AECOM ACM has been selected by Northern Ireland Water (NI Water) to provide a range of services under its IF182 Professional Services Framework. This prestigious appointment underscores AECOM’s long-standing partnership with NI Water, aiming to deliver sustainable water and wastewater infrastructure solutions.

NI Water is responsible for supplying 605 million liters of drinking water daily and treating 362 million liters of wastewater. To meet the region’s growing demand for reliable water services and environmental sustainability, NI Water is executing ambitious capital programs.

AECOM will play a crucial role in two areas of the framework. In Lot 1, ACM will manage civil and mechanical, electrical, instrumentation, control, and automation site supervision services. In Lot 3, it will handle feasibility studies, design, project management, and climate change management.

The deal spans four years, with the possibility of extension by an additional four years. ACM has a strong track record with NI Water, including the Kinnegar Wastewater Treatment Works and Sydenham Pumping Station upgrades. Collaborating with construction partners in a ‘One Team’ approach, AECOM delivers design services for key projects under NI Water’s £1.2bn Living with Water Program.

ACM’s Backlog Growth Raises Hope for the Future

AECOM has been witnessing robust prospects in each of its segments. Currently, it has a good visibility of a strong backlog and pipelines for the upcoming quarters. Impressively, state and local budgets are robust and private sector clients are also investing to restore capacity and adapt to water and energy transition impacts. This apart, growth in the U.K. water market is poised to accelerate in the next five years due to the expected near doubling of AMP8 funding, where ACM has existing experience with nearly every large water utility involved.

Owing to the improving global scenario, which is fostering infrastructural demand around the globe, there has been an increase in demand for ACM’s services. This improving trend is reflected in the company’s backlog levels.

As of the fiscal second-quarter end, the total backlog was $23.74 billion compared with $22.98 billion reported in the prior-year period. The current backlog level includes 54.8% contracted backlog growth. The design business backlog grew 6.3% to $22.29 billion. The metric was driven by a near-record win rate and continued strong end-market trends.

The company’s net service revenues or NSR — defined as revenues excluding subcontractor and other direct costs — have been benefiting from strength across core transportation, water and environment markets. NSR for the fiscal second quarter rose 8% year over year, marking the 13th consecutive quarter of accelerating organic growth.

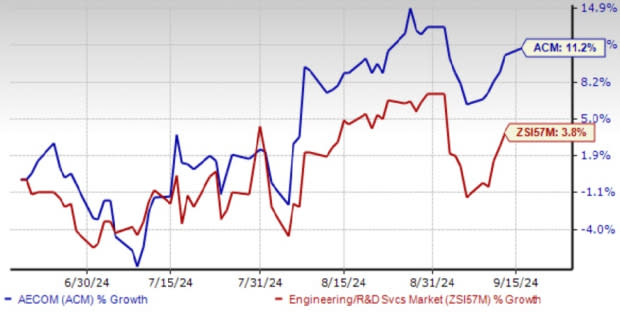

Image Source: Zacks Investment Research

Shares of AECOM have gained 11.2% in the past three months compared with the Zacks Engineering – R and D Services industry’s growth of 3.8%. The ongoing contract wins are likely to boost its prospects in the forthcoming quarters. Also, increasing infrastructural spending trends across the world are encouraging for ACM.

ACM’s Zacks Rank & Key Picks

ACM currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the same space are:

Sterling Infrastructure, Inc. STRL presently sports a Zacks Rank #1 (Strong Buy). Sterling Infrastructure has a trailing four-quarter earnings surprise of 17.4%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for STRL’s 2024 sales and EPS indicates a rise of 9.7% and 26.6%, respectively, from the prior-year levels.

Howmet Aerospace Inc. HWM presently carries a Zacks Rank #2 (Buy). HWM has a trailing four-quarter earnings surprise of 10.9%, on average.

The Zacks Consensus Estimate for HWM’s 2024 sales and EPS indicates a rise of 12.6% and 40.8%, respectively, from the prior-year levels.

M-tron Industries, Inc. MPTI currently carries a Zacks Rank #2. It has topped earnings estimates in three of the trailing four quarters and missed once, with an average surprise of 9.2%.

The Zacks Consensus Estimate for MPTI’s 2024 sales and EPS indicates a rise of 16.1% and 76.6%, respectively, from prior-year levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AECOM (ACM) : Free Stock Analysis Report

Sterling Infrastructure, Inc. (STRL) : Free Stock Analysis Report

Howmet Aerospace Inc. (HWM) : Free Stock Analysis Report

M-tron Industries, Inc. (MPTI) : Free Stock Analysis Report