gorodenkoff

The headlines today about the pullback in EV plans by Ford (F) came as no shock. In April 2023, in the article about minerals, mining and more, the idea that hybrids make more sense on most fronts was presented (and in the video). The chief scientist at Toyota (TM) had illustrated this concept graphically at a Davos summit earlier. But we now have real numbers and real losses about the lack of wider adoption inherent in all-electric vehicles. No government can fund such an infrastructure stock turnover, except maybe China. Even so, it’s not feasible in the likely forecast category.

Eventually, the practical becomes, well, practical. As investors, sifting through the hype and reality is key when placing bets. The AI revolution, and all the ecosystems connected to it, has the same dynamics; shale’s evolution had the same types of boom-bust aspects but with a lot of nuance that’s both different (and similar) to this market push.

WSJ caption on Ford and EVs (Ford Dials Back EVs (WSJ))

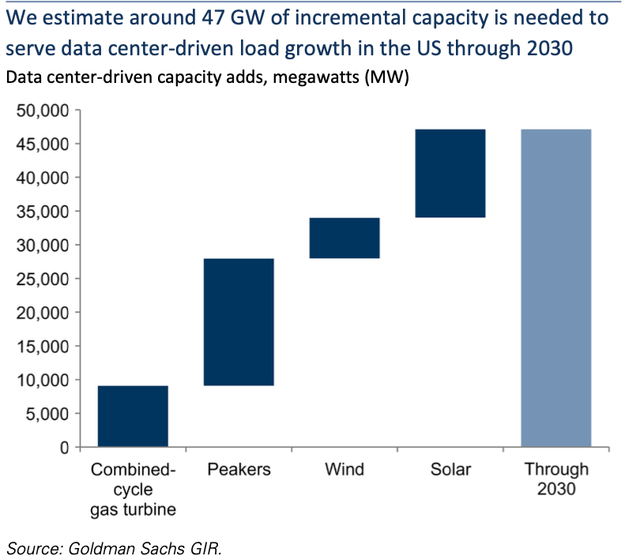

The energy challenge of AI infrastructure and related data centers is now a mainstream discussion that is saturated. Google’s (GOOG) recent CBS reel tries to get ahead of the curve, noting the use of cleaner geothermal power for their infrastructure’s needs. Scenarios abound about high-tech energy demand. The global utility Schneider said 35 GW will be needed to 2028-2023 for data centers and then 11 for AI, as noted in earlier reporting. Goldman Sachs’ estimates are in the general vicinity. Analysts are trying to slice and dice the numbers from many camps and directions.

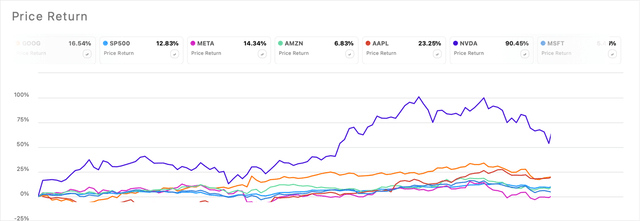

Tech titan stocks ((Seeking Alpha))

Data Center Demand, GW ((Goldman Sachs, 2024))

(Goldman analysts parse the demand of data centers above.)

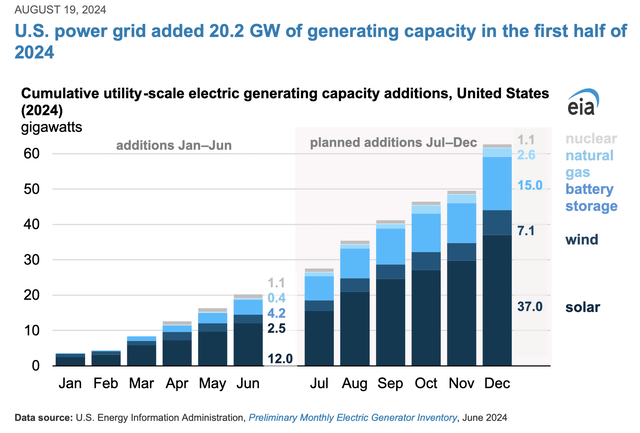

New generation

Large new generation is planned in renewables. And this is leading to the call for utilities as an investment beneficiary. It’s really a mixed and nuanced set for analysis. And standouts have been identified, such as Constellation (CEG), Vistra (VST) and Dominion (D). The U.S. Energy Information Administration estimates that over 42 GWs of new power generation is planned for the second half of 2024.

- Nearly 60% of that planned capacity is from solar (25 GW), followed by battery storage (10.8 GW) and wind (4.6 GW).

- If utilities add all the solar capacity they are currently planning, solar capacity additions will total 37 GW in 2024, a record in any one year and almost double last year’s 18.8 GW.

- Utilities could also add a record amount of battery storage capacity this year (15 GW) if all planned additions come online.

US Power Grid Additions ((EIA, 2024))

In adding color to that potential, a grid infrastructure expert in the Sachs report says that the utility AEP received 80-90 GWs of load request, but that 15 GW is likely “real.” In their first half of 2024, Schneider Electric’s chief executive showed double-digit growth in U.S. markets recently. Global electrification trends are evident too:

India has become a fabulous growth market for us. It’s been a double-digit grower for us…even with the newly formed government, we see extremely good demand to continue.”

Electrification globally is a known factor, but more specificity is emerging as we move into a new economic era post-pandemic. In the June summit discussion, this was highlighted.

