September’s retail sales data showed a (slight) acceleration of spending from August, though we’re well off past peaks.

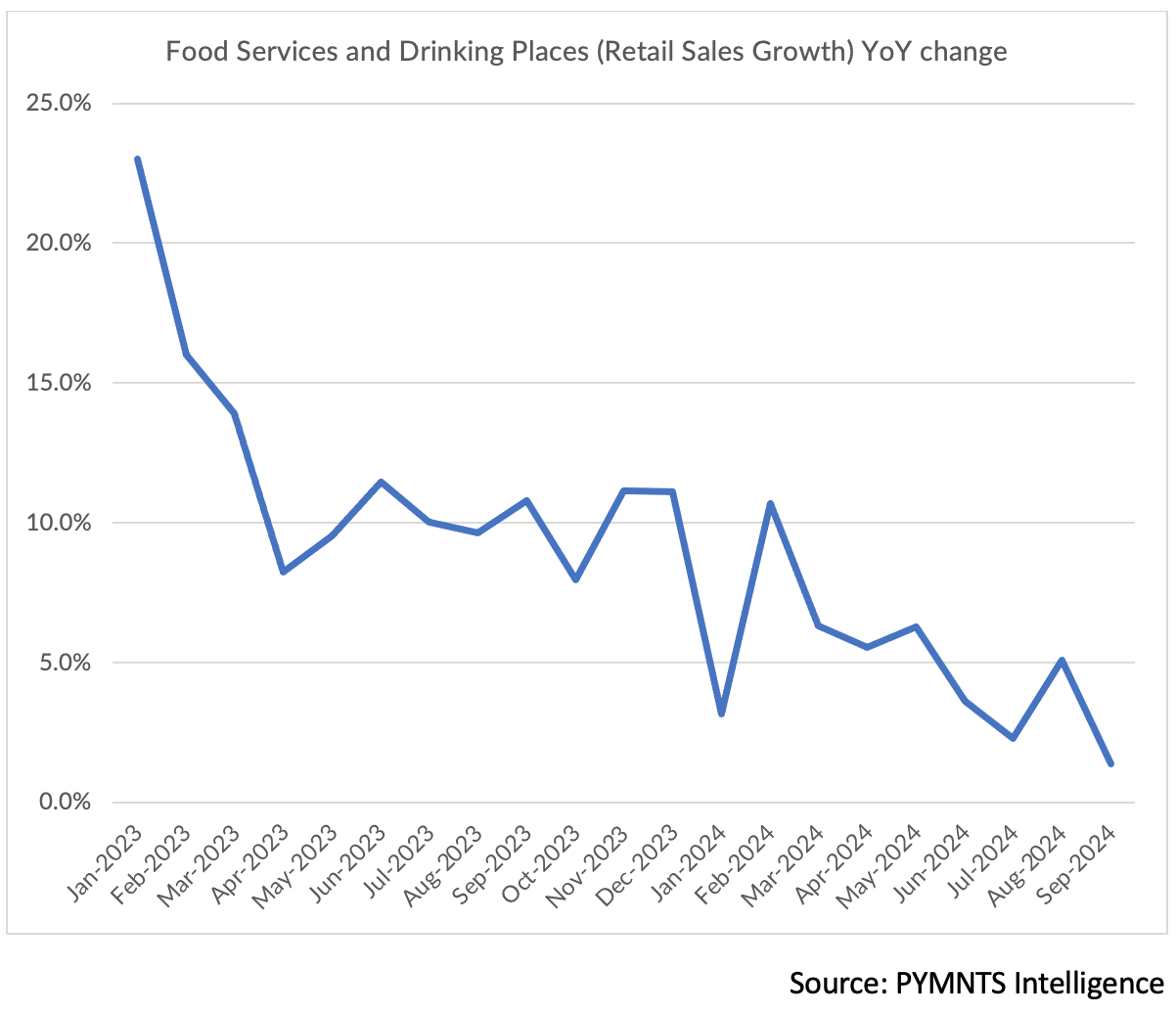

And speaking of past peaks — looking at year-over-year growth rates and patterns, as documented by PYMNTS Intelligence, the summit of early 2023, at least for the U.S. consumer, seems long ago and far away.

Where the Spending Was — and Wasn’t

Most recently, the languid pace of summer’s waning weeks presumably gave way to last minute back-to-school shopping, wardrobe replenishment … and big-ticket items saw a pullback.

Each month the Commerce Department releases its report on retail spending, and this time around, in September, sales were up 0.4%, up from the 0.1% pace seen in August, though below the 1% surge in July.

The consensus had been that the overall sales “headline” number would be up by 0.3%, so the latest data represents a “beat.” Wall Street cheered the news, initially, as stocks were up 0.4% at the open.

For September, we note, as had been the case with August, online sales continued to see a lift. The September data indicate that clicking and buying still is a key way to get commerce done. The measure of retail spending at non-store retailers, which is widely used as a read across for online merchants and platforms, was up 0.4% month over month. That’s a slowdown from the 1.4% jump in August.

Within the most recent report, 10 of 13 categories showed gains — including several discretionary categories such as apparel, which was up 1.5% from August, and sporting goods/hobby-related items, which gained 0.3%. Spending on health and personal care was up 1.1%. And grocery, which is of course non-discretionary, was up 1% month on month.

As to where consumers were not spending … big-ticket items saw a pullback. Furniture and home furnishings, as a category, were down 1.4%. Electronics, which can be, and often are, pricey, slipped 3.3% month on month. This category was up 0.6% in August, so it’s possible there was a “pull in” of sales as families and households bought laptops and phones and other devices as the kids and the college students readied for the connectivity that is demanded by everyday academic life.

The most recent data underscore what we’ve seen from earnings season, which is barely a week old. JPMorgan, Citi and others have all weighed in with reasonably solid metrics on card spending (which included September). Interestingly, JPMorgan management has said that spending is returning to “normal,” in the post pandemic age. Citi is taking note of the “surprisingly resilient” consumer and Wells Fargo management indicated that rate cuts should ease some pressures on consumers, especially those with lower incomes (and where PYMNTS has consistently documented the paycheck-to-paycheck pressures confronting those consumers and households).

The Long-Term Pace

The top chart, per PYMNTS, details just how muted growth has been since the great snapback that had come once economies fully reopened, and, flush with cash, we all went out and we all spent money on experiences and on, well, looking presentable to our fellow humans. The year-over-year growth rates on clothing and apparel have been volatile but are now (as measured on an unadjusted basis) barely positive.

Similarly, dining out has lost at least some of its heady allure, as seen in the second chart.

Merchants might breathe a sigh of relief at the September data, hoping that it pre-sages some continued momentum into the last few months of 2024 — but they are likely to be wistful, too, about the spending frenzies that are only recently in the rearview mirror.