Wirestock/iStock via Getty Images

Investment Thesis

iShares U.S. Infrastructure ETF (BATS:BATS:IFRA) warrants a hold rating due to mixed factors for the fund impacting its outlook. Positive factors include strong demand for U.S. infrastructure improvement due to aging roads, bridges, and railways along with bipartisan support for government funding. However, IFRA has marginal qualities compared to peer ETFs stemming from its tracked index and top holdings. Therefore, other peer funds will likely capture U.S. infrastructure investment more effectively looking forward.

Fund Overview and Compared ETFs

IFRA is a passively managed ETF offered by iShares that seeks to track the NYSE FactSet U.S. Infrastructure Index. With its inception in 2018, the fund has 159 holdings and $2.54B in AUM. The ETF focuses on U.S. companies in two main categories: utility companies and companies that supply material and construction.

For comparison purposes, other funds examined are SPDR S&P Global Infrastructure ETF (GII), U.S. Infrastructure Development ETF (PAVE), and First Trust NASDAQ Clean Edge Smart Grid Infrastructure Index Fund (GRID). GII, as a global fund, includes only 42.24% weight on U.S. companies and has international holdings with companies in Australia (8.68% weight), Canada (8.04% weight), and various others. The fund was included for comparison between U.S. and global infrastructure ETFs. PAVE seeks to capture U.S. companies that benefit from infrastructure investment, regardless of market sector. Finally, GRID is an ETF I covered last December which focuses predominantly on renewable infrastructure companies.

Performance, Expense Ratio, and Dividend Yield

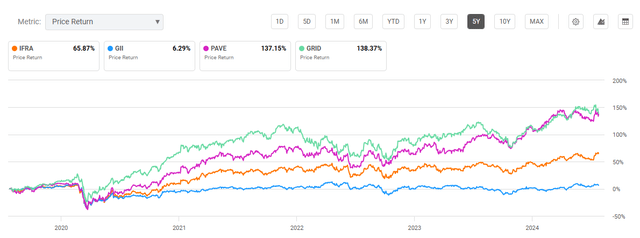

IFRA has a 5-year average annual return of 11.28% with total price return of over 65% over the past five years. GII, a global infrastructure fund, has performed the worst with a 5-year average return of 3.65%. Both PAVE and GRID have seen better recent performance than IFRA with 5-year average returns of 18.5% and over 20% respectively. I will cover more on the factors driving this outperformance in my discussion of each funds’ top holdings.

5-Year Total Price Return: IFRA and Compared Infrastructure ETFs (Seeking Alpha)

Despite its lagging performance, IFRA has a very competitive expense ratio compared to peers. At 0.30%, the fund is the least expensive of compared infrastructure ETFs. IFRA, along with PAVE and GRID, are focused on U.S. companies that offer minimal dividends. Therefore, the funds all have less than a 2% yield currently. Only GII, a globally focused fund, has a significant yield at 3.66%.

Expense Ratio, AUM, and Dividend Yield Comparison

|

IFRA |

GII |

PAVE |

GRID |

|

|

Expense Ratio |

0.30% |

0.40% |

0.47% |

0.57% |

|

AUM |

$2.54B |

$415.91M |

$7.60B |

$1.52B |

|

Dividend Yield TTM |

1.76% |

3.66% |

0.62% |

1.07% |

|

Dividend Growth 5 YR CAGR |

3.24% |

4.27% |

6.75% |

20.33% |

Source: Seeking Alpha, 25 Jul 24

IFRA Holdings and Key Outlook Factors

IFRA is the most diversified fund with over 150 holdings. The fund also has the most even distribution of weight with only 8.3% weight on its top 10 companies. Despite this diversification, the fund has multiple disadvantages in the holdings it contains as discussed later in this article.

