Pla2na

Written by Nick Ackerman, co-produced by Stanford Chemist.

BlackRock Utilities, Infrastructure & Power Opportunities Trust (NYSE:BUI) is a closed-end fund, or CEF, that offers investors a diversified basket of global infrastructure exposure. The fund does not employ leverage, as the majority of closed-end funds do. Instead, the fund sets itself apart by incorporating an options writing strategy, writing covered calls on its underlying portfolio of holdings. This can make it a more overall conservative play in the CEF infrastructure space.

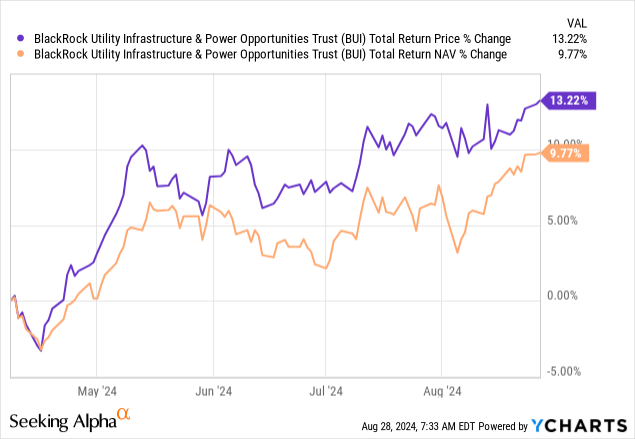

The discount has narrowed since our last update, but the underlying portfolio of the fund has performed well, too. The total NAV returns measure how the underlying portfolio is performing, while the total share price measures the market price that investors are actually buying and selling at.

YCharts

BUI Basics

- 1-Year Z-score: -0.43

- Discount/Premium: -1.87%

- Distribution Yield: 6.27%

- Expense Ratio: 1.08%

- Leverage: N/A

- Managed Assets: $530.5 million

- Structure: Perpetual.

BUI’s investment objective is to “provide total return through a combination of current income, current gains and long-term capital appreciation.”

To achieve this objective, they have quite a bit of flexibility. They will invest:

“primarily in equity securities issued by companies that are engaged in the Utilities, Infrastructure, and Power Opportunities business segments anywhere in the world and by utilizing an option writing (selling) strategy in an effort to enhance current gains.”

The fund is only partially overwritten, as they target a range of 30 to 40%. With the latest figure stating they are 34.24% overwritten as of the end of July 2024.

Performance – Set To Benefit From Rate Cuts

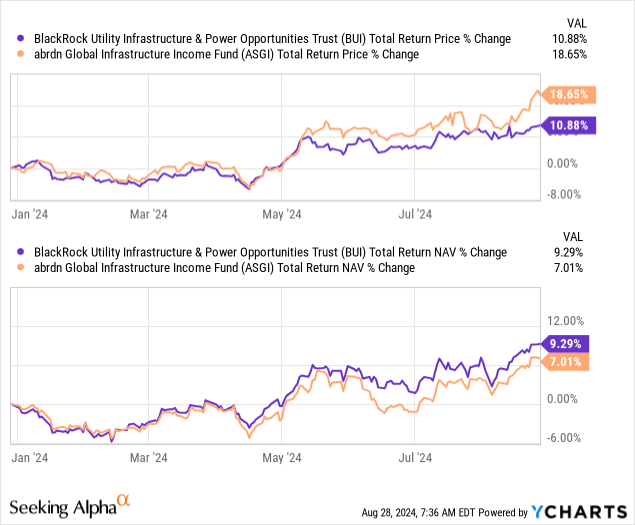

In our prior update, we discussed abrdn Global Infrastructure Income Fund (ASGI) as another infrastructure CEF fund that doesn’t employ leverage. This is why I felt heading into 2024, both of these were a more conservative way to invest in the space with the idea that they should both perform well in a rate-cutting environment. We are now getting much closer to that rate-cutting environment, and both of these funds have been reacting positively.

Utilities and infrastructure companies can do better in a lower-rate environment because they are capex-heavy industries. That means they are constantly borrowing to build out expensive projects, or they already have a lot of debt on their balance sheet that needs to be refinanced at higher rates.

For these types of investments, they also can be considered a competitor for income-oriented investors. When risk-free cash is paying ~5%, that makes a utility yielding 3-5% not as appealing. When risk-free rates come down in a lower rate environment to 3-4%, then those utility yields start to look just a bit more enticing. They also come with the potential for long-term dividend growth and potential upside appreciation.

