djedzura/iStock via Getty Images

Investment Thesis

Brookfield Infrastructure Partners (NYSE:BIP) and its sister corporation, Brookfield Infrastructure Corporation (NYSE:BIPC) have seen their share prices decline by roughly a third since the Federal Reserve started its monetary tightening in early 2022. BIP/BIPC’s particular sensitivity to interest rates stems from high debt levels and substantial capital requirements, but equally important, a predominantly institutional shareholder base executing on income-oriented, low-risk mandates. As interest rates rose, those institutions saw alternative opportunities in the Treasury and bond markets.

We see the upcoming Fed easing cycle as a catalyst for infrastructure companies that have been punished in the previous cycle, particularly BIP.

Company Profile

For all intents and purposes, BIP is a private equity infrastructure investment fund. The company owns equity interests in various companies in the utilities, transport, midstream, and data/telecommunications infrastructure sectors, all controlled by its affiliated company, Brookfield Asset Management (BAM), and its parent company, Brookfield Corporation (BN). What sets BIP apart is BAM’s active approach to managing BIP’s portfolio. BAM acquires, improves, and eventually divests assets to invest in new opportunities on behalf of BIP. This allows BIP to adapt to market trends, and capitalize on emerging sectors while generating attractive returns.

Utility Segment

Nearly half of BIP’s utility assets are regulated, providing a stable source of revenue through government-authorized investments and rate setting. These assets primarily encompass electricity transmission lines and natural gas pipelines. Fees that BIP charges are negotiated each year with federal and state authorities, ensuring a fair return on capital and accessible prices to consumers. In Q1 2024, regulated assets generated $71 million in FFO down from $85 million in the same period of last year because of the sale of its 7.9% interest in AusNet, a gas and electricity transmission provider in Australia on August 2023. Overall, regulated transmission constituted roughly 45% of the utilities segment’s adjusted EBITDA and 40% of FFO.

Unregulated utility assets encompass electric and gas meters and long-term insurance, maintenance, and lease contracts for heating, ventilation, and air-conditioning equipment. As of Q1 2024, the company maintained 2.4 million smart meters and HVAC contracts with 10.7 million customers via its subsidiary Home Serve, acquired last year. The unregulated utility businesses brought $174 million in EBITDA in Q1 2024, up from $163 million last year, benefiting from price rises and growth in customer base.

Looking ahead, we expect moderate growth in the utilities segment as BIP executes its expansion projects. The total value of these projects stands at approximately $1 billion as of Q1 2024, which is not too small, considering that the utility segment’s total assets value stands at approximately $15 billion. Currently, the return on capital, measured as Adjusted EBITDA divided by total assets, is 8.6% on an annualized basis. This falls short of the company’s target range of 12% – 15%. However, even with a modest profitability improvement to 9% ROC, the $1 billion backlog could bring an additional $84 million to the segment’s annualized EBITDA, representing a growth of about 6.5%.

Transport Segment

The Transport segment saw a significant boost in profitability due to the Triton acquisition, with revenue surging 30% to $614 million, compared to $474 million in the prior quarter. Adjusted EBITDA also saw a notable increase of 47% reaching $401 million.

Both the Rail and Toll Road segments benefited from better-than-expected inflation escalators, helping the company maintain profitability despite divesting some of its Indian Toll Road operations in Q2 2023.

Going forward, we expect growth to normalize on a sequential basis. The segment’s capital projected, estimated at roughly $1.12 billion, focuses on capacity expansion for seaport terminals, including deeper ports to accommodate larger vessels, rail network expansion, and additional lanes for toll roads. The current backlog represents roughly 5% of the segment’s total assets.

Midstream Segment

BIP’s Midstream segment experienced a decline in profitability last quarter, with FFO decreasing to $170 million from $198 million in Q1 2023. This decrease was primarily due to rising interest rates. Adjusted EBITDA also declined by 6% to $256 million compared to $272 million in the prior year. This EBITDA decline is attributed to the sale of 12.5% interest in Natural Gas Company of America last year.

Looking ahead, we expect steady performance in the Midstream segment’s revenue and EBITDA. The budget for future expansion projects was $342 million as of March 2024 (excluding $90 – $100 million maintenance capital), a small amount that we don’t expect to significantly impact the segment’s overall earnings. For perspective, the midstream segment’s total assets stood at $16 billion as of Q1 2024.

Data Segment

In Q1 2024, BIP’s data segment demonstrates significant growth and profitability improvements. Adjusted EBITDA increased by 21% YoY while revenue grew by 19.4%. However, this was offset by higher borrowing costs, with FFO decreasing slightly despite higher revenue and EBITDA.

The segment is poised for significant growth going forward, as management continues executing on its budgeted capital projects, which amount to a whopping $5 billion, the highest among its segments.

A significant portion of the budgeted Capex is allocated to BIP’s partnership with Intel to build two semiconductor manufacturing facilities in the US, capitalizing on the recent Federal subsidies under the Inflation Reduction Act and the Chips Act.

About 12% of the backlog relates to data center projects across Europe. Other projects include new telecommunication towers aimed at helping mobile carriers execute their 5G strategy. The company is also expanding its fiber optic network in various locations across the globe.

We expect the Data segment to continue to be a growth driver for BIPs profitability for the foreseeable future.

BIP/BIPC versus Preferred Shares?

