lcva2

Investment Thesis

Since my last coverage of Microsoft Corporation (NASDAQ:MSFT) as a strong buy in April, investors have done well due to CoPilot sales helping power shares higher. However, my concern now lies in the sustainability of this growth, which appears heavily reliant on backend performance to meet Wall Street’s ambitious price targets. For example, the consensus EPS estimate for FQ4 2024 is $2.94/share, reflecting a 9.31% year-over-year growth, while revenue is expected to reach $64.37 billion, marking a 14.56% increase from the previous year. These projections indicate a strong short-term outlook, which I think is too optimistic.

In the long run, AI will undoubtedly play a crucial role in Microsoft’s growth trajectory. The company plans to nearly double their capital expenditures from $32 billion in FY2023 to $63 billion by FY2025, with a significant portion allocated to generative AI and data center capacity. Morgan Stanley predicts that GenAI revenues could increase from $5.3 billion in FY24 to $37.9 billion in FY27, suggesting an aggressive ramp-up in AI-driven revenue streams. Despite this, I am still concerned that Microsoft is prematurely banking on these AI advancements.

Looking at the company’s valuation, the current forward P/E ratio of 36.93 is substantially higher than the sector median of 24.34. The market is assuming substantial future growth, and I just don’t see this as likely now (the market was assuming a winner-take-all outcome for the AI race). The plan was for Microsoft to grab a large AI market share out the gate with their key investment in OpenAI (the makers of ChatGPT). I don’t think we saw the massive market share grab they were banking on. True, they did grab some market share. But Alphabet Inc. (GOOG) (GOOGL) is now back with a vengeance. I expect this to get as (or even more competitive) than the cloud wars. Competition often erodes producer surplus (profits).

Given these factors, I am downgrading Microsoft shares to a ‘hold’ until after the earnings report on Wed. If earnings demonstrate stronger-than-expected growth, especially in AI adoption and CoPilot sales, I will reconsider upgrading to a buy or even a strong buy.

Why I’m Doing Follow-Up Coverage

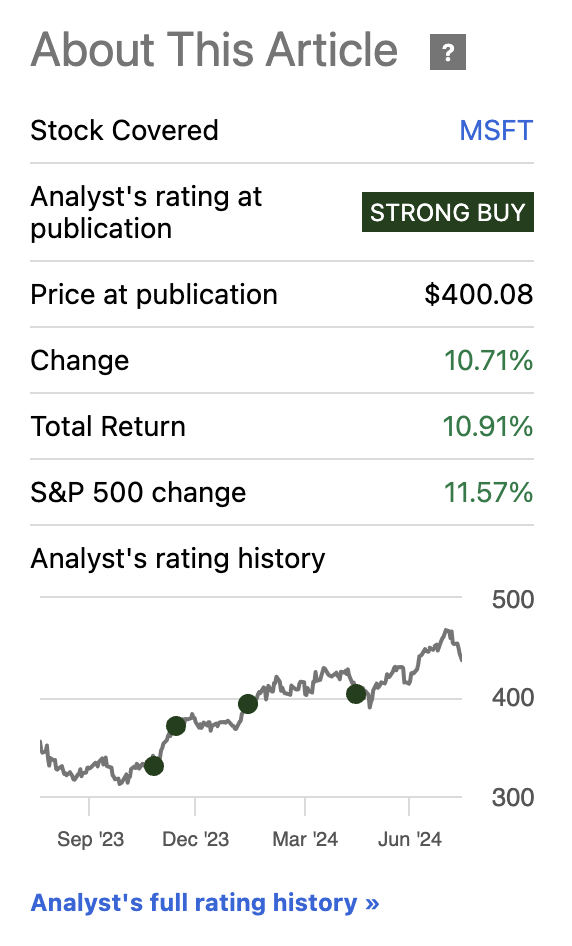

In my previous coverage of Microsoft back in April of this year, I wrote how I believed shares had about a 10% upside after strong Co-Pilot numbers. Since then, the company has had a fairly solid quarter, with shares increasing by about 10% since then.

