In 2023, U.S. hotels faced rising operating expenses outpacing revenue growth, resulting in declining profit margins. To combat this, hotels are leveraging technology to enhance efficiency and guest satisfaction. Key areas of technological investment include employee productivity tools, automated guest services, and improved cybersecurity. Analyzing IT expenditures from 4,121 properties, CBRE found that IT costs represented a relatively controlled 1.4% of total operating revenue, despite a 7.4% increase in 2023. Higher IT spending was noted in Resort and Convention hotels due to their extensive service offerings. For hotels to optimize operations and valuations, understanding and managing their digital infrastructure is crucial.

In 2023, U.S. hotels saw their operating efficiency decline as operating expenses increased at a pace greater than revenue growth, resulting in a decline in profit margins. With forecasts of moderate revenue gains for the next few years, hotel owners and operators are very focused on controlling costs.

Hotels can improve operating efficiencies and guest satisfaction with an increased use of technology. Proper use of technology can enhance the productivity of employees, replace rudimentary manual functions and improve the guest experience.

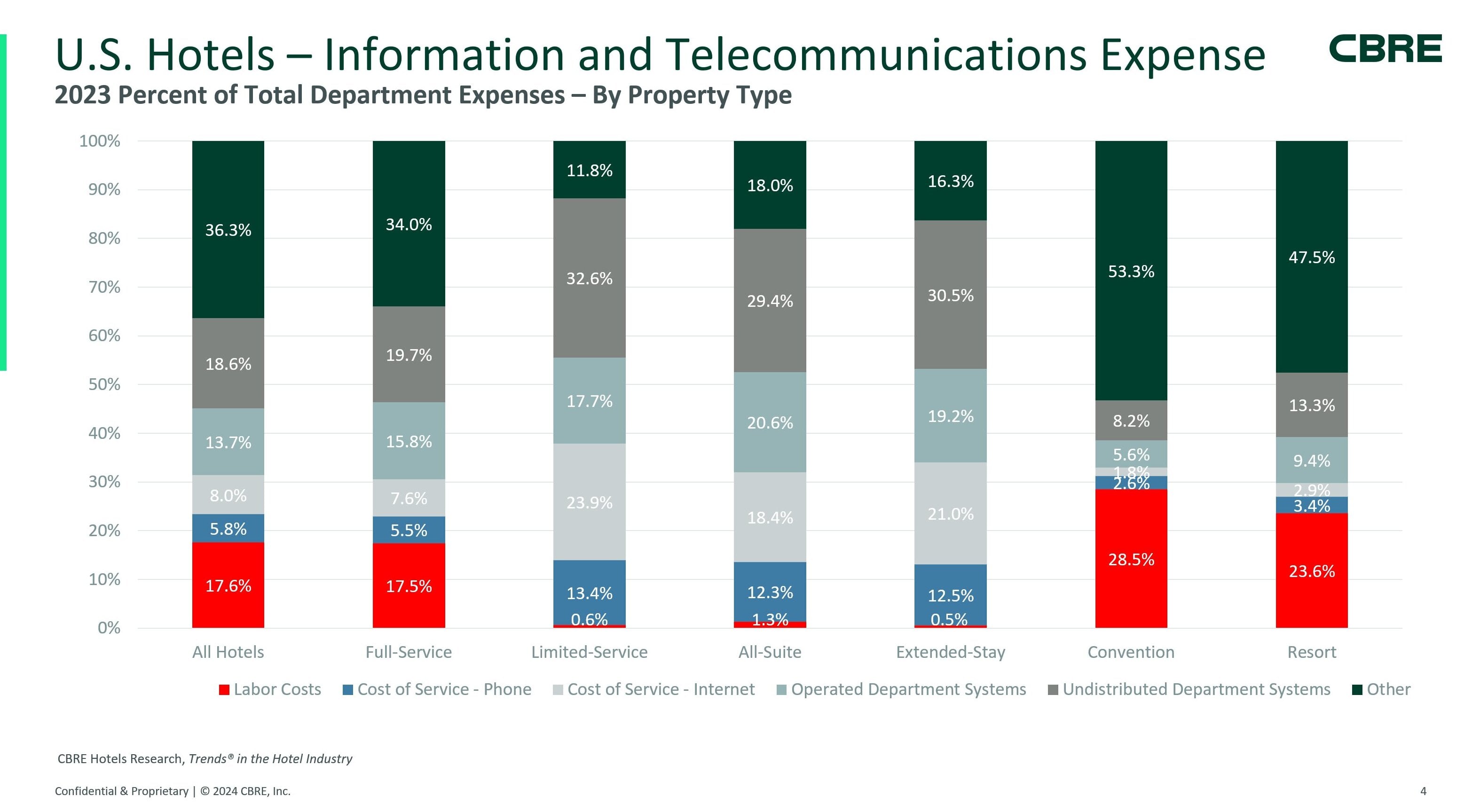

The day-to-day operating costs associated with technology are captured in the Information and Telecommunications Systems (IT) Department of the Uniform System of Account for the Lodging Industry. Expenses within the IT Department are separated into four major categories [1]:

- Labor Costs and Related Expenses – The salaries, wages and employee benefits for telephone operators, directors of information systems, and systems analysts and programmers.

- Cost of Services – The cost of phone, internet, cell, and fax services for administrative purposes, or when offered to guests on a complimentary basis.

- System Expenses – Software licenses, maintenance, service, storage, and software fees associated with IT systems used in both the operated and undistributed departments.

- Other Expenses – All other IT department expenses such as operating supplies, training, system storage and optimization, uniforms, and travel.

To gain a better understanding of recent property-level technology-related expenditures within U.S. hotels, CBRE analyzed the IT Department costs of 4,121 properties that participated in our annual Trends® in the Hotel Industry. In 2023, these hotels averaged 216 rooms in size and achieved an occupancy of 69.6% along with a $213.39 average daily rate (ADR).

A Relatively Controlled Expense

The IT Department is a relatively minor cost center for hotels. In 2023, IT expenses averaged just 1.4% of Total Operating Revenue. Further, these costs have been relatively controlled compared to other overhead expenses within the Undistributed Departments.

