Douglas Rissing/iStock via Getty Images

I last covered Alphabet Inc. aka Google (NASDAQ:GOOGL, NASDAQ:GOOG) in August; I put out a Buy rating on a favorable valuation, outlining its significant strengths in offering low volatility compared to other big tech investments like Amazon (AMZN) and Tesla (TSLA). Since my article, the stock has fallen nearly 9.5% in price. On a pure valuation front, this creates a further buying opportunity, in my opinion.

However, now there is a significant operational development whereby the largest revenue generator of Google hangs in the balance. On the day I write this, Alphabet will be defending itself against the U.S. Department of Justice (DOJ) on claims that it illegally operates an advertising monopoly. During this trial, questions of divestiture continue to circulate in the press. However, with a more moderate regulatory restriction outcome likely, I still consider Google stock a Buy.

DOJ vs. Google: An Advertising Monopoly?

The lawsuit against Google stems from allegations that the company has engaged in a “systematic campaign to seize control” of the online advertising business.

The DOJ is arguing that Google’s dominance has been achieved through strategic acquisitions, including the purchase of DoubleClick in 2008, which led to increased switching costs for users and greater integration for Google.

The DOJ is also focusing on Google’s vertically integrated approach to the digital advertising supply chain, including its ad exchange and its ad server. The claim is that Google has forced market participants to use its products and has leveraged its position to disadvantage competitors.

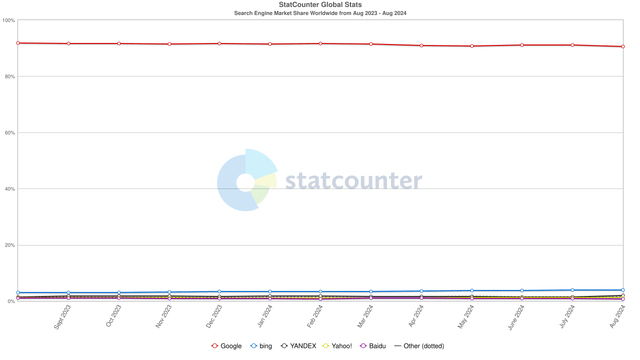

The scrutiny is certainly justified, as Google holds approximately a 90% market share of the global search engine industry; this dominance is foundational to its leading position in ad tech. Already in August 2024, a judge ruled that Google maintained an illegal monopoly in the Internet search market.

Search Engine Market Share Worldwide (Statcounter)

The key element that, I believe, is important and shows why such scrutiny of Google is justified is that the DOJ claims that Google’s practices have inflated costs for advertisers and restricted revenue for publishers. The result of this is less innovation and reduced choices in the market. This is a valid concern. It comes much needed at a time when big tech is expanding rapidly, but the average consumer and small and medium-sized businesses ((SMBs)) are struggling with high inflation, high interest rates, and fears of a broader non-tech-based Western recession.

The most significant outcome here would be Google’s forced divestiture of critical components of its ad tech business, such as the Google Ad Manager suite. This would significantly disrupt its vertical integration, dismantling its ad tech stack, and meaning it loses its ability to offer its fully integrated ad and publishing platform. The Google Ad Manager suite is a substantial revenue generator. In the latest quarter, Google’s Network business, including the GAM suite, recorded $7.44B in revenue. It is worth noting that Google’s overall advertising revenue, which totaled $64.62B in Q2, accounted for approximately 76.3% of Google’s total revenue. In other words, Google is being attacked where it hurts.

The Long-Term Operational & Financial Implications Means Slower Rates of Return

Even if the outcome of the advertising trial against Google is not negative, I believe Google will still likely be curbing its strategies for domination in its core markets following this trial. I find it unlikely that Google’s leadership will continue with the same velocity as before in an attempt to moderate the scrutiny received by the DOJ at this time. It is also arguably the right call of action to show restraint on engendering monopoly at a time of hardship for smaller businesses. By slowing its rate of expansion and strategic consolidation, Google may be able to foster a healthier advertising ecosystem and increase the number of its advertising customers rather than put pressure on pricing. Therefore, I believe Google shareholders can expect a short-term loss here but overall a long-term gain, both for Google and the broader technology and SMB ecosystem, most of which depend on Google for internet relevance.

Google is already known as a slow and steady company; however, we might expect it to be slightly slower from here on out. Its current trials come at a time when the DOJ and the Federal Trade Commission (FTC) have been actively pursuing antitrust cases against other major tech companies, such as Apple (AAPL) and Meta Platforms (META); in 2023, the FTC, along with 17 states, also filed a lawsuit against Amazon, alleging monopolistic practices. Furthermore, the EU’s Digital Markets Act came into effect in March 2024. It targets major tech companies, including Google, Apple, Amazon, Meta, Microsoft (MSFT) and TikTok, which have been designated as “gatekeepers” and must comply with new regulations for fair competition in the digital markets.

