Robert Daly

Blackstone (BX) has long been underweight retail, having mostly bought single family rentals, apartments, industrial and data centers. On 7/30/24, Reuters published a report saying Blackstone is in preliminary discussions to acquire Retail Opportunity Investments Corp. (NASDAQ:ROIC).

Shopping centers have had increasingly favorable fundamentals, as we wrote about here. It would seem private equity is starting to appreciate the sector. Given that Blackstone and other private equity are dramatically underweight shopping centers to the tune of $10s of billions, I suspect this is just the start of M&A for the sector.

In this article, we will examine the potential ROIC buyout and what its valuation signals for the rest of the sector.

Price reaction

After the potential buyout was announced on 7/30/24, ROIC shot up about 19%.

The terms of the buyout are not yet disclosed, and perhaps not yet even finalized. So while we don’t yet know the price of the transaction or for certain that a transaction will happen, I will use today’s post announcement price for valuation analysis. My hunch is that a closed merger would be slightly higher, at maybe $16 a share.

Valuation at market price

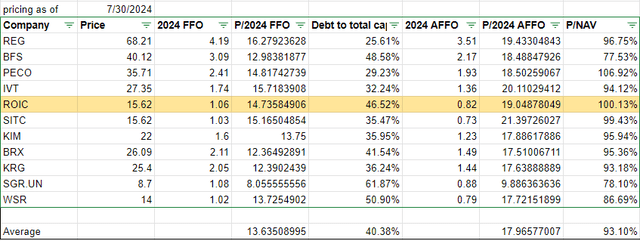

Consensus NAV for ROIC is $15.60 so it is trading right at NAV.

Consensus earnings estimates call for $1.06 and $0.82 of FFO/share and AFFO/share, respectively, in 2024. That puts it at 14.7X and 19X FFO and AFFO, respectively.

Post announcement, ROIC is trading at a premium to shopping center peers on all 3 metrics.

Sector average multiples for FFO and AFFO are 13.6X and 17.96X, respectively.

When considering multiples, one should also factor in leverage. As of the most recent quarter, ROIC has 46.52% debt to total capital, making it slightly higher leverage than the shopping center average of 40.38%.

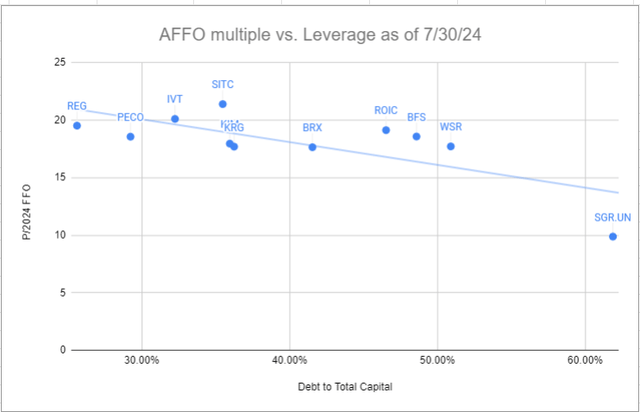

With this data, we can plot a rough leverage neutral valuation. Here are the AFFO valuations of the sector.

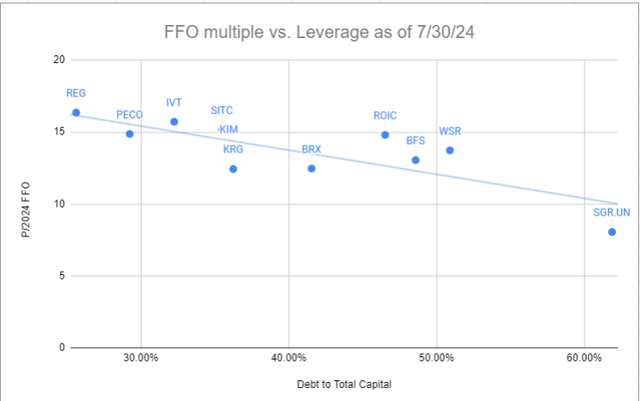

And the FFO valuations.

Vertical deviation from the trendline indicates overvaluation or undervaluation of a company relative to peers on these particular metrics.