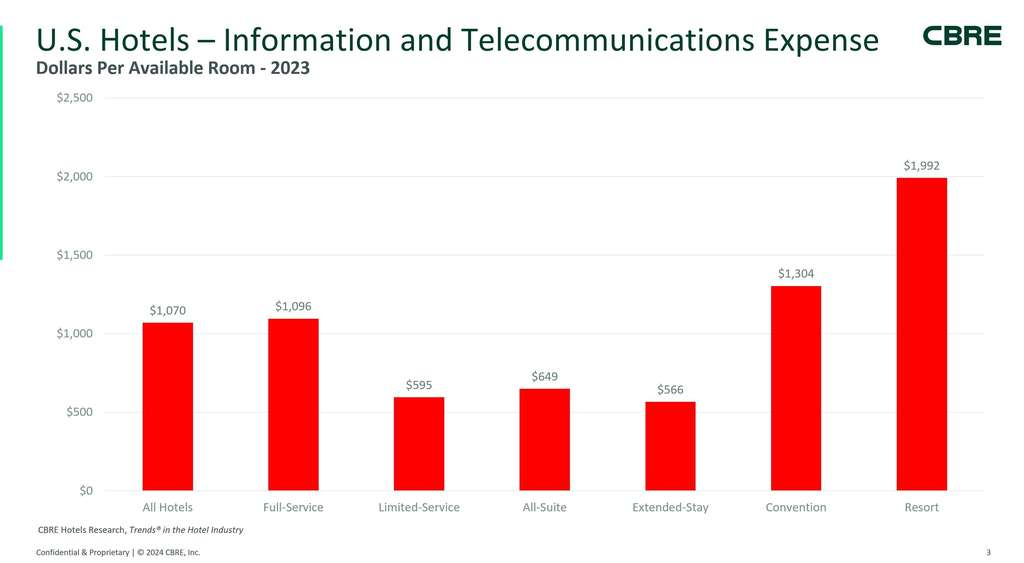

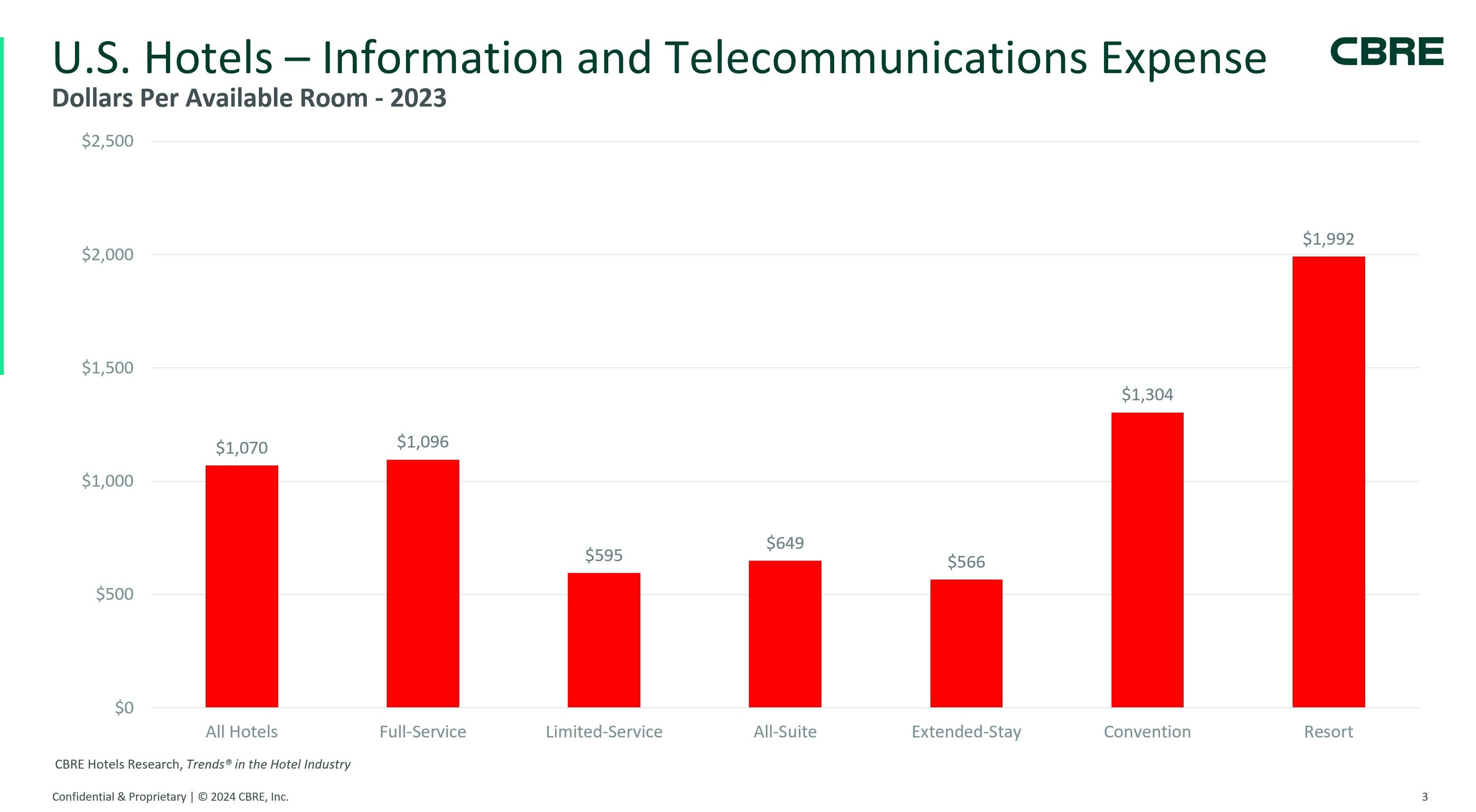

In 2023, IT Department expenses in the study sample increased by 7.4%. This compares favorably to the 9.1% average growth for all Undistributed Departments, as well as the 8.7% rise in revenues. IT Department expense growth was greatest at Convention hotels, and least at Extended-Stay properties.

Within the IT Department, Operated Department System expenses increased the most (16.9%), followed by Payroll-Related expenses (14.0%) and Salaries and Wages (10.8%). The operated departments are where most guest-facing technologies are found. The Cost of Service for phone calls (-13.2%) was the only IT Department cost category that declined from 2022 to 2023.