Top 10 Holdings for IFRA and Peer Infrastructure ETFs

|

IFRA – 159 holdings |

GII – 74 holdings |

PAVE – 99 holdings |

GRID – 102 holdings |

|

HE – 1.13% |

NEE – 5.74% |

TT – 3.55% |

NGG – 8.98% |

|

MSEX – 0.85% |

ANYYY – 4.86% |

URI – 3.34% |

ABBNY – 8.09% |

|

UTL – 0.81% |

TRAUF – 4.70% |

ETN – 3.32% |

SBGSF – 8.02% |

|

ARTNA – 0.81% |

ENB – 4.06% |

EMR – 3.21% |

JCI – 7.55% |

|

OGS – 0.80% |

SO – 3.50% |

PH – 3.05% |

ETN – 7.34% |

|

AWR – 0.79% |

DUK – 3.25% |

SRE – 2.98% |

PWR – 3.72% |

|

YORW – 0.79% |

PAC – 2.89% |

PWR – 2.96% |

PRYMF – 3.39% |

|

SJW – 0.78% |

IBDSF – 2.86% |

MLM – 2.90% |

HUBB – 3.25% |

|

SR – 0.78% |

AUKNY – 2.72% |

VMC – 2.69% |

APTV – 3.10% |

|

POR – 0.77% |

WMB – 2.70% |

HWM – 2.65% |

ENPH – 2.64% |

Source: Multiple, compiled by author on 25 Jul 24

Looking forward, there are multiple reasons to be optimistic about investment in U.S. infrastructure. These factors include the aging network of roads, bridges, and other systems that will require investment to repair or replace. Additionally, political sentiment is favorable towards allocating funding towards solving the aging infrastructure problem. This represents multiple tailwinds for IFRA and peer ETFs.

Concerning State of U.S. Infrastructure

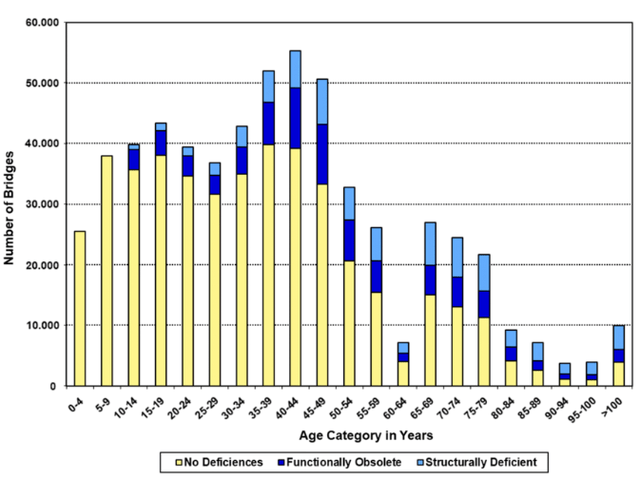

The U.S. economy relies on a robust and resilient infrastructure to produce its gross domestic product of over $25 trillion annually. Unfortunately, many infrastructure systems are significantly aged and need repair. However, this disrepair presents an opportunity for U.S.-focused infrastructure funds including IFRA. The below figure depicts U.S. highway bridges by age and condition. Of the 617,000 bridges across the U.S., 42% are 50 years old or more. Additionally, 7.5% of all bridges are considered structurally deficient.

U.S. Bridges By Age and Condition (Journal of Civil Structural Health Monitoring)

Unfortunately for travelers, this data has resulted in tangible failures. One such example was the 52-year-old Pittsburgh’s Forbes Avenue bridge which collapsed due to structural failure in 2022. Structural failures are only one part of the infrastructure problem as well. Bridges and other U.S. infrastructure systems require costly repair due to trail derailments, ship collisions, severe weather, and other factors. A recent example was the failure of Baltimore’s Francis Scott Key Bridge earlier this year due to a ship collision. Repairs to the Maryland bridge are estimated between $1.7 and $1.9 billion.

Bipartisan Support for Infrastructure Funding

Despite the troubling news stated above, this challenge presents an opportunity for infrastructure companies. The backlog of bridge repair work needing to be conducted is estimated at $125 billion. To fulfill this need, investment into U.S. infrastructure has received bipartisan support. One example from the Biden Administration was the Infrastructure Investment and Jobs Act signed in 2021. This bill along with other legislation has contributed to a cumulative $1 trillion in funding for critical infrastructure projects.

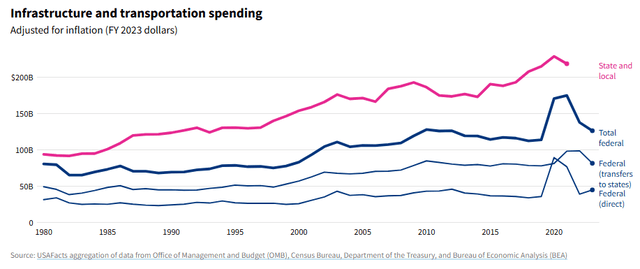

U.S. Infrastructure and Transportation Spending, Adjusted for Inflation (Office of Management and Budget, Census Bureau, DOT, BEA)

Such funding has resulted in an upward, long-term trend in infrastructure spending, as depicted above, even when adjusted for inflation. Regardless of the next presidential administration, both parties support infrastructure investment. The Trump Administration also pushed a $1.5 trillion infrastructure plan back in 2018 to address aging infrastructure.