Unlike the leveraged funds, BUI and ASGI don’t get the ‘double-shot’ boost of pressure coming off their borrowing costs and better underlying performance. However, that doesn’t mean that they still haven’t been able to deliver solid results on a YTD basis.

YCharts

As we entered into 2024, it took these funds some time to start looking more appealing. Through the first quarter, the funds were struggling. That started to turn around in the last several months, with the idea that rate cuts were getting nearer and nearer.

ASGI was the leader in terms of the total share price return, but the total NAV return has BUI edging just ahead. We recently touched on ASGI in more depth. In that piece, we touched on the fund’s significant boost in its distribution through 2024, which is the prime catalyst that has helped that fund deliver such a superior total share price return. That saw the fund’s discount narrow materially, thus driving up the total return results. To be fair, the underlying portfolio has also been performing well for ASGI, too.

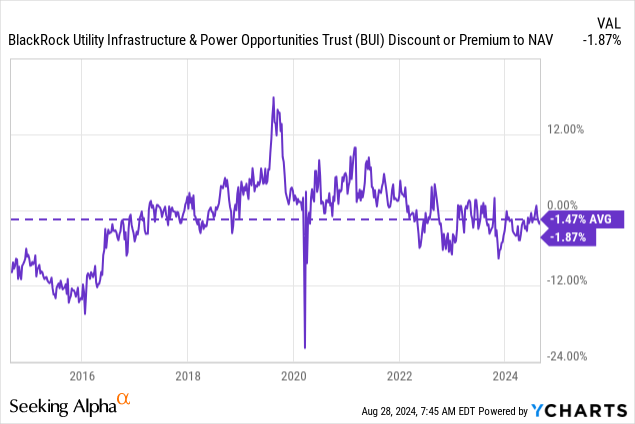

Despite ASGI’s narrowing discount, it still has a wider discount relative to BUI. However, BUI has historically traded at these narrower discounts over the long term.

YCharts

CEFs will always have to deal with discount/premium fluctuations, which means that BUI could plunge into a double-digit discount. We saw that happen in COVID-19, and there really is no guarantee it can’t happen again. However, based on the no leverage, it makes it a relatively more conservative pick.

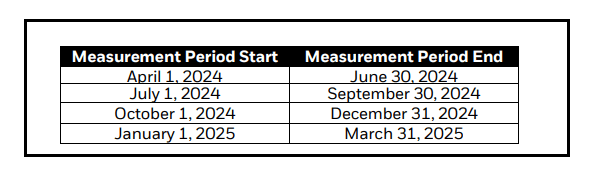

Worth noting is that BlackRock currently has a discount management program in place. This is where they are conducting tender offers for 2.5% at 98% of NAV. The trigger for that is if a fund is trading at a wider than 7.5% discount over four different measurement periods. We recently finished up with the first measurement period, and BUI is one of just two funds with this current discount management program in place that didn’t have the tender offer triggered.

Measurement Periods For Tender Offer Triggers (BlackRock)

We are currently in the midst of the next measurement period, and the way it is looking, BUI will not be participating in the next one either. That isn’t necessarily a negative, either, as investors could simply sell shares on the open market for an even better price right now.

Distribution – Due For A Boost

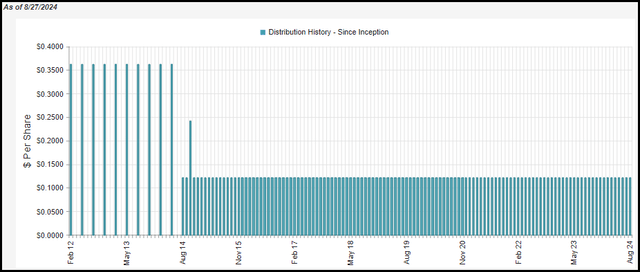

Activists have pressured a number of BlackRock CEFs to boost their distributions; however, BUI is not one of them. They’ve been delivering a consistent distribution since the fund was incepted. Though they paid quarterly initially, when they converted over to a monthly schedule, they kept the equivalent payout.

BUI Distribution History (CEFConnect)

With that said, I think that BUI is actually due for a boost in its payout to investors. Currently, the NAV distribution rate works out to 6.16%-with only a shallow discount, the distribution rate for shareholders comes in at a similar 6.27%. If my optimistic view pans out and BUI keeps heading higher, the fund’s distribution rate is only going to sink lower and lower.

So, I think they have the room here to raise the payout. Even sticking with a more conservative 7% NAV rate would raise the distribution by 13.7% to $0.1376 a month. On the other hand, whatever they don’t pay out will simply be retained by the fund and added to NAV, which could lift the share price. BUI is one of the rare CEFs with a higher NAV and share price than its inception.