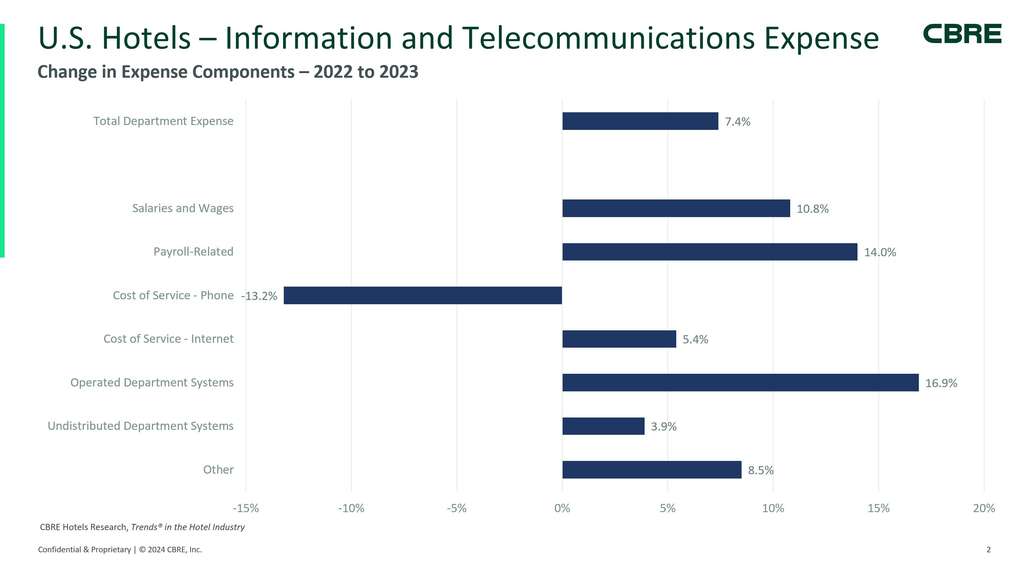

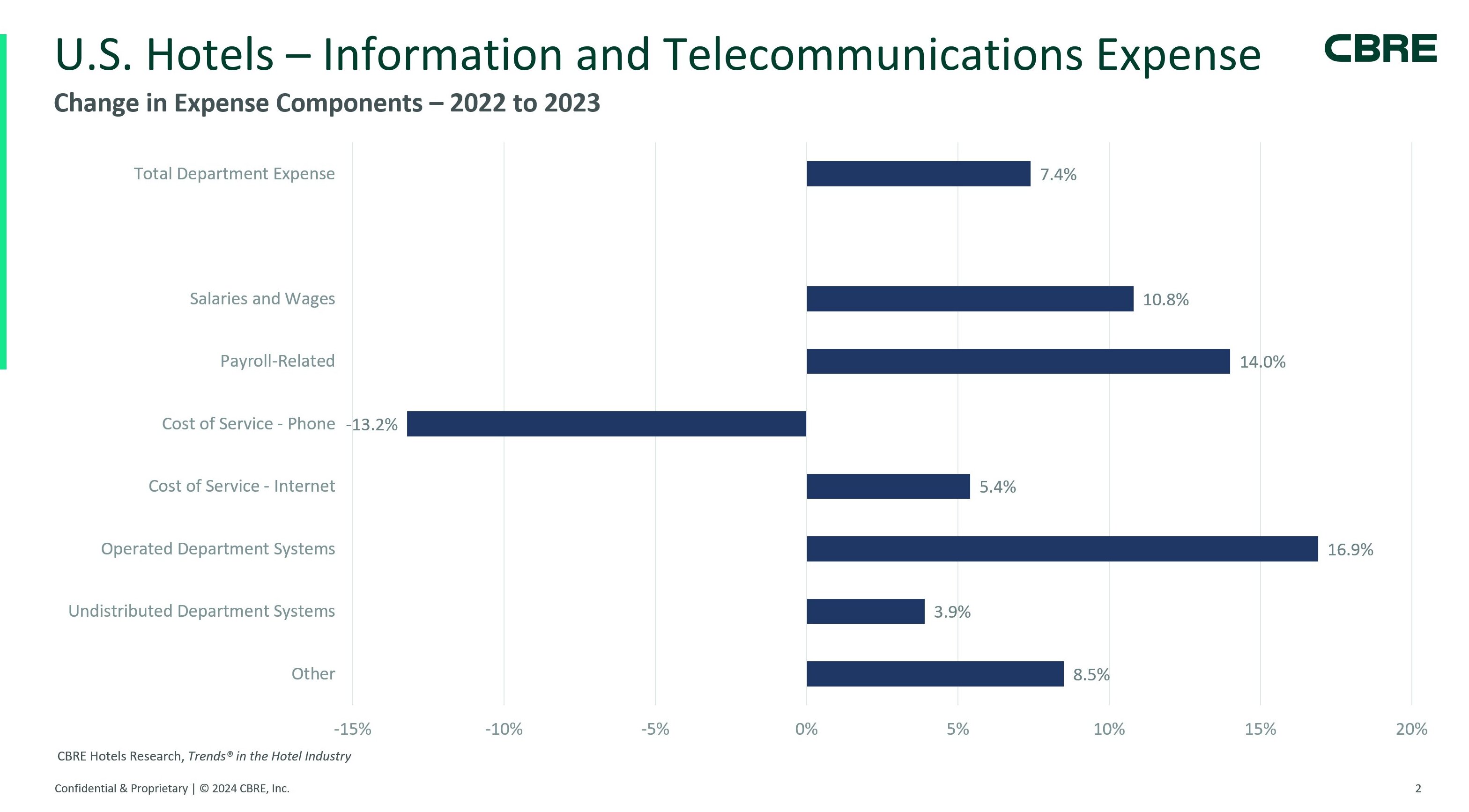

Among the different types of hotels, IT Department expenditures are greatest at Resort and Convention hotels, which are the property types that are most likely to have dedicated technology personnel (IT technicians and PBX operators). Further, Resort and Convention hotels have large back-of-the-house accounting and marketing functions that use multiple systems and offer their guests a diverse array of services and amenities that require the use of guest-facing technologies.

For Limited-Service and Extended-Stay properties, IT Department expenses are relatively low on a dollar-per-room basis, but still average 1.4% of revenue, similar to other property types. These moderate-priced properties offer guests complimentary phone and internet service and use limited versions of the same back-of-the-house systems that full-service hotels operate.

Digital infrastructure Considerations

Digital infrastructure is defined as all the connectivity allowing employees and guests to access public and private networks which gives access to hotel operations and amenities. Hotel owners and operators should consider the following when evaluating the digital infrastructure of their hotels.

- Guest Experience – Guests want a frictionless interface when using technology during the booking platform, the check-in process, and finally as they exit and receive their billing information. While at the hotel, guests interact with hotel technology to book services and avail themselves of amenities. Guest use of self-service applications such as remote check-in, digital room keys, and being able to turn off housecleaning services allow the hotel operator to efficiently deploy their labor force and increase guest satisfaction.

