PM Images

Introduction

It’s time to talk about a very important topic: infrastructure investing.

While I went with a very catchy title, it’s not clickbait, as infrastructure investing has become a favorite of some of the wealthiest investors and funds in the world.

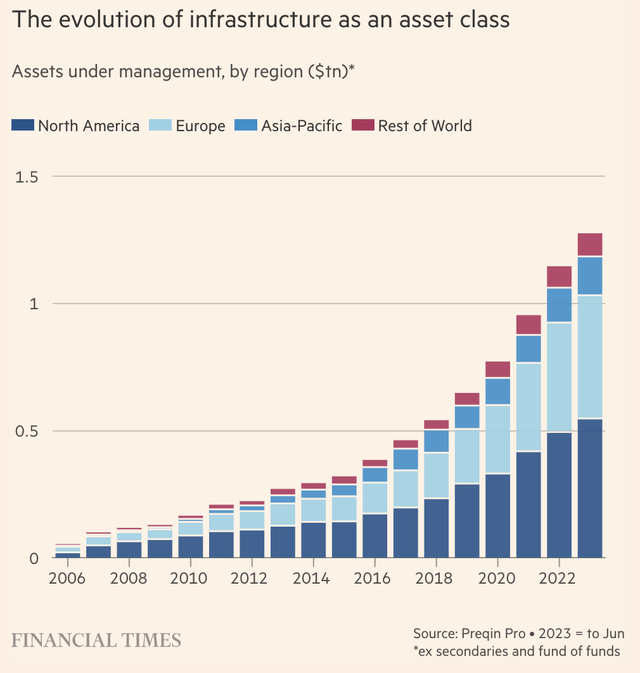

In March, the Financial Times wrote an in-depth article titled “Infrastructure: from investment backwater to a $1tn asset class.”

In 2006, global infrastructure was an asset class of roughly $80B. Last year, that number was $1.3 trillion. That’s a CAGR of 17.8%!

Financial Times

Initially, infrastructure investing was mainly for smaller projects, utilities, and municipal bankers.

Now, it has turned into one of the largest investment areas, which attracts some of the biggest asset managers in the world.

Today’s infrastructure market is more crowded. The success of entities such as Stonepeak and GIP, along with a decade of rock-bottom borrowing costs, prompted asset managers like BlackRock, CVC and General Atlantic to enter the fray by acquiring large infrastructure managers. A further wave of deals is brewing, according to bankers and private equity executives.

Once an investment backwater, infrastructure became a favoured area for pension funds looking for yield and protection against market volatility. Infrastructure assets under management worldwide have soared beyond $1tn, more than six times their level in 2008, according to data provider Preqin. – Financial Times (emphasis added)

More recently, on June 6, The Wall Street Journal wrote that KKR (KKR), GIP, and Indo-Pacific Group are forming a $25 billion regional infrastructure fund.

Their investments will be focused on energy, transportation, waste, and digital sectors.

Readers who have followed me for a while may know that I love these sectors as well.

The beauty of investing in infrastructure is that investors buy critical parts of the global economy. Without infrastructure, our modern economies will falter.

We need water to drink, roads to travel on, airports for airplanes, utilities for electricity, gas for cars, data centers for artificial intelligence, bridges to cross rivers, transportation to support supply chains, natural gas to cook on, and so much more.

That’s why I own railroads, energy producers, a pipeline owner, machinery companies producing construction equipment, real estate investment trusts, and others.

Although I would never compare myself to legendary investors, it’s interesting to see that some follow a similar playbook.

- According to First Sentier Investors, Warren Buffett’s Berkshire Hathaway (BRK.B) generates roughly 15% of its profits from infrastructure assets, including a railroad, utilities, renewable power, and pipelines.

- The same source reports that Bill Gates has a multi-billion dollar portfolio focusing on waste management, railroads, airport operations, and utilities.

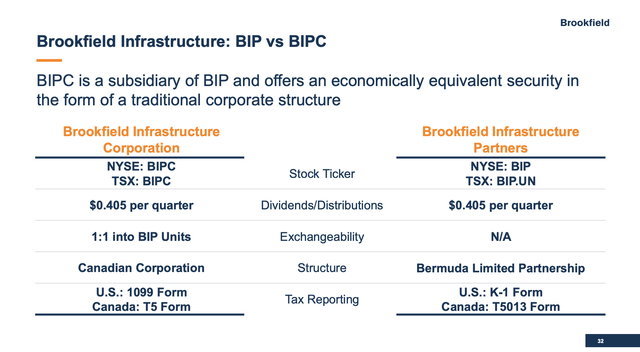

For investors looking for a perfect mix of income and growth without having to handpick single investments, I present the Brookfield Infrastructure Corporation (NYSE:BIPC), which is also traded under Brookfield Infrastructure Partners LP (NYSE:BIP).