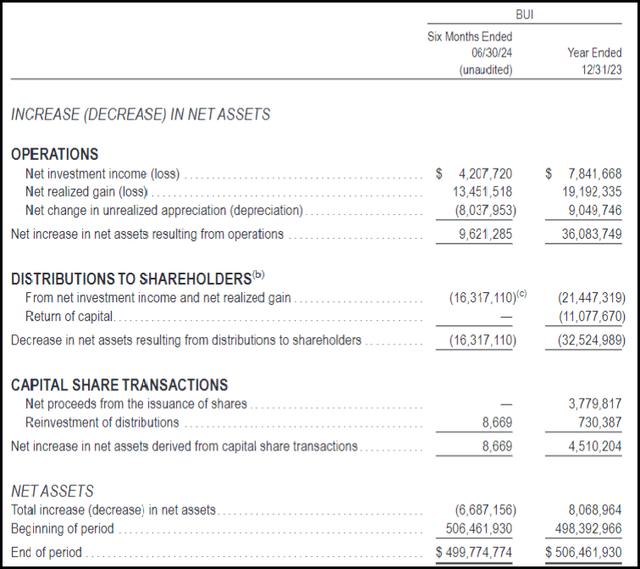

The fund’s net investment income coverage in the first six months of the year came to 25.79%, putting it around the same as last full year’s 24.11% coverage.

BUI Semi-Annual Report (BlackRock)

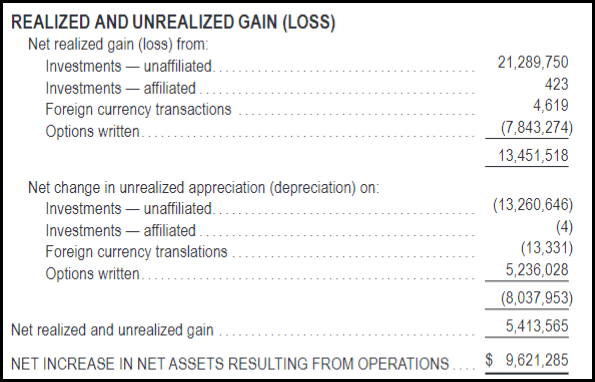

That might seem like low coverage, but BUI, as a mostly equity fund and writing options, will cover its distribution through capital gains primarily. The fund realized a sizeable portion of capital gains in the first half of the year but saw that offset by unrealized losses and also realized losses on their written options. The realized losses on the options written were offset by some degree by the sizeable unrealized gains of options written.

BUI Realized/Unrealized Gains/Losses (BlackRock)

Losses can be realized when writing covered calls if they are closing out the contracts for greater than the option premium received. This could be appropriate to do if the underlying investment they are writing against rises materially, and they don’t want the position to be called away.

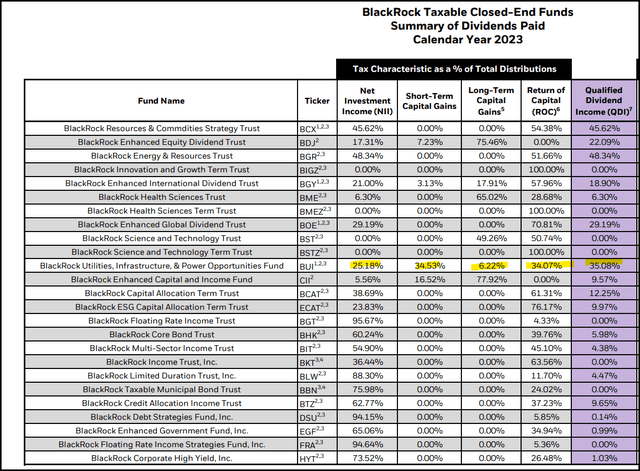

For tax purposes on the distribution, we have quite the mix for 2023. They’ve listed income, short-term and long-term capital gains, return of capital and a portion of the income that was considered qualified.

BUI Distribution Tax Classification (BlackRock (highlights from author))

We also saw quite a mixture in 2022, which can make it difficult to plan for taxes. That said, it was more tax-efficient, with it being all either long-term capital gains, qualified dividends or return of capital. That is mostly what we should expect due to the characteristics of this fund’s underlying portfolio. On the other hand, a more tax-sensitive investor may choose to put this in a tax-sheltered account to be safe. Though that would miss out on the tax benefits of qualified dividends, long-term capital gains and return of capital.

