Tech stock Alphabet (GOOGL) is rising today after Marc Benioff praised the new Google Gemini AI Live Assistant. The Salesforce (CRM) founder and CEO is a respected voice in the tech community. Yesterday afternoon, he posted to X that he had recently downloaded Gemini Live, describing the Google AI assistant as “truly groundbreaking.” Benioff encouraged other users to try it out as well, highlighting its ease of use as an AI tool that users can speak to.

Don’t Miss our Black Friday Offers:

What’s Happening with Alphabet Stock?

News of Benioff’s comments is helping push Alphabet stock up today. As of this writing, GOOGL is up 1% after shaking off some volatility this morning. While shares remain in the red over the past week, the leading tech stock has still performed well over the past quarter, bouncing back after an early September slump to rise 5%. Now, Benioff’s comments suggest that shares could continue rising as enthusiasm builds for Google’s new Gemini Live assistant.

As the AI arms race continues to unfold, more and more companies are doubling down on their AI-powered products and services. Benioff’s endorsement suggests that Google’s new virtual assistant may represent an important step forward for the company. “This voice interaction is the future of consumer AI,” he stated in the post, describing himself as “absolutely blown away” by the experience.

Google CEO Sundar Pichai responded to the post, promising “Lots more to come” from his company. The fact that Alphabet stock is in the green today shows that the market is optimistic about Google’s prospects. Today also brought reports that Soros Fund Management, the hedge fund owned by George Soros, has trimmed its GOOGL stock position. However, shares have managed to rally, indicating that Alphabet is strong enough to shake off bad news, especially when good things are also happening.

Wall Street Remains Highly Bullish on GOOGL Stock

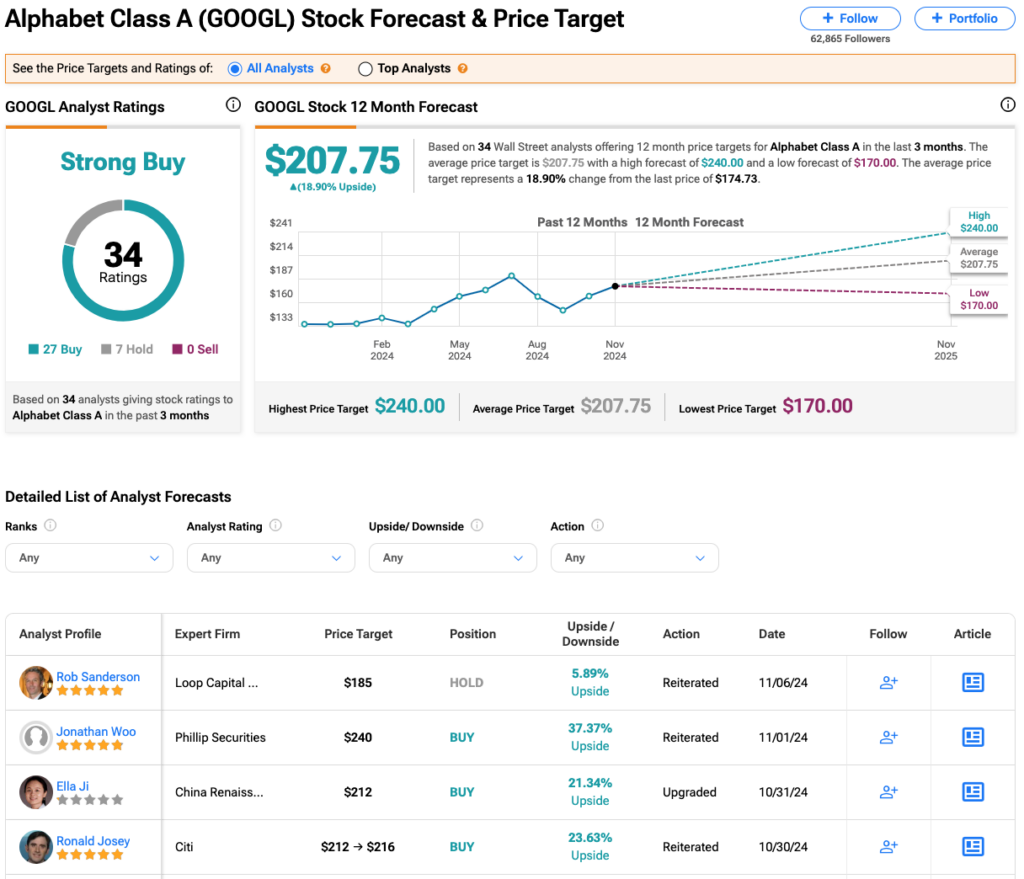

Turning to Wall Street, analysts have a Strong Buy consensus rating on GOOGL stock based on 27 Buys and seven Holds assigned in the past three months, as indicated by the graphic below. After a 29% rally in its share price over the past year, the average GOOGL price target of $207.75 per share implies 19% upside potential.