In both cases, ROIC looks to be slightly overvalued relative to peers.

ROIC also looks more expensive than peers on an NAV basis, trading at 100% of NAV compared to the sector average of 93%.

ROIC overvalued or the rest undervalued?

14.7X FFO and 19X AFFO are not particularly high multiples. A company would only need to grow at a slow to moderate pace for these multiples to generate a market average return.

I believe shopping centers are positioned to grow at a moderate to fast pace given the following fundamentals:

- Undersupplied on current inventory

- Minimal new construction, indicating continued undersupply through at least 2026

- Strong demand, with store openings substantially exceeding store closings

- Mark-to-market on lease rollover of 20%-60%.

- Occupancy gains ranging from 100 to 500 basis points for the sector

We explored these factors in greater detail in the previously linked shopping center fundamentals article, so I will reference that rather than repeat the data.

These factors suggest a significant runway of growth, which is further backed up by the recent 2Q24 shopping center earnings report from Brixmor (BRX).

Some are performing better than others, but I think there are fundamental tailwinds for the entire sector. As such, I don’t think ROIC is overvalued at the merger rumored market price. Instead, most of the rest of the sector is undervalued.

Implied cap rates suggest material upside for shopping centers

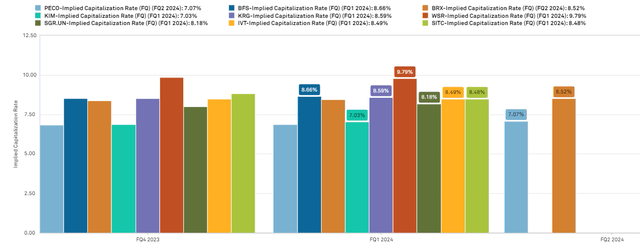

At today’s price, ROIC is trading at just north of a 6.5% implied cap rate using first half of 2024 NOI.

The rest of the sector is trading at implied cap rates in the 7s, 8s and even 9s.

S&P Global Market Intelligence

If other shopping center REITs were bought out at similar valuations to ROIC, shareholders would get substantial upside.

All of this valuation discussion so far is agnostic to property quality, which is of course an important factor in what valuation a company is worth.

Quality of ROIC relative to peers

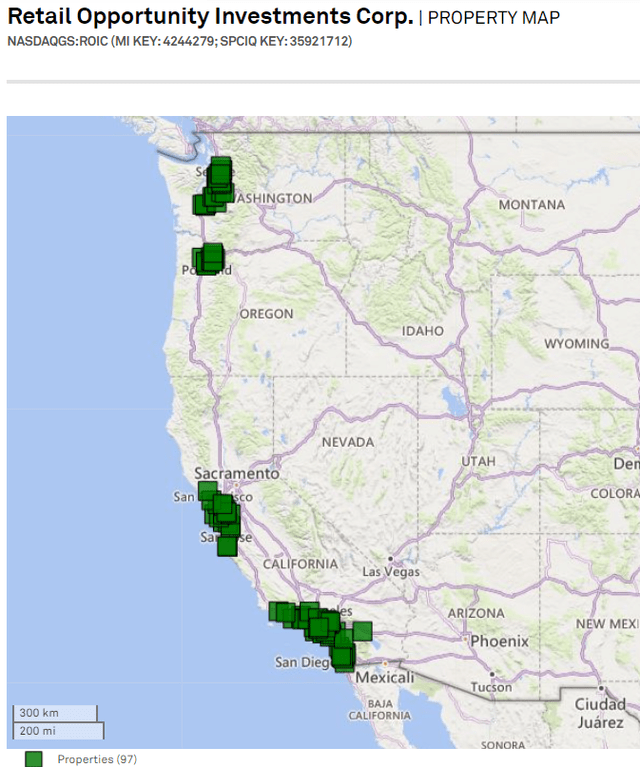

Quality changes with time as fundamentals move. Five-ten years ago, ROIC’s portfolio was where everyone wanted to be.

S&P Global Market Intelligence

Today, these West Coast locations are not as strong, as population and jobs are slowly moving away. I don’t think they will fail by any stretch, but I suspect forward demand growth for shopping centers will be lower here than in areas with higher population and job growth.

