As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q2. Today, we are looking at infrastructure distributors stocks, starting with Watsco (NYSE:WSO).

Focusing on narrow product categories that can lead to economies of scale, infrastructure distributors sell essential goods that often enjoy more predictable revenue streams. For example, the ongoing inspection, maintenance, and replacement of pipes and water pumps are critical to a functioning society, rendering them non-discretionary. Lately, innovation to address trends like water conservation has driven incremental sales. But like the broader industrials sector, infrastructure distributors are also at the whim of economic cycles as external factors like interest rates can greatly impact commercial and residential construction projects that drive demand for infrastructure products.

The 4 infrastructure distributors stocks we track reported a slower Q2. As a group, revenues missed analysts’ consensus estimates by 1.7%.

Stocks–especially those trading at higher multiples–had a strong end of 2023, but this year has seen periods of volatility. Mixed signals about inflation have led to uncertainty around rate cuts, and infrastructure distributors stocks have had a rough stretch. On average, share prices are down 8.8% since the latest earnings results.

Weakest Q2: Watsco (NYSE:WSO)

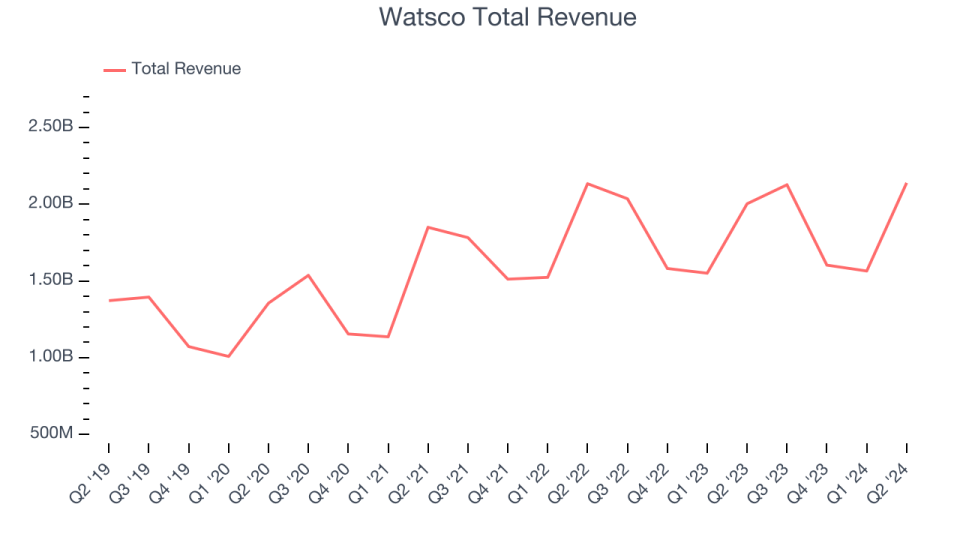

Originally a manufacturing company, Watsco (NYSE:WSO) today only distributes air conditioning, heating, and refrigeration equipment, as well as related parts and supplies.

Watsco reported revenues of $2.14 billion, up 6.8% year on year. This print fell short of analysts’ expectations by 2.1%. Overall, it was a disappointing quarter for the company with and a miss of analysts’ earnings estimates.

A.J. Nahmad, Watsco’s President, commented: “We continue to make good progress towards our goal of scaling Watsco’s customer-focused technologies to more and more contractors. Our e-commerce sales grew at nearly double the rate of overall sales, indicating more progress in scaling our industry-leading tools and platforms. We are also engaging with more contractors and technicians than ever before through our mobile platforms, which should generate more operating efficiencies over time. I am encouraged by our progress and we have produced great results, but I feel the bulk of the benefit from our technology investments remains ahead of us.”

Watsco scored the fastest revenue growth of the whole group. Even though it had a great quarter relative to its peers, the market seems discontent with the results. The stock is down 7.4% since reporting and currently trades at $12.19.

Read our full report on Watsco here, it’s free.

Best Q2: MRC Global (NYSE:MRC)

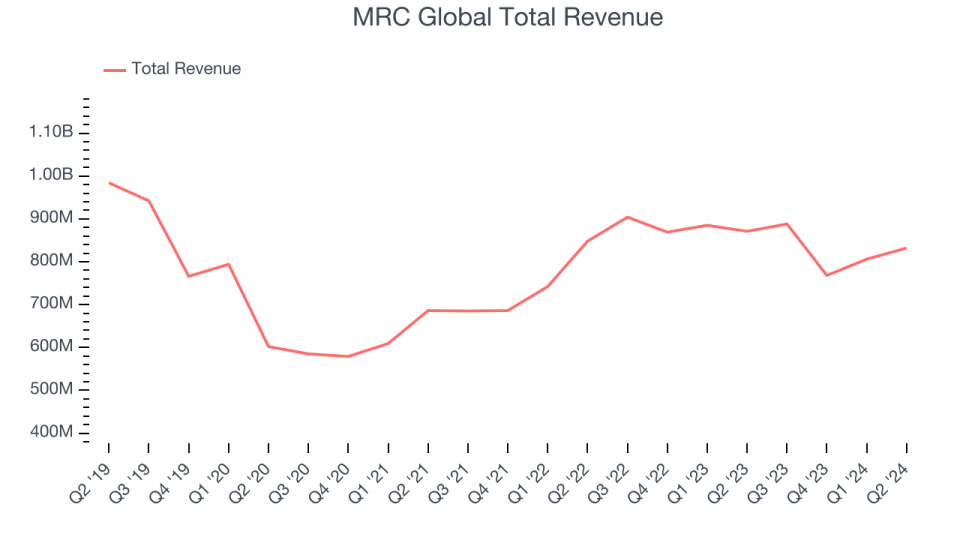

Producing bomb casings and tracks for vehicles during WWII, MRC (NYSE:MRC) offers pipes, valves, and fitting products for various industries.

MRC Global reported revenues of $832 million, down 4.5% year on year, in line with analysts’ expectations. The business had a very strong quarter with an impressive beat of analysts’ operating margin and earnings estimates.

MRC Global achieved the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 7.4% since reporting. It currently trades at $12.19.

Is now the time to buy MRC Global? Access our full analysis of the earnings results here, it’s free.

Core & Main (NYSE:CNM)

Formerly a division of industrial distributor HD Supply, Core & Main (NYSE:CNM) is a provider of water, wastewater, and fire protection products and services.

Core & Main reported revenues of $1.96 billion, up 5.5% year on year, falling short of analysts’ expectations by 4.5%. It was a disappointing quarter as it posted a miss of analysts’ earnings estimates.

Core & Main delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 13.5% since the results and currently trades at $40.50.

Read our full analysis of Core & Main’s results here.

NOW (NYSE:DNOW)

Spun off from National Oilwell Varco, NOW Inc. (NYSE:DNOW) provides distribution and supply chain solutions for the energy and industrial end markets.

NOW reported revenues of $633 million, up 6.6% year on year. This number was in line with analysts’ expectations. It was a strong quarter as it also put up an impressive beat of analysts’ operating margin estimates and a decent beat of analysts’ earnings estimates.

The stock is down 11% since reporting and currently trades at $12.50.

Read our full, actionable report on NOW here, it’s free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.