The only difference is the tax treatment. BIPC was essentially founded to give the company access to a broader range of investors, including funds that are unable to invest in Limited Partnerships.

Brookfield Infrastructure Corporation/Partners

My most recent article on BIPC was written on March 13. Since then, the total return is -1.9%, roughly 550 basis points below the S&P 500’s return.

While this isn’t a great return, I’m quite happy it hasn’t taken off, as it offers investors a chance to buy income and growth at an attractive price.

Hence, in this article, I’ll update my thesis using the latest earnings and major developments to explain why I continue to love this ETF-like infrastructure investment.

So, let’s get to it!

Buying High-Quality Infrastructure

Infrastructure may not be as fascinating as some of the high-tech companies that are currently performing so well on the stock market.

The good thing is they don’t have to be, as they come with very specific characteristics that make them fantastic income vehicles for investors.

When done right, infrastructure investments come with both growth and income.

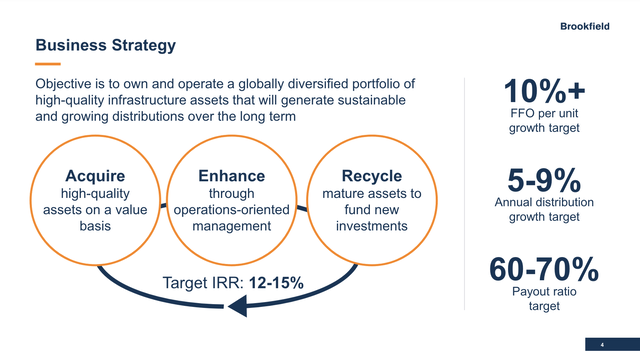

Brookfield Infrastructure has one objective, which is to own globally diversified infrastructure that allows it to generate sustainable and growing distributions over the long term.

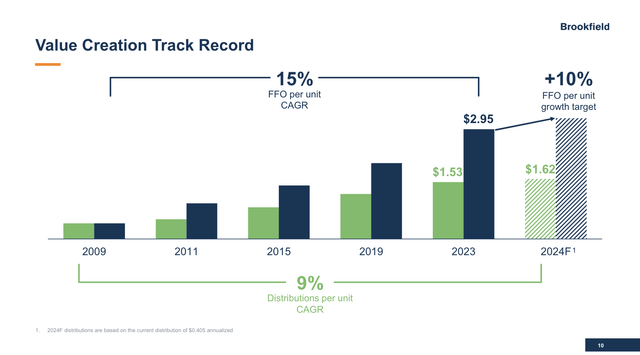

The company has a highly-favorable long-term annual per-share funds from operations (“FFO”) growth target of more than 10%, supporting an annual dividend growth target of 5-9% with a payout ratio of no more than 70%.

Please note that “units” are the same as shares when we discuss a Limited Partnership. A dividend from a Limited Partnership is called “distribution.” In the case of BIP and BIPC, both apply.

Brookfield Infrastructure Corporation/Partners

Since 2009, the company has grown per-unit FFO by 15% per year, supporting 9% annual distribution/dividend growth.

Currently, BIPC pays $0.405 in quarterly dividends, which translates to a yield of 4.9%. BIP yields 5.7%. The only difference is that BIP is taxed on an individual level. The total dividend is the same as the overview above showed.

Brookfield Infrastructure Corporation/Partners

In order to grow over time, the company uses a massive portfolio of infrastructure.

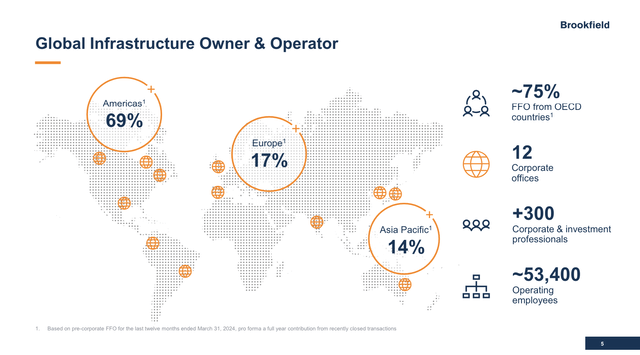

As of March 31, the company had 12 corporate offices, more than 53 thousand employees, and north of 300 corporate and investment professionals that generated roughly 75% of FFO in OECD nations, with the majority of that coming from the Americas.

