By unifying liquidity across blockchains, streamlining the trading experience, and providing robust support for diverse trading needs, omnichain infrastructure is revolutionizing DeFi, driving efficiency and broader market participation.

As decentralized finance (DeFi) continues to expand, a critical issue of liquidity fragmentation has emerged. A survey highlights that more than $100 billion in assets are locked in DeFi protocols, yet fragmented liquidity reduces overall market efficiency.

A report predicts that Layer 2 (L2) solutions, designed to increase blockchain scalability, will drive Ethereum’s market cap to $1 trillion by 2030. Additionally, data shows that the number of L2 networks on Ethereum has increased by 40% in the past year, inflaming the fragmentation problem.

Cumulative total value locked Ethereum L2s. Source: L2beat

Another study finds that bridging assets between L2s increases processing times by 30% and costs by 25%, contributing to user frustration and market inefficiency. When assets and transaction volumes are dispersed across various L2s, users must bridge different layers, leading to high transaction costs and security risks.

These challenges not only discourage casual users but also pose a barrier to the wider adoption of DeFi, underscoring the importance of interoperability and highlighting the significance of multi-chain alternatives.

Orderly Network: Redefining DeFi with Cross-Chain Solutions

A permissionless liquidity layer for Web3 trading, Orderly Network aims to redefine DeFi by providing a robust omnichain trading infrastructure that unifies liquidity across different blockchains. This approach addresses critical challenges in the DeFi sector by delivering liquidity and settlement support for any asset, chain or interface, thereby enhancing the efficiency and trading experience across various platforms.

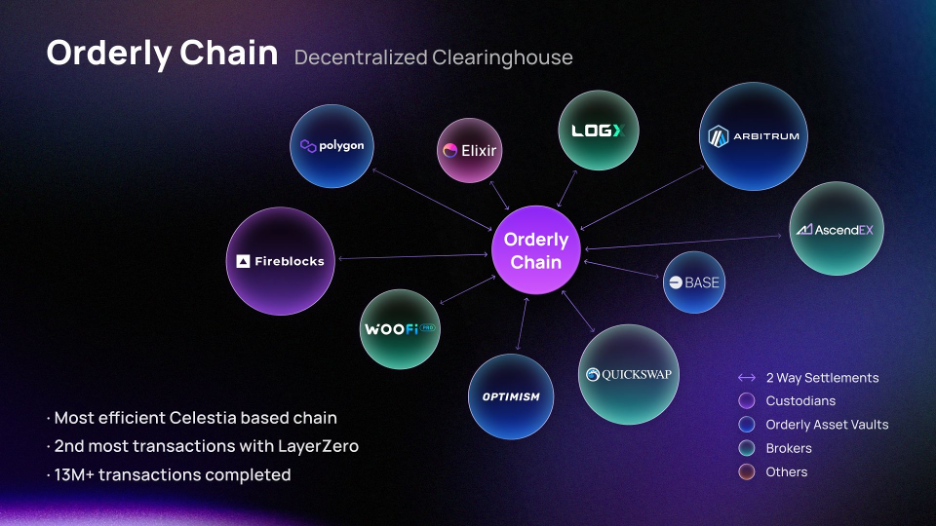

To achieve these capabilities, Orderly has implemented the Orderly Chain, which acts as the primary settlement layer and ledger for all transactions, including user balances and trading data. The platform is built on the OP Stack, which facilitates the development and deployment of blockchain apps.

Orderly Network combines an order book-based trading system with a liquidity layer for spot and perpetual. Source: Orderly Network

The Orderly Chain leverages Celestia’s data availability to ensure constant access to data and LayerZero’s cross-chain protocol to facilitate seamless transfers between blockchains. As one of the most active protocols on LayerZero, Orderly ensures smooth operations even during potential downtimes of the matching engine order book. This resilience enables brokers to manage trading positions and user balances without interruption confidently. According to recent data, Orderly is the largest user of the Celestia network, accounting for more than 35% of its data. It also remains the second-largest protocol on LayerZero, accounting for 28% of all messaging on LayerZero.

Orderly’s system offers cross-network functionality that improves trading efficiency, expands liquidity, tightens spreads and integrates capabilities that were previously unattainable in DeFi. This functionality is similar to the operational model of CME in traditional finance. Orderly Network aims to enhance and address the fragmented liquidity issue.

With its robust trading system and liquidity layer, it not only supports the ongoing development of the ETH ecosystem but also extends its benefits to other blockchains. Orderly functions as an omnichain trading and transaction platform, facilitating seamless transactions across various blockchain networks.

Versatile Solutions for Enhanced Trading Across Platforms

Orderly Network supports various use cases by offering a permissionless liquidity layer for Web3 trading. Wallets and custodians can leverage the network to provide users with optimal swap rates for major assets and create custom swap widgets. Trading desks and sophisticated traders benefit from Orderly’s API, which provides a centralized exchange-level experience with low-latency order execution.

