VisionsofAmerica/Joe Sohm

No matter how much money is being thrown at alternative sources of energy, it isn’t enough to fully remove oil from the equation. The demand for fossil fuels will continue to grow in the decades ahead, and with that comes investment dollars to support the infrastructure behind it. That’s where the First Trust North American Energy Infrastructure Fund (NYSEARCA:EMLP) comes into play. EMLP is an actively managed exchange-traded fund offering investors an opportunity to access the energy infrastructure space in North America. The fund primarily invests in equity securities of companies headquartered or incorporated in the US and Canada.

EMLP normally expects at least 80% of its net assets to be invested in the equity securities of companies that operate in the energy infrastructure sector. These include master limited partnerships (MLPs) and MLP affiliates, pipeline companies, utilities and other companies that obtain at least 50% of their revenues from operating, or providing support to, energy industry assets including the transportation, storage, and processing of energy products such as pipeline networks, power transmission and petroleum and natural gas storage.

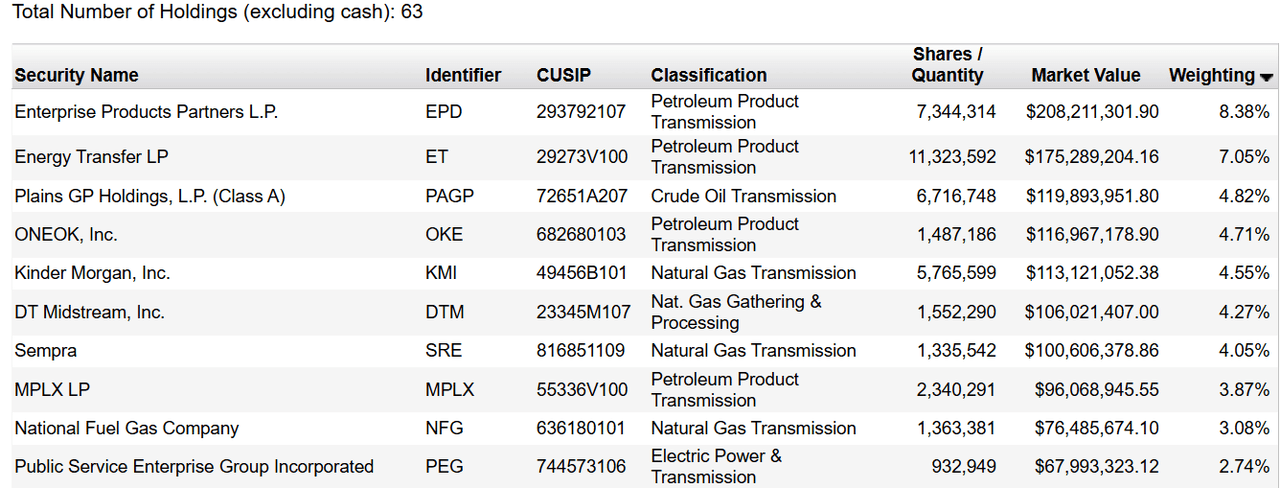

A Look At The Holdings

EMLP’s portfolio represents a managed selection of the largest companies in energy infrastructure. Its top holdings include master limited partnerships and other companies involved in energy infrastructure.

The top holdings are good examples of what you’re buying into thematically here. For example, Enterprise Products Partners L.P. (EPD), based in Houston, is one of the primary North American companies involved in the midstream segment of the energy industry; that is, in shuttling around to store and get energy goods – natural gas and natural gas liquids (also referred to as NGLs), or the hydrocarbons derived from natural gas, plus crude oil, refined products and petrochemicals. Another example is ONEOK, Inc. (OKE), a leading midstream service company, transports, fractionates and stores natural gas liquids (NGLs), as well as providing related services through its NGL division.