[After The Summit: U.S. Energy, Global Energy – Drivers And Opportunities]

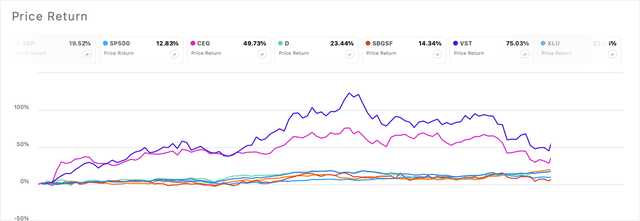

AI Power Gen Stocks ((Seeking Alpha, author picks))

Prospects of Gen AI

In June 2023, I wrote about the now-obvious prospects of generative AI and LLMs. The jockeying has reached a more fevered pitch.

While the jockeying for the dominant tech in AI begins, the use cases are starting to happen as we have seen many announcements and partnerships. The media and content potential are clear. For a knowledge worker like me, it can be an assistant and boost productivity. But LLMs at present cannot substitute for the discriminative power of human analysis, ie., subject matter expertise. While they mirror some of the complexity of the human thought processes, there are limits.

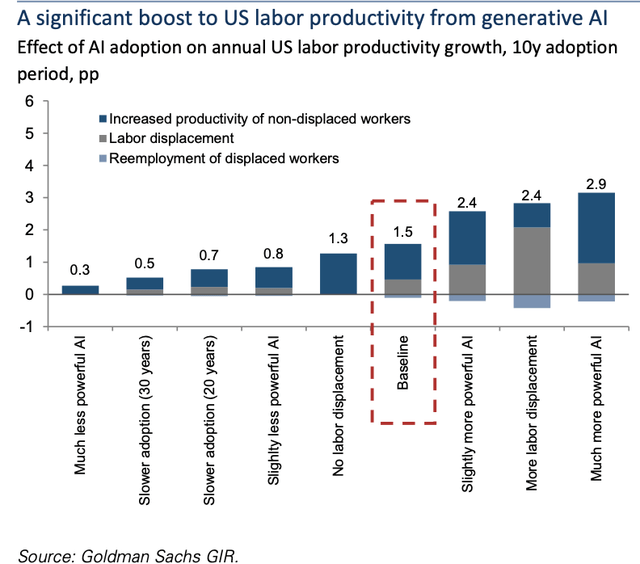

In a June 2024 Goldman Sachs AI analysis, Prof. Acemoglu of MIT notes, “The quality of the data also matters, and it’s not clear where more high-quality data will come from and whether it will be easily and cheaply available to AI models.” The productivity boosts are possible. What will be important is at what cost? Adding an estimated capex of $1 trillion seems massive. However, in relation to forecast “energy transition” capex, it may not be so hefty. Time and investor’s market understanding will tell.

AI productivity gains ((Goldman Sachs AI report, 2024))

Hidden value

In December 2019, right before the pandemic, I profiled this research about the valuations of big tech. It captures the rise of intangible assets, ie., human capital. That still has validity, but the models are changing, wherein these firms are now adding hard assets to their balance sheets.

There has been a “seismic shift” in what drives the value of the economy. Among the largest firms in the U.S. are the “FAANG” stocks which stand for Facebook, Apple (AAPL), Amazon (AMZN), Netflix (NFLX), and Google. They don’t have plants, property and equipment to speak of. “Their balance sheets have virtually nothing and they’re worth hundreds of billions of dollars,” says Wang. “It’s the intangibles missing from the balance sheet that are largely responsible for this gap.”

There’s some balance, or sweet spot, between human capital and innovation and the physical real assets that support this growth and drive of the digital economy. Goldman notes, “leading tech giants, other companies, and utilities (are expected) to spend an estimated ~$1 trillion on capex in the coming years, including significant investments in data centers, chips, other AI infrastructure, and the power grid.”

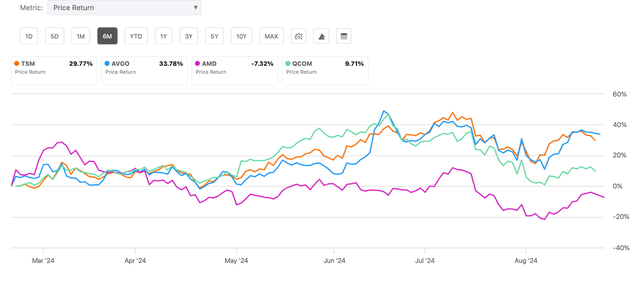

(Below, I compare the middle of the pack of NVDA peers, also throwing out a lagging firm.)

Semiconductor firm’s stocks ((Seeking Alpha))

A “Phase 2” of AI-related benefactors have been semiconductors, cloud infrastructure and services and utility stocks. Various ETFs have seen appreciation, and then volatility, as recession fears have waxed and waned. Examples are semiconductors (SMH) and utilities (XLU). Differentiation is starting to emerge within and among the tech titans, Microsoft (MSFT), Nvidia (NVDA) and Advanced Micro Devices (AMD), and in generative AI with Amazon, Meta (META) and all the rest.

In this infrastructure space, the idea of picks and shovels is relative, both literally and figuratively. That concept in a portfolio extends to an array of energy and “new era” infrastructure funds and firms. It could even be a 60/40 split-yet to be determined. The formula for the optimal portfolio eludes, just like the optimal energy mix.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.