Brookfield Infrastructure Corporation/Partners

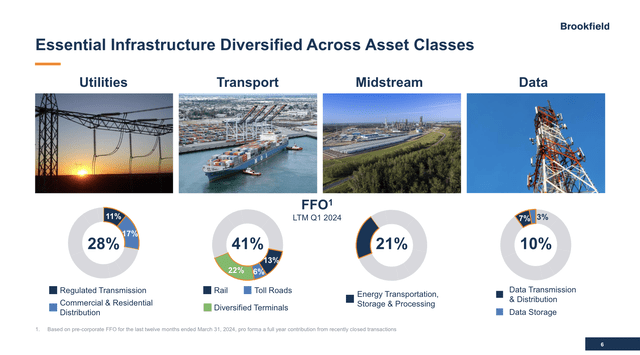

These assets come with an enterprise value of $55 billion, covering utilities, transportation, midstream, and data.

Using the data below, we see the company generates most of its FFO from utilities and transport, which includes roughly 4,200 kilometers of natural gas pipelines, 2,900 kilometers of electricity transmission lines, more than 8 million electricity and natural gas connections, 37,300 kilometers of rail, 3,300 kilometers of toll roads, 7 million TEU intermodal containers, ten terminals, and two export facilities.

Brookfield Infrastructure Corporation/Partners

For my American readers, please note that Brookfield is Canadian, which means it uses kilometers instead of miles. One kilometer is 0.62 miles.

It also owns 25,600 km of gathering, transmission, and transportation pipelines that connect energy producers to customers.

With regard to modern connectivity, the company owns 228 thousand telecom towers, two semiconductor foundries, and more than one million fiber connections.

In other words, the company has built a network that reaches every part of the economy, from basic energy needs to the transportation of goods and modern connectivity solutions.

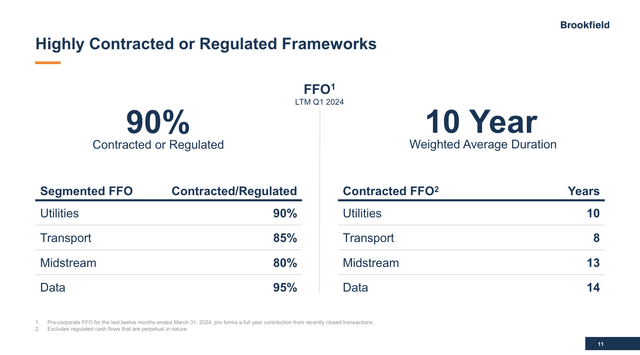

Even better, 90% of its FFO comes from contracted or regulated sources with a weighted average duration of ten years. This massively lowers earnings volatility and improves visibility.

Brookfield Infrastructure Corporation/Partners

Essentially, its entire business is recurring, fee-based revenue.

- 70% of FFO over the past four quarters had no volume or price exposure.

- 20% was exposed to regulated rates with GDP growth exposure.

- Just 10% was “market sensitive.”

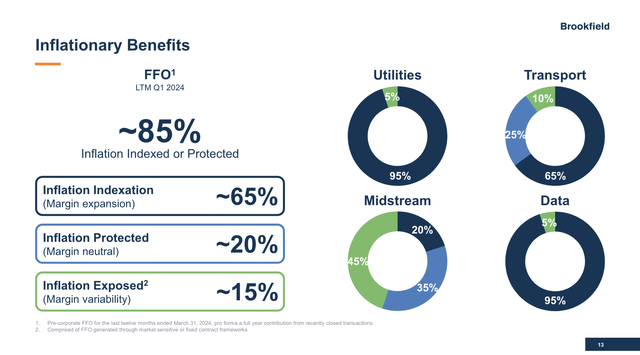

Speaking of stability and safety, 85% of the company’s FFO comes with inflation protection.

- 65% is indexed to inflation, allowing the company to grow margins when inflation is rising.

- 20% is inflation-protected, allowing the company to keep margins steady.

- Just 15% is exposed to inflation, with most of these operations occurring in its midstream operations.

Brookfield Infrastructure Corporation/Partners

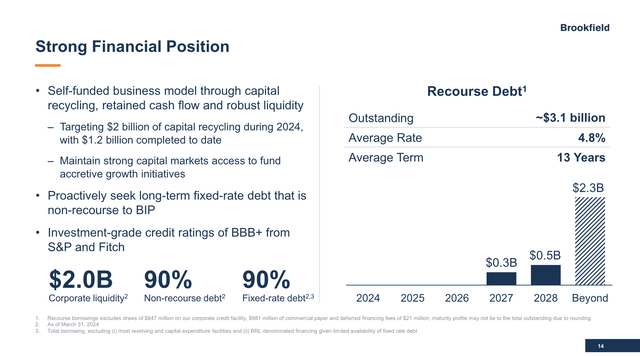

With regard to stability, the company also enjoys a strong balance sheet and has effectively managed its debt over the past few years.