Continued scrutiny, any divestitures, and a broader breakup of its key operating arms are likely to strain Google’s margins. This will primarily be the result of the fact that it is likely to lose pricing power from greater competition in the ad tech market. Google could also face substantial fines and legal costs if it is found guilty of antitrust violations, directly reducing its net income and profit margins. The scrutiny over its advertising and search business might also cause the company to divert resources toward less provocative operations, like its growing position in AI. The issue with this strategy is that AI regulations are likely to intensify over the coming years, and its Gemini and other AI projects are far less of a revenue generator than its ad business.

As I mentioned, Google is not the only tech company going through this, but I believe the DOJ and the United States government are warning big tech to slow down in many respects. With a broader economy that is suffering from high prices, lowered demand, and a weakening jobs market, the big tech growth position is rightly being questioned. This is especially true during this time of high AI and automation investing, which should continue to be accretive to the magnificent seven, but arguably leave many SMBs worse off.

Is Google a Buy, Sell or Hold During the DOJ Advertising Trial?

Google is much more attractively valued than three months ago, when it was selling 13.8% higher in price. I mentioned in my last analysis of Google that it was approximately fairly valued at the time; now, it is likely moderately undervalued, although I believe we could see more of a price decline following the ruling by the DOJ.

That being said, I believe the decline will be temporary and purely based on sentiment, with only moderate financial implications for Google in the near term, even in the case of a negative DOJ ruling. I consider any near-term downside that occurs in Google stock over the coming quarters from this, and also from a more general slowdown in revenue, primarily related to peak growth from AI tapering, as excellent long-term buying opportunities.

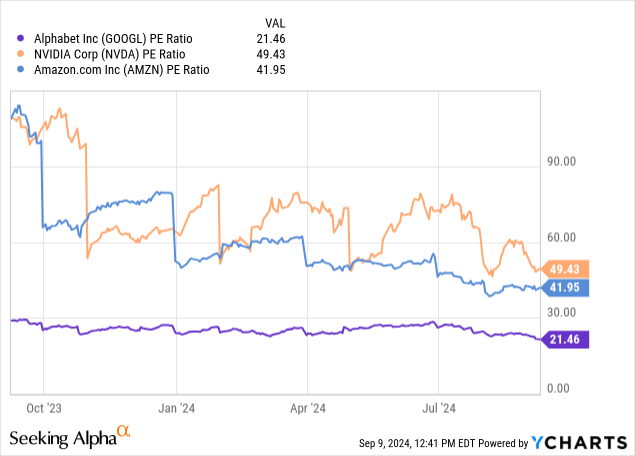

Google has a P/E ratio that is almost half that of Amazon and far below Nvidia’s (NVDA) P/E ratio of 50. Given that Google is expected on consensus to deliver YoY normalized EPS growth of 14% in calendar 2025, Amazon 22.70%, and Nvidia 40.50%, such disparity is justified. However, with Nvidia estimated to achieve a much lower calendar 2026 normalized EPS growth of just 18%, one can expect much better value and much less future volatility from Google at this time.

Despite the DOJ trials that Google has faced recently being incredibly significant, they are not enough and are also not intended to impact the long-term growth trajectory of Google. In a worst-case scenario where significant portions of Google’s advertising and search business are forced to be divested by the DOJ, we can expect a significant drawdown in Google’s valuation multiples and stock price. This would be as a result of a decline in its total revenue under its stock ticker.

I believe a heavy divestiture requirement from the DOJ is unlikely and also not favorable to the United States and West, with Google acting as one of the leading capital allocators and pioneers in the digital ecosystem. I expect we are to see potentially moderate fines and regulatory restrictions, including focusing on the exclusionary agreements that Google has with device manufacturers like Apple. Therefore, a significant drawdown is unlikely, but a slight to moderate one is, and this opens up a further buying opportunity. This ruling is not focused on one of Alphabet’s core future operational drivers, which will be AI, and I expect a lot from this in the upcoming decades.

As a result of my valuation analysis and the unlikelihood of a divestiture requirement, I consider Google a Buy. If, in 12 months, it trades at a P/E ratio of 21.5 and prices at the current FY25 GAAP EPS consensus estimate of $8.72, the stock will be worth $187.50. This indicates a 12-month upside of 25.30%.

Conclusion

Based on my analysis, the current DOJ trials against Google are being slightly overexaggerated in the press. The likelihood of divestiture requirements here is slim, and instead, the regulatory restrictions and fines are much needed, especially during this period when the average SMB in America is struggling. Some more balance in the tech ecosystem is needed and deserved. Google may deliver slower growth than if it were left to operate unabated, but this is likely a short-term contraction for a long-term benefit, both for Google and the wider Western and global economy. Google is currently fairly valued, with a protracted drawdown unlikely and continued growth on the horizon. Therefore, Google stock is a Buy.