The key with retail real estate is that there is virtually no new supply across the entire U.S. so the primary differentiator in net absorption will be demand. Retail demand follows population and jobs.

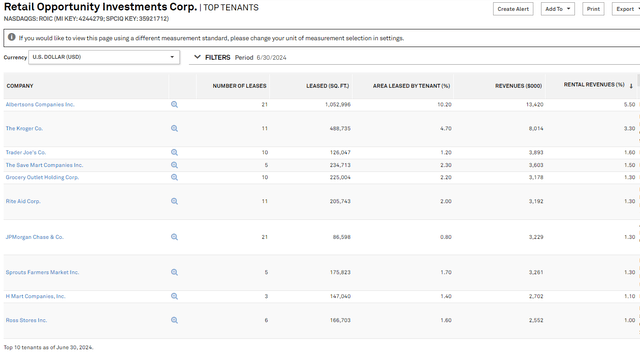

On the tenant front, ROIC has excellent grocery anchors. The vast majority of ROIC’s tenants look healthy to me, with the one sore thumb perhaps being the 1.3% revenue exposure to Rite Aid.

S&P Global Market Intelligence

Overall, it is a good tenant list.

ROIC’s rent per square foot and occupancy are slightly above average within the sector. This is to be expected as these locations have fairly high household income.

In terms of growth, ROIC is reasonably strong. In the 2nd quarter, it reported a 12.4% increase in same-space comparative base rent.

That level of growth is well worth the price Blackstone is potentially paying for ROIC.

However, I think shopping center peers will generally grow faster than that.

Not many have yet reported 2Q24 earnings, but those who have are coming in higher. Brixmor, for example, reported a 27.7% spread on comparable space.

“Executed 1.4 million square feet of new and renewal leases, with record rent spreads on comparable space of 27.7%, including 0.6 million square feet of new leases, with rent spreads on comparable space of 50.2%.”

Generally speaking, I prefer the growth profile and properties of peers over those of ROIC. As such, I suspect that over time they will move up toward valuations closer to where ROIC might get bought.

Natural market price gains or more buyouts

In the recent REIT rally, shopping center REITs performed fairly well and that momentum accelerated with the ROIC news as many shopping center stocks gained 3%-4% on the day.

Between still cheap valuations and strong fundamentals evinced by a string of earnings beats, I suspect there will be continued buoyancy in shopping center REIT prices. We are heavily overweight shopping centers and intend to maintain that position.

Beyond regular market price movement, I think there is potential for more M&A beyond a likely ROIC buyout.

3 shopping center REITs stand out as potential targets:

- Slate Grocery REIT (OTC:SRRTF) is very cheap, trading at just over 8X FFO. Its low valuation is consequent to its Canadian listing and high cost of debt. Both of these “ailments” could be fixed immediately in a buyout, allowing the buyer to get strong properties at a substantial discount to NAV while shareholders of SRRTF could still get a healthy premium.

- Kite Realty (KRG) is at a point in its growth cycle where it would make sense to sell. With their leasing, they have amassed $35.3 million of NOI in signed-but-not-open leases, which gives a buyer some easy baked in growth that they could take credit for. Any PE buyer would love to report to investors that NOI has risen $35.3 million in the first year after purchase.

- Whitestone (WSR) has already been the intended target of mergers, although the pricing was such that WSR rejected in favor of realizing the value itself. I would not be surprised to see follow on offers for WSR as its portfolio is so concentrated in key growth markets.

Kimco and Brixmor are large and have particularly clean operations. As such, I think they are more likely to be buyers than takeout targets. Private equity could be less likely to buy them because it would be hard to find low-hanging fruit.

That said, I think they are worth owning for their own merits with strong growth and cheap valuation.

Risks to investment in shopping center REITs

Demand for shopping center space is somewhat related to GDP. Currently, strong tenant demand could wane in a recession. As such, the sector would likely perform best in a soft landing scenario. It can also perform well if interest rates simply remain high, but it may lag if there is a significant economic downturn.

Further down the road, construction is the risk factor to watch. Due to the lack of permits presently, I don’t foresee significant deliveries before 2026, but watch for construction starts as an early indicator of the sector moving from undersupplied to balanced.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.