Currently, over 90% of its capital structure is fixed rate with an average term of seven years. Only 4% of its asset-level debt matures in the next 12 months.

Moreover, the company has no corporate maturities until 2027, which buys it a lot of time in this environment of elevated rates.

Furthermore, with more than $2 billion in corporate liquidity, BIPC makes the case it is in a great spot to support future growth plans and take advantage of favorable market conditions for refinancing and capital optimization.

It has an investment-grade rating of BBB+ from both S&P and Fitch, which is one step below the A range.

Brookfield Infrastructure Corporation/Partners

Adding to that, 85% of the company’s FFO comes from investment-grade businesses, which means its holdings also come with subdued financial risks.

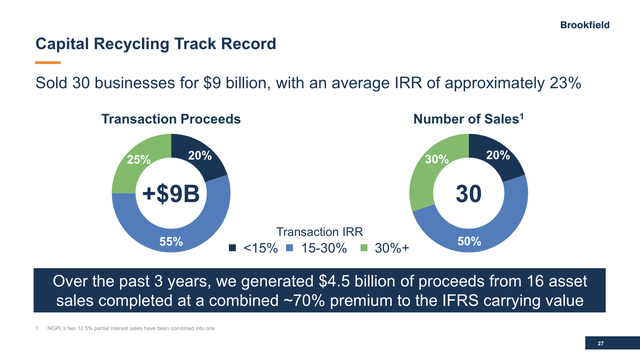

A major reason for its healthy balance sheet is its capital recycling track record.

Essentially, the company sells some of its holdings at a profit (instead of just keeping them for growth and income), which frees us new liquidity for future investments.

Over the past three years, the company has generated roughly $4.5 billion from 16 asset sales at a combined 70% premium to its official carrying value.

So far, it sold more than $9 billion of assets in 30 transactions. The majority of these had internal return rates of more than 15%.

Brookfield Infrastructure Corporation/Partners

In 1Q24, the company revealed a major deal in France, which perfectly shows how well it generates value without taking on elevated risks.

In April, we signed binding documentation to sell the fiber platform within our French telecom infrastructure business. The transaction has an enterprise value of over EUR 1 billion and is expected to result in an IRR of 17% and a multiple of capital of approximately 1.9x. We created this greenfield fiber development segment in 2017 and quickly scaled the business to become a leading wholesale fiber-to-the-home network in the region. – BIPC 1Q24 Earnings Call (emphasis added)

How Attractive Is BIPC At These Levels?

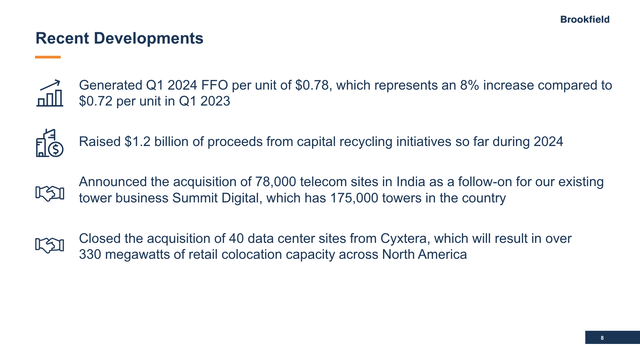

Speaking of 1Q24, the company continues to invest in new opportunities, including buying an additional 10% stake in its Brazilian integrated rail and logistics provided for roughly $365 million.

The company made this transaction 20% below what it considers to be fair value.

Additionally, the company is advancing a $1 billion acquisition of telecom towers in India. Its share of this deal is roughly $150 million.

In general, in 1Q24, the company generated an FFO of $615 million, 11% higher compared to the prior-year quarter. Per-share FFO increased by 8%.

Brookfield Infrastructure Corporation/Partners

This was driven by 7% organic growth, with tailwinds from inflation indexation in its utility business, inflationary tariff increases and higher traffic volumes in its transportation segment, gas storage and demand benefits in midstream, and rising demand for data and storage in its data segment.

Going forward, despite potential short-term volatility due to geopolitical situations and a flat to lower interest rate environment, the company used its 1Q24 earnings call to explain it remains optimistic about the long-term outlook for the global economy and infrastructure assets.

