- Bitcoin ETFs saw $880 million inflows on the 4th of June.

- Despite Bitcoin’s rise, Google searches for related terms remain low.

Since its debut in January 2024, spot Bitcoin [BTC] Exchange-Traded Funds (ETFs) have showcased exceptional performance.

Recent data indicates substantial inflows, with a collective $880 million and $488.1 million inflows recorded on 4th June and 5th June respectively.

Farside Investors’ data reveals that on 4th June, the Fidelity Wise Origin Bitcoin Fund led in inflows, totaling $220.6 million.

At the same time, Bitcoin has also breached its much-anticipated $70K mark, with press time prices of $71,082.55.

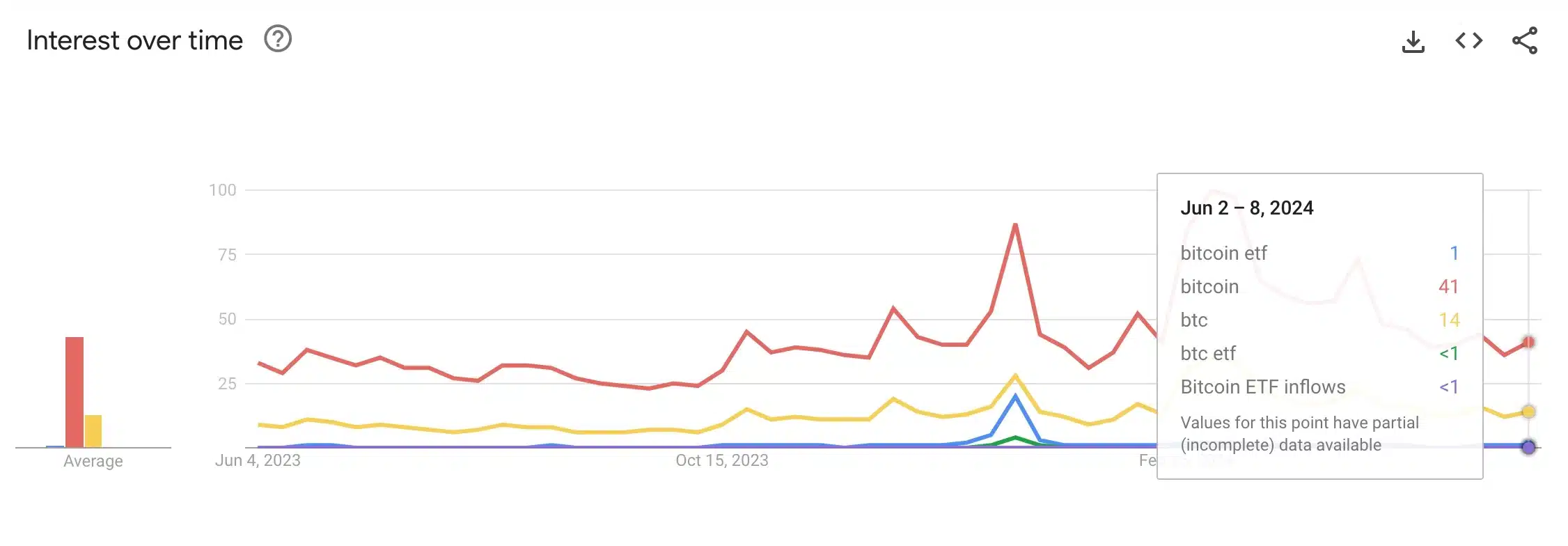

Google data shows a declining trend

However, what’s surprising here is that Google data showed a strikingly low level of search interest compared to the 2021 bull run.

This suggests that retail investors, a significant market segment, have yet to fully engage with Bitcoin ETFs which might be a bullish indicator for potential future growth.

According to Google Trends, which assigns a score based on a search interest’s relative peak popularity, terms like “Bitcoin” and “btc” scored 41 and 17 out of 100 respectively.

However, phrases such as “bitcoin etf,” “btc etf,” and “Bitcoin ETF inflows” registered a score of less than 1 globally.