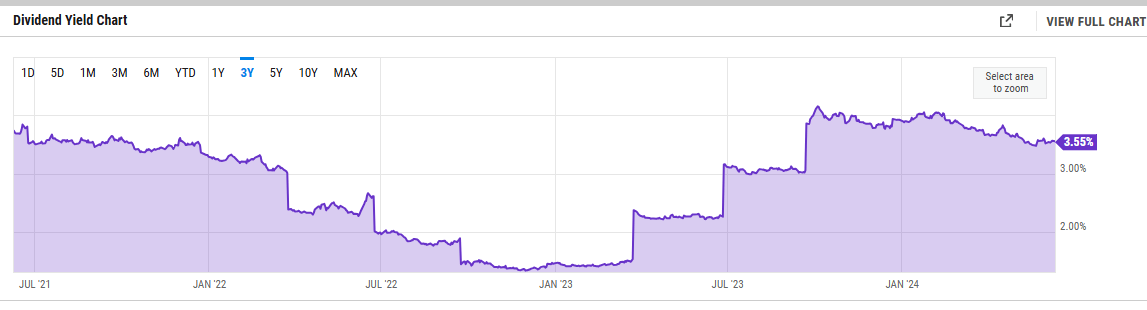

Importantly, these companies tend to have solid yield. The overall dividend yield of 3.55% isn’t something to be overlooked if you’re an income focused investor.

ycharts.com

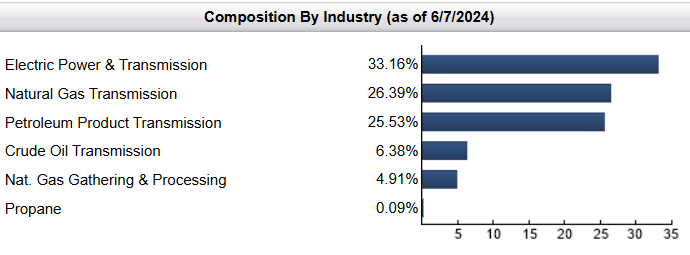

Sector Composition

EMLP’s sector composition is well-diversified in order to gain broad industry exposure from the energy infrastructure industry.

ftportfolios.com

I like the mix here, as these are companies and subgroups within the Energy sector that typically don’t make up a large portion of other energy funds.

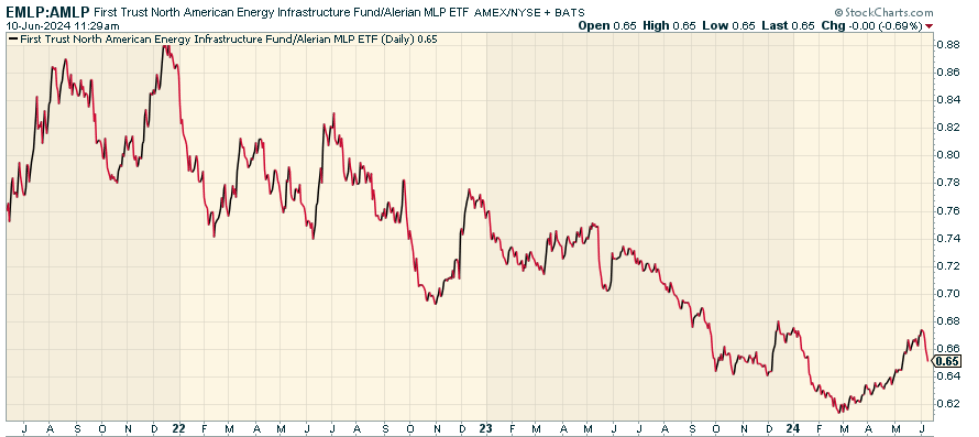

Peer Comparison

I think it’s worth comparing EMLP to the Alerian MLP ETF (AMLP). That ETF is an actively managed fund with a mix of midstream energy infrastructure MLPs and corporations that stand to gain from the energy renaissance. It’s not exactly an apples to apples comparison, though, given MLPs dominate AMLP. Still, when we look at the price ratio, EMLP has lagged, though it may have bottomed suggesting better relative performance could be ahead.

stockcharts.com

Pros and Cons

On the positive side, investors in EMLP can get exposure to an important and fast-developing industry with huge demand for energy infrastructure all over North America. This part of the energy sector has underperformed the broad energy sector, but the demand for infrastructure long-term should make this attractive and an outperformer over time.

That said, the energy industry remains very risky, and it is impossible to tell whether, over time, forces such as changes in energy commodity prices, regulation, and expressed concerns about the environment will hamper the performance of energy infrastructure companies. In addition, given its high degree of investment concentration in a single industry and region, the fund may be more volatile and responsive to geopolitical risks than the average portfolio.

Conclusion

EMLP is a good way to get highly diversified, and actively managed, exposure to a truly exciting sub-sector of the North American economy. And because energy infrastructure is an income generator, investors will be able to take advantage of the stable yield. I like the fund overall, the sector it plays in, and think this is worth considering in a diversified portfolio overall. It should be less sensitive to the price of oil, while still benefiting from its usage independent of whether it’s a recession or expansion.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.