JARAMA

Earlier this year I wrote an article on Brookfield Infrastructure Partners (NYSE:BIP)(TSX:BIP.UN:CA)(BIPC), which is a global infrastructure player with a market cap of over $14 billion.

My thesis back then was predicated on the following three BIP characteristics:

- Durable current income, which is backed by defensive cash generating assets (e.g., utility infrastructure, public private partnership agreements, regulated midstream segment etc.)

- The lion share of cash inflows linked to inflation dynamics or based on embedded periodical revenue escalators, which introduce an attractive organic growth component.

- AFFO payout level, which leaves a decent chunk of internal equity for BIP to reinvest and generate additional cash flow growth on top of the aforementioned escalators.

- Investment grade balance sheet, which de-risks the overall investment thesis and also enables BIP to further support the inorganic growth aspect.

All in all, my decision to invest in BIP boiled down to enjoying a relatively decent (and protected) dividend yield of ~5% in combination with a close to double digit dividend growth rate going forward.

Since the publication of my article two things have happened. First, BIP has underperformed the market by registering a flat total return performance. Second, BIP has releases its Q1, 2024 earnings deck bringing some interesting messages for us to digest and contextualize with my bull thesis.

Let’s review the Q1, 2024 earnings deck and decide whether the bull case still remains in tact.

Thesis review

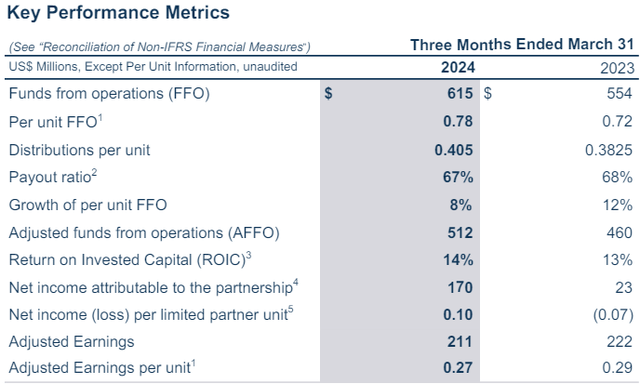

The Q1, 2024 earnings results marked a significant progress compared to Q1 in the last year. The improvements can be observed across the board. For example, the most important metric – FFO per unit – advanced by 8%, which directly fed into the dividend growth of ~6%. From the table below we can also notice that the FFO payout ratio has remained unchanged (or even decreased by 1%), which means that BIP has indeed managed to deliver on its strategy to accommodate dividend growth through a sustainable growth in the underlying cash flows.

BIP Supplemental Information Q1 2024

Part of this is possible from the embedded revenue bumps and the indexation to inflation, but most of the growth really stems from the accretive capital recycling and organic growth avenues that are supported by the retained FFO generation (i.e., conservative FFO payout ratio). For instance, notable drivers behind the FFO growth this quarter came from the acquired German telco towers, two data center platforms, and the purchase of 40 retail collocation data centers.

Yet, the capital recycling or asset rotation strategy has played an even more significant role in driving the FFO expansion. Here we have to understand that for BIP to deliver on its organic growth target of 6 – 9% per year, it has to venture into large-scale M&A activities or organic development projects. Neither revenue escalators or incremental CapEx via the retained FFO generation is sufficient to reach this target. So, to move the needle in terms of the FFO growth, BIP has to find fresh capital to accommodate its growth strategy.

In this respect, selling parts of the existing projects (i.e., JVs) or even the entire project or asset is an optimal way how to access liquidity in a shareholder friendly manner. First, it allows to avoid the issuance of additional equity (diluting the existing shareholder base), and, second, it allows to capture the embedded value in projects that were initially financed by BIP, but now once they are already operational there is a potential for higher IRR realization.

Here is a relevant commentary from the recent earnings call by Sam Pollock – Chief Executive Officer – on how BIP has managed to source in fresh liquidity by divesting parts of its current portfolio to later use these proceeds to fund new acquisitions at better multiples.

In April, we signed binding documentation to sell the fiber platform within our French telecom infrastructure business. The transaction has an enterprise value of over €1 billion and is expected to result in an IRR of 17% and a multiple capital of approximately 1.9 times. We created this greenfield fiber development segment in 2017 and quickly scaled the business to become a leading wholesale fiber-to-the-home network in the region.

So far this year (as of Q1, 2024), BIP had made a considerable progress on the capital recycling front by securing roughly $1.2 billion in proceeds, which is more than half of the 2024 target amount of $2 billion. Given this momentum, it seems that BIP will end the year with a way more unlocked value from its portfolio than $2 billion, which, in turn, should enhance the growth prospects even further. The most important thing in this context is to have the supply of attractive projects in place so that the Management can put the recycled capital back at work at enticing IRR expectations.

Here again by reading Sam Pollock answers to one of the analysts questions around the investment landscape, we can easaly conclude that BIP will not have major struggled in finding where to deploy its capital:

Yes. Look, I think we are — everything’s got to be risk adjusted. But for the last year and a bit, we have definitely targeted opportunities in the 15% to 20% range with ability to even achieve returns in excess of that, if certain parts of our business plan come together. So, we’re definitely being a bit greedy at the moment, to take one of Buffett’s words, I guess, but we — I think that’s just the environment that we’re in at the moment.

Finally, during this quarter BIP also managed to strengthen its capital structure by doing several notable refinancing. As a result of some debt rollovers, over 90% of BIP’s debt side was based on fixed rate borrowings with an average term of more than seven years. This provides the necessary cash flow stability and predictability for BIP to be active at the inorganic growth end.

The bottom line

BIP delivered yet another quarter of stable growth in its FFO per unit without impairing its balance sheet. The earnings growth came from the embedded rent escalators, but, most importantly, from the successful capital recycling program that enabled new deal and growth activity for BIP.

The current momentum in the capital recycling in conjunction with attractive investment space should provide strong tailwinds for BIP to continue grow it FFO generation in a meaningful fashion, while keeping the balance sheet robust.

As a result of this Brookfield Infrastructure Partners continues to remain an attractive buy with a dividend yield of ~5%, which is clearly set to grow over time.