Interestingly – but not surprisingly – the company expects strong interest from institutional investors looking for stability, which is what we discussed in the first part of this article.

With all of this in mind, the company’s stock price performance is poor.

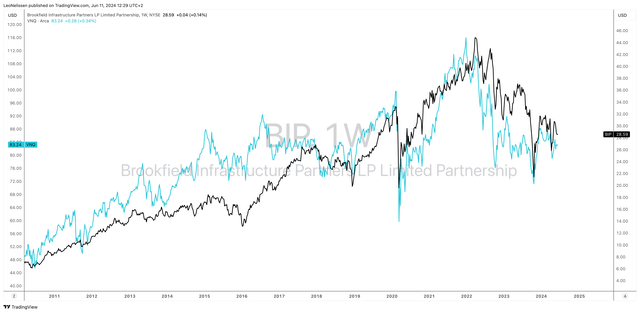

BIP, which has been stock listed much longer than BIPC, is currently trading 36% below its all-time high. In the chart below, I compare it to the Vanguard Real Estate ETF (VNQ), which is represented by the blue line.

The main purpose of this comparison is to show why BIPC is down despite doing well.

In general, the market has turned its back on investments that are funding-intensive with a lot of contracted revenues.

While BIP is not a REIT, it’s somewhat in the same boat, as the high correlation between the two assets shows.

TradingView (BIP, VNQ)

However, this comes with opportunities. After all, we discussed that BIP has a healthy balance sheet, inflation protection, and secular growth opportunities.

If the market wants to throw the baby out with the bathwater, it opens up new opportunities for investors.

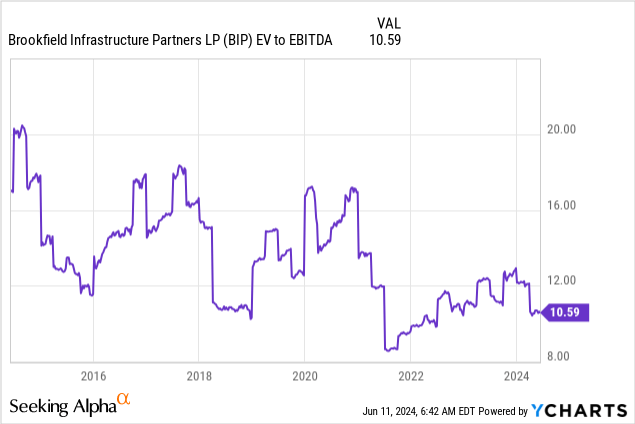

Currently, BIP trades at just 10.6x EBITDA, which is below its longer-term median of roughly 15x EBITDA.

The consensus price target is $38, which is roughly 33% above the current price and is supported by the company’s favorable long-term growth outlook of more than 10% annual per-share FFO growth.

I agree with that.

While it may take a while for the market to jump back into BIP/BIPC due to elevated rates and sticky inflation, I believe that buying at these prices offers both income, growth opportunities, and an overall favorable risk/reward.

The only reason why I don’t invest in BIPC is my focus on single stocks.

Essentially, I’m building my own infrastructure portfolio.

Takeaway

Infrastructure investing is no longer a niche interest. On the contrary, it’s a powerful asset class attracting the world’s wealthiest investors and funds.

With a massive growth trajectory, investing in infrastructure means owning critical parts of the global economy, from utilities to transportation and data centers.

Brookfield Infrastructure perfectly captures the strength and potential of this sector, offering stable, inflation-protected, and diversified income.

Despite recent market challenges, the company’s strong balance sheet and growth opportunities make it an attractive buy for investors seeking a mix of income and growth.

Pros & Cons

Pros:

- Stable Income: BIPC offers a reliable income with a 4.9% yield and consistent growth.

- Diversified Portfolio: The company owns a wide range of assets, including utilities, transportation, midstream, and data.

- Inflation Protection: 85% of BIP’s FFO is inflation-protected.

- Strong Growth Potential: With a historical FFO growth of 15% per year and a solid pipeline of new investments, BIP is well-positioned for future growth.

- Attractive Valuation: Due to poor recent performance, the company is attractively valued.

Cons:

- Interest Rate Sensitivity: Higher interest rates can impact funding costs and investor sentiment.

- Geopolitical Risks: As a global operator, BIP is exposed to geopolitical uncertainties that can affect its operations.

- Economic Growth: Although the company’s business model is mainly anti-cyclical, economic downturns can negatively impact its growth opportunities and re-sell the value of its capital recycling program.