Quanta Services, Inc. PWR shares crafted a new 52-week high of $308.31 on Oct. 7, 2024. The stock pulled back to end the trading session at $307.51.

PWR stock has gained 20.7% over the past three months, outperforming the Zacks Engineering – R and D Services industry’s 18.9% growth. The stock has fared better than the Zacks Construction sector and the S&P 500 Index’s 18.1% and 2.5% rallies, respectively. The stock has outperformed companies like Dycom Industries, Inc. DY, which has gained 14.2% over the same period, and EMCOR Group, Inc. EME, which has gained 22.2%.

This growth was driven by continued demand for infrastructure services, especially in renewable energy and power grid development. The company has been effectively leveraging megatrends to take the lead in driving the transition toward sustainable energy solutions and facilitating technological advancements.

PWR’s 3-Month Price Performance

Image Source: Zacks Investment Research

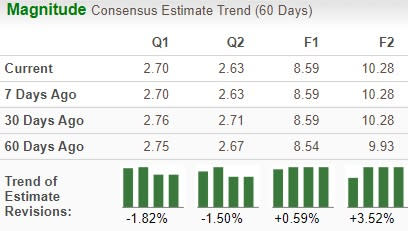

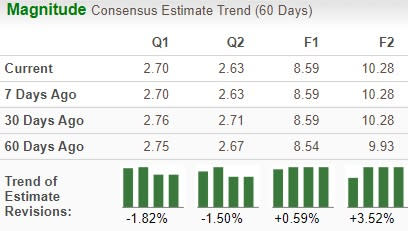

PWR’s Estimate Movement

It is also witnessing northbound estimate revisions for 2024 and 2025 earnings per share (EPS). The estimated figure indicates 20% growth for both 2024 and 2025.

The company surpassed profit estimates in three of the trailing four quarters and missed on one occasion, with the average earnings surprise being 4.6%.

Image Source: Zacks Investment Research

Let’s take a look at the factors supporting the growth of PWR.

Solid Backlog: The company ended second-quarter 2024 with a total record backlog of $31.31 billion and a 12-month backlog of $16.62 billion. This compares favorably with the 12-month backlog of $15.64 billion and a total backlog of $27.2 billion reported in the year-ago period. This underscores the resilience of its fundamental operations, showcasing the company’s core strength.

Quanta holds a positive outlook for its future, driven by its growing backlog, which is expected to remain healthy and continue to expand. Quanta still envisions delivering a 10% organic adjusted EPS compound annual growth rate (CAGR) and more than 15% adjusted EPS CAGR through 2026.

Decarbonization Efforts: Quanta is anticipated to enjoy the benefits of its engagement in diverse technological solutions aimed at advancing decarbonization initiatives. These encompass various domains, including carbon management and mitigation, compliance consulting, as well as the full spectrum of infrastructure necessary to support carbon-neutral energy solutions.

Quanta has been strategically positioned to capitalize on major trends driving the energy transition and fostering technological advancements. Notably, initiatives like the expansion of electric vehicle charging infrastructure and the undergrounding of electrical infrastructure are gaining significant traction, further contributing to the company’s growth prospects.

Acquisitions: Quanta considers acquisitions as a pivotal element of its strategy to augment its market presence and expand its order backlog. On July 17, Quanta completed the acquisition of Cupertino Electric, Inc. (“CEI”). Cupertino provides electrical infrastructure solutions, including engineering, procurement, project management, construction and modularization services, to the technology, renewable energy and infrastructure and commercial industries. Its results will be included in the Electric Power and Renewable Energy segments. During the first half of 2024, Quanta acquired five businesses, with two acquisitions completed in January 2024.

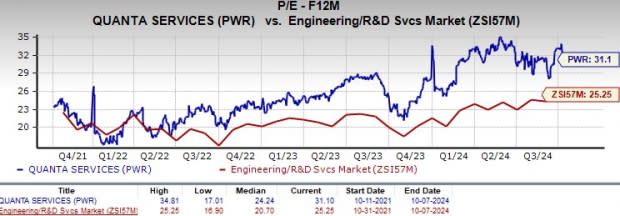

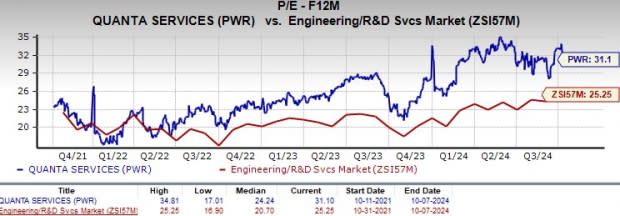

PWR Stock Not Cheap

PWR’s stock is currently overvalued compared to its industry, as shown in the chart below. The stock is currently trading at a forward 12-month price-to-earnings (P/E) ratio of 31.1, which is above its three-year median of 24.2. The stock is also trading at a premium compared to Comfort Systems USA, Inc. FIX, which is trading with forward 12-month P/E multiples of 27.17.

Image Source: Zacks Investment Research

Conclusion: Why is PWR Stock Still a Buy?

Despite trading near its 52-week high, PWR stock is still worth considering for investors looking for exposure to the infrastructure sector. The ongoing transition toward renewable energy in North America and the need for power grid modernization fueled Quanta’s growth.

Customers are investing heavily in building resilient and reliable energy systems. Also, the acquisition of CEI, a key provider of electrical infrastructure solutions, expanded Quanta’s service portfolio and market reach. CEI’s turnkey solutions are expected to facilitate synergies in electrical infrastructure development between utilities and large power consumers.

With strong tailwinds from government spending, a high valuation is reasonable and upward estimate revision depicts promising prospects ahead. This Zacks Rank #2 (Buy) company offers a compelling investment opportunity for those looking to benefit from the ongoing infrastructure boom and the favorable rate environment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Quanta Services, Inc. (PWR) : Free Stock Analysis Report

EMCOR Group, Inc. (EME) : Free Stock Analysis Report

Dycom Industries, Inc. (DY) : Free Stock Analysis Report

Comfort Systems USA, Inc. (FIX) : Free Stock Analysis Report