MSFT Share Price Growth (Seeking Alpha)

However, looking forward, I’m just not sure what catalysts there are to power further growth as I think a lot of the AI potential is priced in while the risks are priced out. Microsoft has pushed Copilot to most of their users as an upsell, but the issue is that only so many will convert. With this, the competition from Google highlighted in one of my recent research pieces indicates that the AI market was not a race to adopt a winner-take-all market as many pundits believed a year ago.

Microsoft’s AI technology is strong, but I do not think it is strong enough out of the gate to push people to search, let alone switch providers. Therefore, this follow-up coverage is meant to demonstrate how market expectations may be inflated in the short run.

Expectations Are High

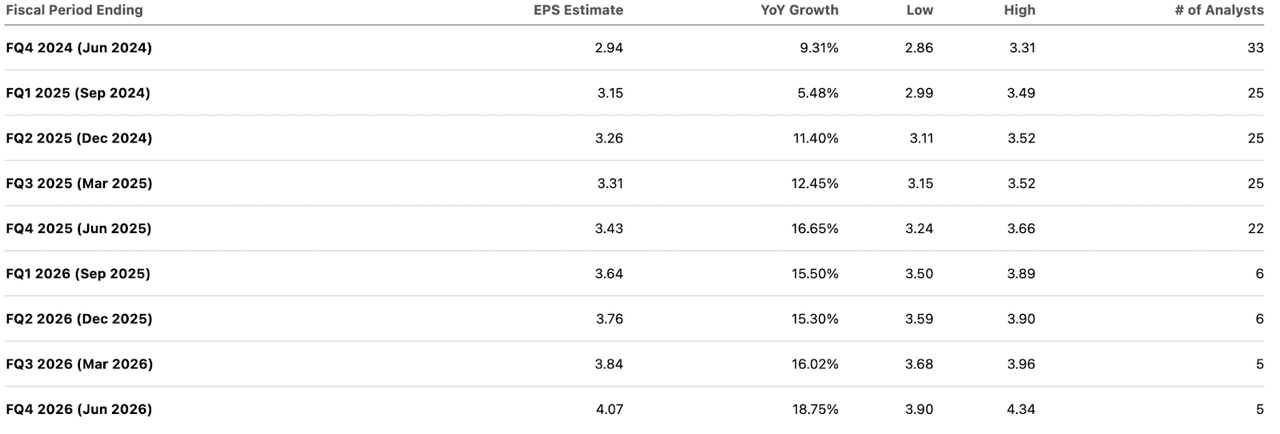

Heading into earnings on July 30th, expectations for Microsoft’s performance are high. Below is an image of quarterly estimates from Q4 2024 to Q4 2026.

Forward EPS Estimates (Seeking Alpha)

As seen in the photo above, consensus EPS estimates for FQ4 2024 are equal to $2.94, marking a 9.31% year-over-year growth, and $3.15 for FQ1 2025, reflecting a 5.48% increase. This trend continues further into the future, with estimates for FQ2 2025 growing 11.40% year over year, reaching $3.26, and $3.43 by FQ4 2025. Over the last three months, there have been 37 upward EPS revisions compared to only 4 downward revisions.