Spot aggregators can tap into Orderly’s extensive liquidity to secure the best market rates, drive volume and earn trading fees. Perpetual aggregators can access the shared order book and liquidity to develop front-ends integrated with the perpetual ecosystem.

Orderly Network deploys its omnichain vaults across major chains. Source: Orderly Network

Games and decentralized applications (dApps) can enhance user experiences by integrating Orderly’s in-game widget for seamless token swaps. Trading bots can access top spot and perpetual rates with features such as stop-loss and limit orders, gasless transactions and customizable fees.

Additionally, Orderly provides comprehensive hedging tools that help safeguard positions on other exchanges through its extensive order book, ensuring efficient risk management strategies.

Driving Growth and Expanding the DeFi Landscape

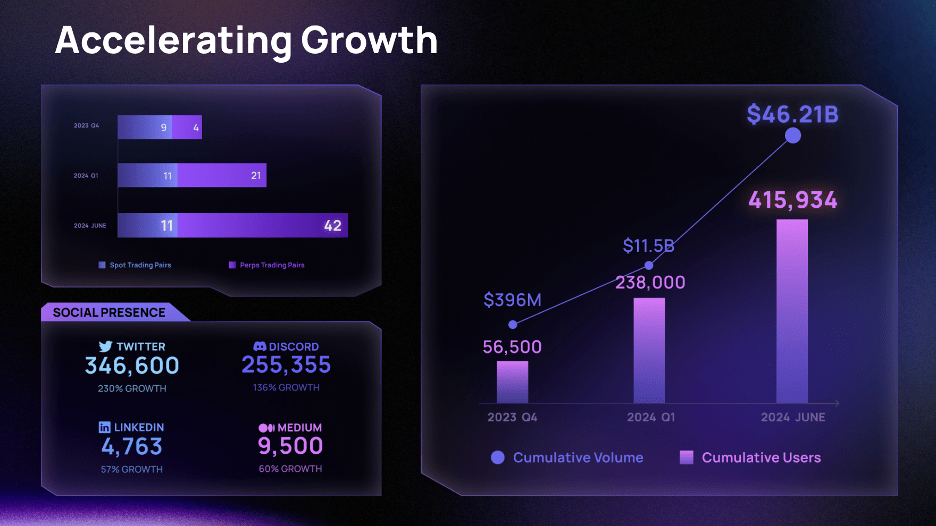

Orderly Network has achieved significant milestones, including surpassing $50 billion in cumulative transaction volume and seeing a 100% increase in total value locked (TVL) to $40 million in just one month. The network has deployed vaults in six major blockchain ecosystems — Near, Polygon, Arbitrum, Optimism, Base and Mantle. It also has expanded its infrastructure to include the Ethereum mainnet, simplifying deposits and withdrawals between Ethereum and other supported chains. With support for more than 14 DEXs, Orderly ranks among the top five on DeFiLlama’s lists.

Orderly Network has seen consecutive quarterly increases in cumulative transaction volume and user numbers. Source: Orderly Network

Highlighting the importance of liquidity in the dynamic DeFi landscape, Ran Li, co-founder of Orderly Network, stated, “As omnichain pioneers, we empower diverse users with liquidity and settlement support for any asset, any chain, or any interface. We’re thrilled to see how this next phase unfolds and to continue pushing the boundaries of DeFi trading together.”

Innovating with Omnichain SDK and Future Developments

Orderly has introduced its Omnichain SDK, which is designed to streamline the development of perpetual protocols and advanced trading tools for EVM developers. This toolkit, functioning like a plug-and-play system, allows developers to quickly build order book-based perpetual DEXs, significantly reducing development time and effort for Web3 teams.

In preparation for its token launch, Orderly Network has launched “The Road to the Order” campaign, a gamified initiative that rewards active traders with “Merits” for each trade. These Merits will contribute to their share of the upcoming airdrop following the token generation event. The campaign, currently in its 11th epoch, has already engaged over 57,000 weekly active traders, who can track their progress and rewards through a dedicated webpage.

The roadmap of Orderly Network contains ambitious goals for H2 2024. Source: Orderly Network

Looking forward, Orderly Network plans to enhance its platform capabilities and user experience in the second half of 2024 with initiatives such as introducing isolated margins to improve risk management and trading flexibility. This feature will allow traders to allocate specific amounts of margin to individual positions, effectively limiting potential losses. Another significant addition is the multi-collateral functionality, which will increase the platform’s versatility by enabling investors to use various assets as collateral for their positions.

Orderly Network also plans to integrate on-chain oracles to provide continuous, transparent and diversified data sources for pricing, enhancing the platform’s reliability and security. As Orderly continues to expand and introduce new features, it aims to set new standards for liquidity and risk management in DeFi, facilitating smoother and more efficient trading experiences.

Social links

Official Website | Twitter | Telegram | Discord | Linkedin