BUI’s Portfolio

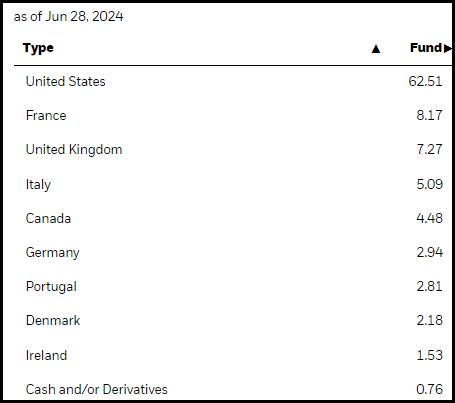

BUI has seen some modest portfolio turnover in the first half of the year, with a turnover rate of 19%. That would put it on pace to eclipse last year’s 31% and 2022’s 36%. That said, we don’t tend to see too much in terms of dramatic shifts with this fund in its overall allocation. The U.S. exposure is the fund’s largest allocation, at around 62.5%, which is up a bit from our prior update. That still leaves plenty of exposure outside the U.S., though.

BUI Geographic Breakdown (BlackRock)

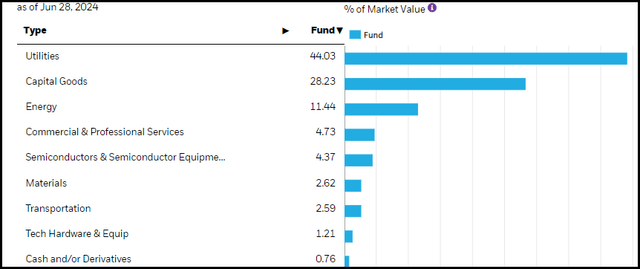

Similarly, the breakdown of sector exposure since our prior update has BUI staying with a meaningful weight in utilities. Previously, this accounted for 41.05% of the fund. Capital goods/industrials are the second-largest allocation in the fund; that was previously at a 31.47% weight. From there, we have energy as the next meaningful sleeve of the fund-which was also fairly consistent with the prior allocation coming in at 9.77%.

BUI Sector Allocation (BlackRock)

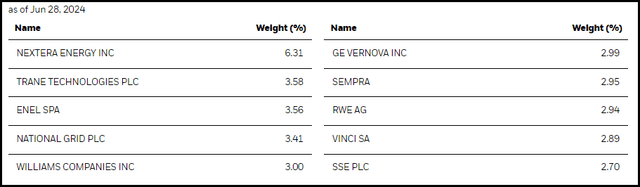

The fund lists a total of 54 holdings, with the top spot still NextEra Energy (NEE).

BUI Top Ten Holdings (BlackRock)

NEE has been performing quite well, which is likely a reason why we’ve seen the allocation increase from the 5.75% it was at previously. The second-place spot was previously Vinci SA (OTCPK:VCISF), but that has slipped down to the 9th largest allocation now as the allocation has decreased from 3.9%.

VCISF trades on the pink sheets, but it certainly is not a small company, as it commands a market cap of over $68 billion. This is an industrial company based out of France-of course, then represents some of that French geographic exposure we saw on the global breakdown above.

Trane Technologies plc (TT) now comes in as the second-largest holding, though this was a position in the fund previously at number 4. The allocation increased from 3.33%.

In looking at new names in the top ten, we have GE Vernova (GEV) and SSE plc (OTCPK:SSEZF). SSEZF was a position in BUI previously, at least looking back to the N-PORT filing with the full holdings listed as of March 31, 2024. GEV was a new name, but it only became available as it started trading publicly as an independent company in early April.

GEV is one of the spin-offs from what was GE after it split itself apart earlier this year. GEV is the energy-focused portion of the business that is electrifying “the world while simultaneously working to help decarbonize it.” In this move, it likely made it appropriate to fit into a fund like BUI, when the conglomerate of GE previously wouldn’t have made as much sense.

SSEZF is another company traded on the pink sheets in the U.S. but comes with a sizeable market cap of ~$27 billion. In this case, it is an electric utility company based out of the U.K.

Conclusion

Overall, there has certainly been some excitement in the interest rate-sensitive areas of the market, which includes utilities, and that’s helped to propel BUI higher. The discount on this fund remains stubbornly narrow, I think there is still some more upside to go, and the fund is still set to benefit in the near and medium term with rate pressures coming down. While I’m optimistic about the short and medium-term outlooks, I also view this fund as favorable over the long term as well. It helps to add global exposure for more potential opportunities around the world. Along with no leverage and an options writing strategy, making it relatively more conservative as well.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.