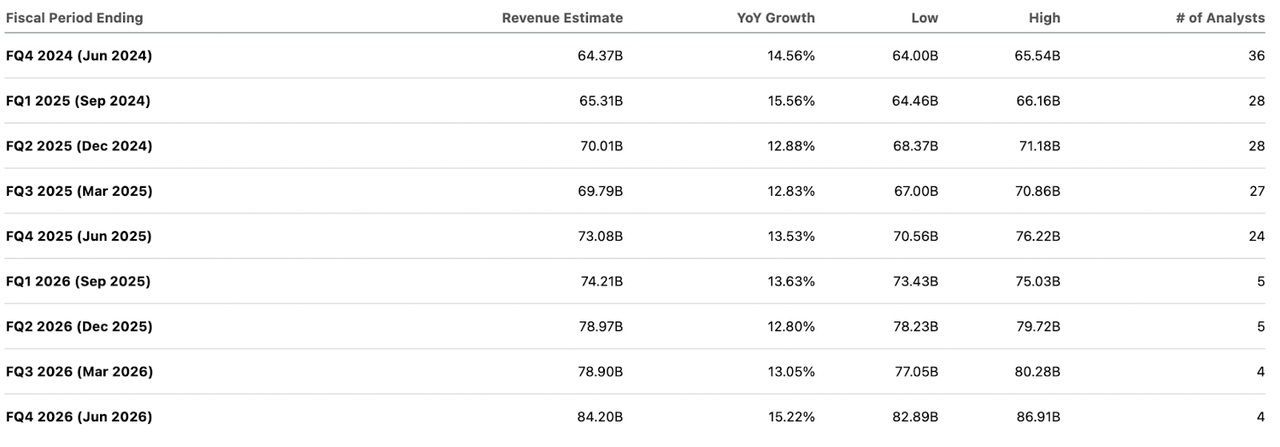

Microsoft’s revenue estimates follow a similar trend as their EPS, with expectations high as well. Seen below is the quarterly outlook of revenue from Q4 2024 to Q4 2026.

Forward Revenue Estimates (Seeking Alpha)

Revenue estimates for FQ4 2024 stand at $64.37 billion, growing to $65.31 billion in FQ1 2025, and reaching $70.01 billion by FQ2 2025. This progressive increase is expected to continue, with revenues anticipated to hit $73.08 billion by FQ4 2025 and $84.20 billion by FQ4 2026. In the last three months, there have been 41 upward revisions and only 7 downward. There is a huge bullish bias just as I think the AI momentum is slowing. I think this is misguided.

These optimistic EPS and revenue estimates are increasingly dependent on accelerated growth in the later periods.

Given these factors, while the current estimates are promising, they are built on multiple assumptions. If these assumptions fail to actually occur, this could significantly hurt Microsoft’s future performance, especially given the run-up in the share price YTD and over the last ~18 months

What I Am Looking For On The Call

As Microsoft approaches their upcoming earnings call, I’ll be paying attention to two key areas: CoPilot adoption and competition.

One of the primary aspects I will be looking for is evidence that Microsoft is working towards gaining a more competitive edge in the AI market. For a while, Microsoft’s partnership with OpenAI granted them this edge. However, this edge is disappearing due to recent developments indicating that competitors like Google are rapidly catching up (again as outlined in my recent coverage on Google) with their new model deployments.

Similar to this, I’m also looking to see if the call will cover their current performance compared to competitors like Google and Amazon. In a recent survey focusing on chief information officers, it was found that the majority prefer using Microsoft for their companies’ generative AI needs compared to some of their competitors such as Google and Amazon. It would be interesting to see further data on consumer base opinions such as this during the upcoming earnings call. The survey that A16 put out (see my Google research) shows them a close second when you include models being tested before being deployed.

In this same train of thought the most critical area will be the focus adoption rates and customer feedback regarding Microsoft’s CoPilot product. As I mentioned previously, the initial rollout of CoPilot has been successful and was my reason for a strong buy rating in April. However, I do not think there is much short-term upside left for Microsoft to capitalize on this front as the feedback from some CoPilot users has been poor. Piper Sandler previously anticipated an 18% conversion rate with CoPilot by 2026. Specifically, I will be watching any signs of churn or cancellation of CoPilot subscriptions.

