A new report from the American Society of Civil Engineers shows that continuing federal infrastructure spending at current levels, which reflect increases under the Infrastructure Investment and Jobs Act, would have a positive impact on the U.S. economy, and cutting spending back to pre-IIJA levels would hamper it.

The “Bridging the Gap” report, which ASCE released May 13, examines the economic impacts of two infrastructure scenarios: maintaining federal infrastructure spending at current levels, which ASCE calls the “Continuing to Act” case, and reducing federal funding to pre-IIJA totals, which ASCE terms the “Snapback” option. The time spans are 10 years.

Most of the report’s focus is on the 2021 IIJA, but it also discusses the 2022 Inflation Reduction Act, which has tens of billions of dollars for infrastructure, mainly in programs dealing with the climate change.

The report says that continuing IIJA funding levels would significantly improve infrastructure efficiencies—such as in moving freight and people—which in turn would boost industrial production and households’ disposable income.

Harm from the ‘Snapback’

But the report also forecasts that a snapback to pre-IIJA funding levels would have a “cascading” negative economic impact for years, reducing disposable income, business output and the Gross Domestic Product (GDP).

Specifically, the report says that continuing current infrastructure spending levels over the next 10 years would shield U.S. industries from losing more than $1 trillion in their output and help to avoid the loss of more than $600 billion in GDP.

Maintaining those continuing infrastructure funding levels also would boost U.S. households’ disposable income by $550 billion and save 237,000 jobs, the report says.

Marsia Geldert-Merphey, ASCE’s president, says “the report “finds that, in short, when we invest in our infrastructure network, America and taxpayers and businesses win.”

Speaking at a Washington, D.C., conference accompanying the report, Geldert-Murphey noted that ASCE’s earlier economic studies carried the “Failure to Act” title. Before the IIJA, the gap between infrastructure needs and spending had been widening.

Battling the Spending Gap

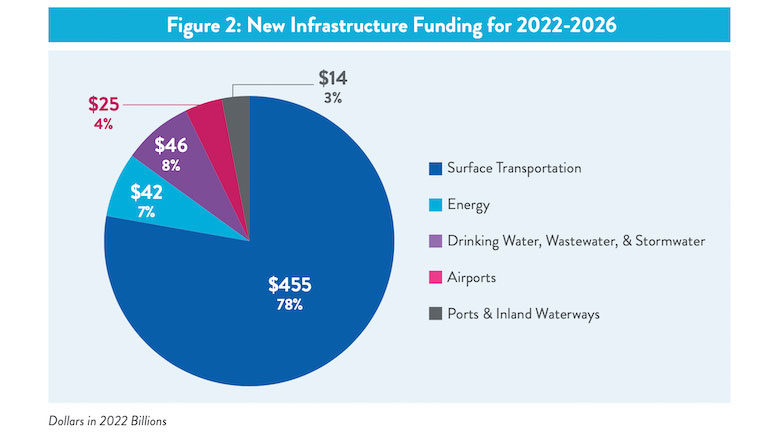

But the enactment of the IIJA and its infusion of several hundred billions of new federal dollars “stopped the gap in its tracks,” she says.

And Geldert-Murphey said, “the name Failure to Act no longer felt appropriate.”

Still, the gap is not completely closed by current investment levels. The report estimates the shortfall under the Continuing to Act case would be about $2.9 trillion over 10 years and about $800 billion more than that under the snapback.

The ASCE report looks ahead to the 2026 expiration of the IIJA and the Inflation Reduction Act. It says that “Congress will be tasked with deciding how these programs will be funded going forward.”

Several firms worked with ASCE on the report, including EBP, Daymark Energy Advisors, Downstream Strategies and Inforum.