- Artificial Intelligence – Like the rest of the business world, hotel owners and operators are getting bombarded with news of artificial intelligence (AI). One of the most prevalent initial uses of AI technology by hotels can be found in their contact centers. AI helps reduce the amount of time it takes for agents to field phones calls and properly route those calls to the most appropriate live agent. In turn, this reduces operator costs and improves the customer experience by reducing the amount of time it takes for a guest to get the answer or the form they are looking for, whether over the phone or in some digital format.

- Cyber Security – Cyber security is top of mind for hoteliers. An increasing number of hotel owners and operators are faced with cyber-attacks such as ransom, where a bad actor will cripple a hotel operating system and demand payment to give control back to the hotel. We find most hotel operators are overspending in certain areas of cyber security, and underspending in other areas, not only increasing their tech spend per room, but keeping vulnerabilities wide open for troublemakers. Managed Security is a focus for hotels as they evaluate the latest technology and fit for their brand and property.

- Capital Markets – Because of recent shifts in the capital markets, hotel owners are increasingly reassessing their portfolio or selling properties to raise capital. Without truly understanding their digital infrastructure, along with other critical elements, owners could be selling properties below their existing value and buyers could be purchasing properties above existing value. It is critical to look at all properties of a portfolio every three to five years from digital infrastructure and other technology perspectives.

[1] Not included in the IT Department are capital expenditures for major IT software and hardware installations.