Alphabet’s (GOOGL) Google is reportedly developing an artificial intelligence (AI) agent to handle the tasks on the internet and web browsers. Google’s project Jarvis would be able to carry out tasks such as researching the internet, shopping, travel booking, and more. The Information was the first to report the development of the AI agent, citing people familiar with the matter.

Google and AI Companies Foster Advanced AI Agents

Google is set to launch the model under the code name “Project Jarvis” in December, alongside the release of its next iteration of the generative AI model, Gemini. The AI tech is also known as a computer-using agent (CUA). The model will enable users to browse the internet freely with minimal intervention. Notably, Anthropic also recently announced a similar AI model that interacts directly with the computer and conducts related functions such as browsing, clicking, and inputting text.

Moreover, rival Microsoft (MSFT)-backed OpenAI has also been developing a similar CUA that will allow users to autonomously conduct online research. Google and Anthropic’s CUAs are expected to be more advanced in the sense that they will research as well as interact with the user’s computer or web browser, making them interactive digital assistants.

Alphabet’s Earnings Set to Impress Tomorrow

Interestingly, the news comes just a day ahead of Alphabet’s expected Q3 FY24 results, due after the market closes on October 29. The Street expects Alphabet to post diluted earnings of $1.84 per share on revenue of $86.37 billion. The earnings and revenue projections show a remarkable improvement over Alphabet’s comparable last year’s figures. In Q3 FY23, Alphabet reported diluted earnings of $1.55 per share on revenue of $76.69 billion.

Remarkably, Alphabet has exceeded earnings estimates in six of the past eight quarters.

Is Google Stock a Buy Right Now?

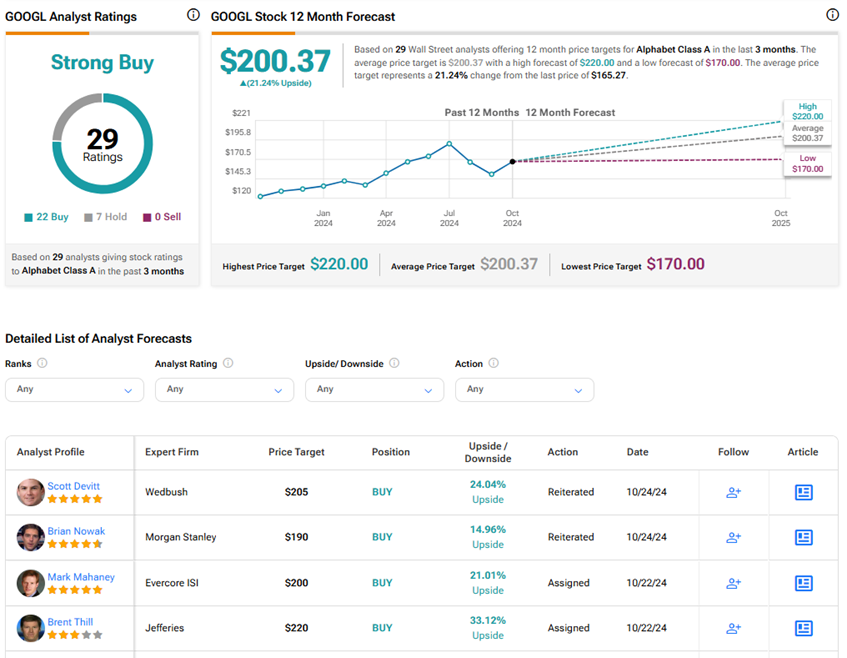

Analysts are awaiting Alphabet’s Q3 results with high expectations. On TipRanks, GOOGL stock commands a Strong Buy consensus rating based on 22 Buys versus seven Hold ratings. Also, the average Alphabet Class A stock price target of $200.37 implies 21.2% upside potential from current levels. Year-to-date, GOOGL shares have gained 18.6%.