Exploring the Dividend Performance and Sustainability of CK Infrastructure Holdings Ltd

CK Infrastructure Holdings Ltd (CKISY) recently announced a dividend of $1.18 per share, payable on June 27, 2024, with the ex-dividend date set for May 24, 2024. As investors look forward to this upcoming payment, the spotlight also shines on the company’s dividend history, yield, and growth rates. Using the data from GuruFocus, let’s look into CK Infrastructure Holdings Ltd’s dividend performance and assess its sustainability.

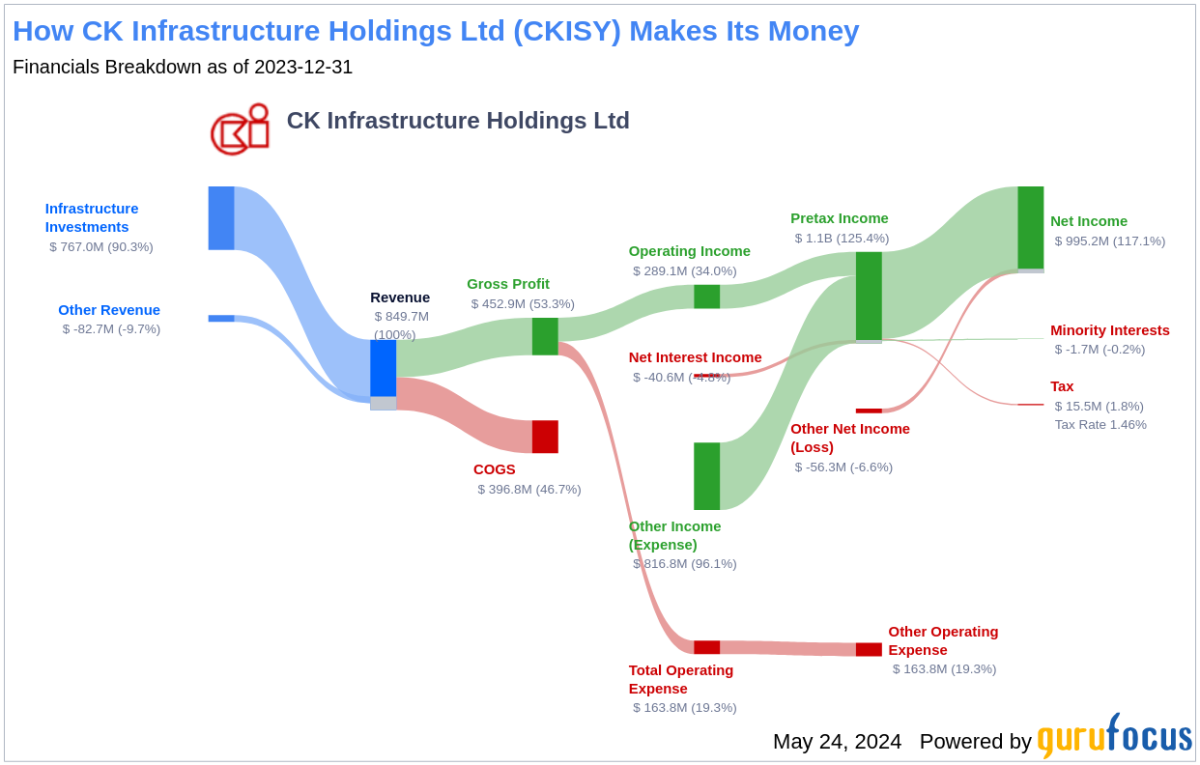

What Does CK Infrastructure Holdings Ltd Do?

CK Infrastructure Holdings is a leading global utility and infrastructure investment company with a focus on regulated utility assets. It is part of the CK Hutchison group of companies, holding the bulk of the group infrastructure businesses. CKI’s investments stretch across Hong Kong, the UK, Australia, Europe, Canada, and New Zealand. The UK division contributes about half of total group net profit. The company also owns an infrastructure materials business in Hong Kong and mainland China, producing cement, concrete, asphalt, and aggregates.

A Glimpse at CK Infrastructure Holdings Ltd’s Dividend History

CK Infrastructure Holdings Ltd has maintained a consistent dividend payment record since 2014, distributing dividends bi-annually. The stock is recognized as a dividend achiever, a prestigious title awarded to companies that have increased their dividend each year for at least the past 10 years. Below is a chart showing annual Dividends Per Share to track historical trends.

Breaking Down CK Infrastructure Holdings Ltd’s Dividend Yield and Growth

Currently, CK Infrastructure Holdings Ltd boasts a trailing dividend yield of 5.50% and a forward dividend yield of 5.56%, indicating expected increases in dividend payments over the next 12 months. Over the past three years, the annual dividend growth rate was 1.10%, which increased to 1.20% per year over a five-year horizon. Over the past decade, the annual dividends per share growth rate stands at 3.50%. The 5-year yield on cost for CK Infrastructure Holdings Ltd stock is approximately 5.84%.

The Sustainability Question: Payout Ratio and Profitability

To assess the sustainability of the dividend, one needs to evaluate the company’s payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. As of December 31, 2023, CK Infrastructure Holdings Ltd’s dividend payout ratio is 0.75, suggesting that the company’s dividend may not be sustainable. The company’s profitability rank offers an understanding of the company’s earnings prowess relative to its peers. GuruFocus ranks CK Infrastructure Holdings Ltd’s profitability 6 out of 10, suggesting fair profitability. The company has reported positive net income for each year over the past decade, further solidifying its high profitability.

Growth Metrics: The Future Outlook

CK Infrastructure Holdings Ltd’s growth rank of 6 out of 10 suggests a fair growth outlook. However, the company’s revenue and earnings growth rates have been underperforming relative to global competitors, with a 3-year revenue growth rate of -5.90% and a 3-year EPS growth rate of 1.40% per year on average. Additionally, the 5-year EBITDA growth rate of -7.20% also underperforms relative to global competitors.

Conclusion: Evaluating Dividend Sustainability

While CK Infrastructure Holdings Ltd has demonstrated a strong history of dividend payments and growth, its current payout ratio and underperforming growth metrics raise questions about the long-term sustainability of its dividends. Investors should consider these factors alongside the company’s solid profitability and dividend yield when making investment decisions. For further insights, GuruFocus Premium users can utilize the High Dividend Yield Screener to identify high-yield investment opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.