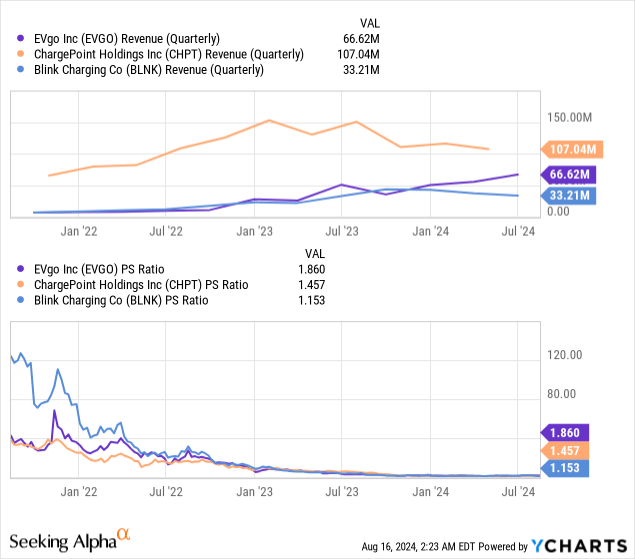

Based on the development trajectory of the industry and company, although all 3 of the listed charging companies in the US are not making positive earnings as of last quarter, EVgo is the only one growing in terms of quarterly revenue. The impressive growth of sales, as discussed earlier, is anticipated to outgrow than its peers. As such, the prospect of EVgo is certainly better.

This is already shown in terms of valuation multiples, its listed peers all share similar P/S ratio which is lower than EVgo’s. I forecast that this ratio and rank will not change substantially and will remain at a similar level, if not slightly higher, since the sector is going to be bothered by the EV / ICE car debate and trend in the next 2 – 3 years, especially since the economy is in a downtrend and EVs are considered more luxurious.

Therefore, applying a slightly-improved PS ratio in 2024 of 1.8x – 1.9x, and using the projected revenue at $250 million in FY 2024, the target price is at $4.2 – 4.4 per share, which is around the current level. Therefore, given the prospect and the target price, it is a Hold to us.

Investment risks

- Regulatory changes: The Inflation Reduction Act and other subsidy schemes in the US for EV and EV charging are the major driver for the industry and sub-sector that EVgo operates in. However, once the government halt these favorable policies, the company might be negatively impacted. These kinds of uncertainties are more likely in the coming year with the election and the economy downturn.

- Consumer preference changes: The EV market is undergoing a potential shift from “pro-EV” because of its novelty and environmental benefits, to “doubtful” due to the underwhelming performance. This drift is critical to the company since its revenue hinges on the sales performance of EV

- Intense competition: The EV charging points face competition from its other industry peers such as ChargePoint and Blink as we discussed, as well as alternative fuels, rapidly evolving chargers, and new entrants.