BIP’s preferred equity shares offer a compelling opportunity for income-oriented investors. Series A Preferred Shares (NYSE:BIP.PR.A) and Series B Preferred Shares (NYSE:BIP.PR.B) are cumulative shares, meaning that if BIP misses a dividend payment, it accumulates and must be paid in full before any dividends are paid to common shares/unit holders. Dividends on the preferred are fixed at $1.28 and $1.25 for BIP.PR.A and BIP.PR.B respectively, and based on today’s prices, yield 6.94% and 7.2% respectively. This is higher than the dividend/distribution yield on BIP (6%) and BIPC (4.8%).

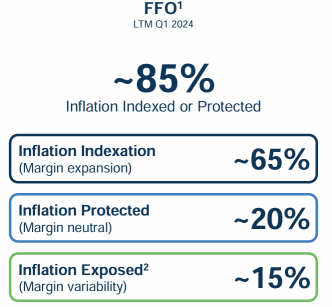

Although the preferred shares yield higher rates, the common shares and units have a growth advantage. BIP targets a growth rate of 5% -9% annually for its common units and shares. Moreover, 85% of its FFO is either indexed to inflation or inflation-protected, unlike the preferred shares.

BIP

Valuation and Peer Comparison

One common problem in assessing valuation is the dissociation between the economic and book value of assets, with assets recorded net of depreciation, but the real economic value is based on cash flows.

To solve this problem, we value BIP based on its FFO net of maintenance capital, a ratio that BIP calls Adjusted FFO ‘AFFO’. In Q1 2024, BIP generated AFFO of $512 million, which translates to $2.36 billion on an annualized basis.

Since BIPC is economically equivalent to BIP, we combine its shares to the number of units in calculating AFFO per share. BIPC’s total number of shares outstanding stood at 131,872,066 while BIP’s units stood at 654,175,813, with a combined total of 786,047,789 as of Q1 2024.

This translates to an AFFO/share of $3 and a Forward Price/AFFO ratio of 9x, a pretty attractive rate in absolute terms.

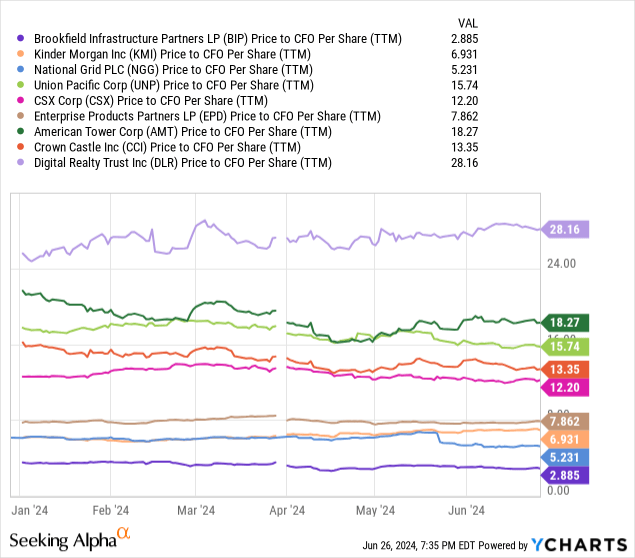

Since AFFO is a non-GAAP figure that can have different meaning to different companies, we used the more standard Price-to-Operating Cash Flow ratio to compare the relative value of BIP. The peer group shown in the chart below includes companies operating in one of BIP’s four segments: Electric and Gas Utilities, Transport, Midstream, and Data Infrastructure, and mirrors BIP’s relative undervaluation, lending us confidence in our buy rating.

Finally, when looking at BIP’s preferred shares, both Series A and Series B trade below their redemption value of $25 per share. However, we also noted that the decline in BIP and BIPC was far more severe than the preferreds, supporting our view that BIP/BIPC offers a more attractive value compared to the preferred shares.

Final Thoughts

BIP runs a diversified portfolio of long-life infrastructure assets that generate stable cash flows with a potential for long-term capital appreciation, appealing to the conservative mandates of institutional investors. However, the high interest rate environment has created other opportunities in the bond markets for BIP/BIPC’s typical shareholders, channeling funds away from the company. We see this as an attractive entry point, given the minimal impact of interest rates on the long-term prospects of BIP/BIPC.

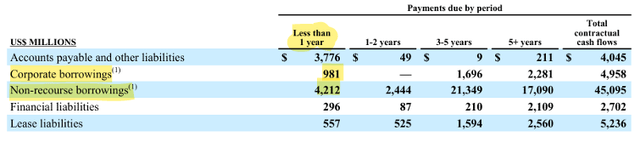

As of Q1 2024, the company had a decent debt-to-assets ratio of 1.4x and an interest coverage ratio of 1.5x, despite a 40% increase in interest expense. Nearly 90% of total borrowing is tied to fixed interest rates, so there is always a refinancing risk. The good news is, as of Q1 2024, only 15% of BIP’s debt matures within the next three years, which means that by the time the majority of its debt reaches maturity, it is likely that interest rates would have come down, as the Fed executes on its inflation-reduction monetary policy.

We view BIP/BIPC and their preferred shares as conservative investment prospects, but we are aware of some risks that could impact our total returns. Roughly 10% of BIP’s FFO is sensitive to commodity prices, a significant portion of which relates to its midstream segment. While the exposure is small, perceived adverse impacts of commodity price volatility could have big impacts on BIP’s share price. Additionally, while unlikely in the short and medium run, some of BIP’s assets could become obsolete or lose value. For example, rapid changes in semiconductor technology could render BIP’s data centers obsolete or less valuable. Nonetheless, our buy rating borrows confidence from the fact that 90% of BIP’s earnings are either regulated, with negotiated ROC rates, or contracted under long-term agreements, with an average duration of 10 years.