Execs weighs in

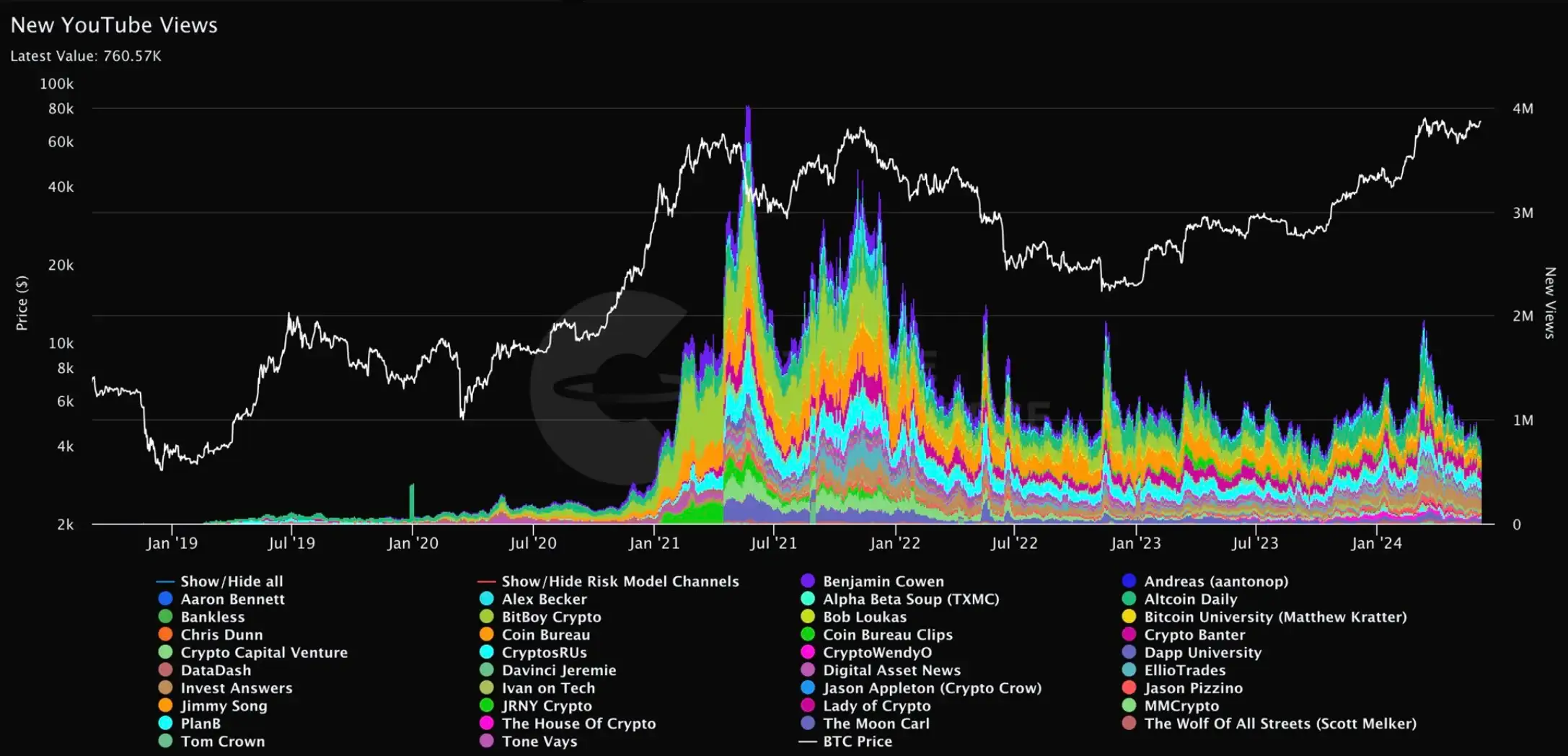

Adding to the fray, Crypto analyst Miles Deutscher, in his 6th June X post, underlined that interest in crypto-related content on YouTube has declined compared to the peak levels seen in 2021.

“There is no indicator in the world that sums up the current state of the market better than crypto YT views. $BTC at $70k in 2021: 4m views/day. $BTC at $70k in 2024: 800k views/day. Retail isn’t back yet.”

Deutscher further highlighted that the current market cycle has posed greater challenges for most investors compared to previous bullish periods.

Additionally, altcoins have generally not performed as well as Bitcoin, leading to a mismatch between market sentiment and actual price movements.

Despite the decline in search interest, the community remains bullish on Bitcoin, especially applauding the accumulation of Bitcoin by various Bitcoin ETFs.

Echoing a similar sentiment, Bit Paine took to X and said,