IFRA: Unconvincing Holdings Mix

A key drawback for IFRA is its mix of top companies or holdings. First, the ETF lacks significant weight on companies that focus on forward-looking renewable technologies. By contrast, GRID has several advantages including Eaton Corporation (ETN), National Grid (NGG), and ABB Ltd (OTC:ABBY). Eaton is a multinational company that provides electric power distribution that has seen impressive growth including a 22% YoY EBITDA along with 14% net profit margin. ABB Ltd is another strong renewable energy company that focuses on electric power solutions internationally. ABBNY has also shown solid fundamentals including a 11.4% YoY EBITDA growth with 11.8% net income margin.

By contrast, IFRA’s top holdings are much less impressive. IFRA’s #1 holding by weight is Hawaiian Electric Industries, Inc. (HE). Hawaiian Electric has shown poor fundamental metrics including negative earnings growth and a low net income margin. Subsequently, the holding has seen a -58% one-year price return. While HE has a relatively low P/E ratio at 9.9, its fundamental metrics do not drive any buy signals. Middlesex Water Company (MSEX), IFRA’s #2 holding, does not fare much better. The water utility and wastewater company has seen negative YoY EBITDA growth along with an unattractive P/E ratio of 31.9, or 72% higher than its sector median. While each of these top holdings represent low weights for IFRA, they are indicative of a fund that does not concentrate on top companies with solid fundamental metrics.

Current Valuation

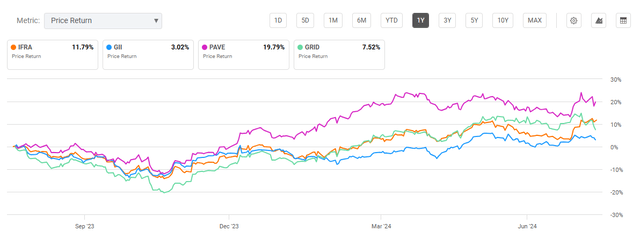

Of the infrastructure ETFs examined, PAVE has seen the best recent performance and has even outperformed the S&P 500 Index with a one-year return of almost 20%. By comparison, IFRA has seen a more modest 11.8% return over the past year. GII, the fund with the least weight on U.S. holdings, has seen the worst performance. This underperformance is consistent with its long-term trend which will likely continue due to a relatively high amount of U.S. infrastructure investment.

One Year Performance: IFRA and Peer ETFs (Seeking Alpha)

Despite the poor performance for several of IFRA’s top holdings, the overall valuation for the fund is not significantly attractive. With a P/E ratio of 19.3, IFRA is roughly on par compared to higher performing PAVE and GRID ETFs. Given the fundamental differences between IFRA’s top holdings compared to peers, its valuation does not paint a compelling picture for the fund.

Valuation Metrics for IFRA and Peer Infrastructure Funds

|

IFRA |

GII |

PAVE |

GRID |

|

|

P/E ratio |

19.34 |

16.84 |

19.72 |

22.50 |

|

P/B ratio |

2.00 |

2.01 |

2.91 |

3.18 |

Source: Compiled by Author from Multiple Sources, 25 Jul 24

Risks to Investors

Despite consistent state, local, and federal spending towards infrastructure improvements, IFRA and peer funds are not immune to market fluctuations. In fact, IFRA has seen notable volatility, as measured by its standard deviation of 18.35%. This standard deviation is over 20% higher than the median for all ETFs.

Another major risk factor is overall government spending. I covered increasing government debt in my previous coverage of Invesco’s Aerospace & Defense ETF (PPA). A high amount of spending as a percentage of GDP could indicate that budget cuts are on the horizon. Therefore, while it is a reasonably safe assumption that infrastructure spending will persist in the short term, it is less assured over the long term.

Concluding Summary

U.S. infrastructure will likely continue seeing strong investment to repair and replace aging systems and fuel economic growth. While IFRA has a solid track record of performance that will likely benefit from this investment, the fund is sub-par compared to peer funds due to its tracked indexes and selection of holdings. IFRA has a valuation roughly on par with peers, presenting few compelling reasons to buy.