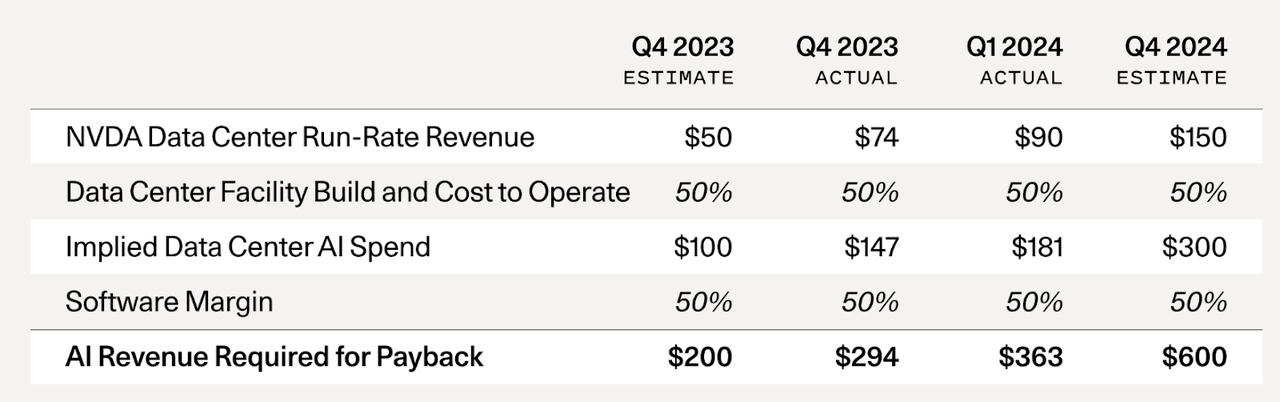

With this, the earnings call should provide insights into Microsoft’s broader AI strategy, including detailed plans for capital expenditures. For example, as I mentioned previously, Microsoft plans to almost double their Capex from $32 billion in FY2023 to $63 billion by FY2025. As a recent Sequoia report noted, the industry now needs over $600 billion in software layer spend to justify the level of AI capex spend that’s taking place. Microsoft (being a big Capex spender) will have to make up a large part of this.

Sequoia AI Report (Sequoia)

Valuation

Considering my current stance on the stock is now a hold, I do not feel I can confidently estimate a fair value. There are a few aspects I would like to go over.

Despite their robust growth projections, Microsoft’s valuation appears stretched compared to their sector medians. For instance, The forward Non-GAAP P/E ratio is currently 36.93, which is significantly higher than the sector median of 24.34, indicating that the market is pricing in substantial future growth. Comparing this to my last report, the forward P/E ratio was 35.33, demonstrating a slight tick upward.

Looking at Google, who I think is currently the biggest threat to Microsoft, Google is much more set up for EPS growth than Microsoft. Google’s current diluted forward EPS growth is set to be 23.63% year over year, whereas Microsoft’s is 11.48%. Despite this, Microsoft’s P/E ratio is 36.93, which is roughly 58% higher than Google’s (23.30). Not only do I not see as much potential for Microsoft to actually live up to this premium, but this also emphasizes the overvaluation of the stock compared to Google. The market is pricing in Microsoft as the AI leader today, tomorrow, and five years from now. Will this actually be true when we look back?

Bull Thesis

Although my current stance is a hold, playing devil’s advocate, I do think there is still potential for the stock to be valued as a buy if the earnings report is a home run. One of the primary reasons for me to upgrade back to a buy (and for me to admit I was wrong) would be accelerating demand for Microsoft’s CoPilot product. Since my last piece, CoPilot has already demonstrated strong initial uptake, contributing significantly to the company’s recent financial performance. If this demand continues to grow and adoption rates exceed current expectations, it could provide a substantial boost to Microsoft’s bottom line. Some estimates suggest that CoPilot adoption could reach 18% by 2026, which, if surpassed, I think the stock would have more room to run.

I mentioned the counterpoint earlier in the article (the boom from the Co-pilot initiative is running out) so I do not see this as a future catalyst to propel accelerated growth.

However, at the same time, the company will have to nearly double their capital expenditures from $32 billion in FY2023 to $63 billion by FY2025, primarily to support generative AI and data center capacity. If these investments are used efficiently, I think there is a possibility we will see significant growth in AI-driven revenue streams. For example, Morgan Stanley projected that GenAI revenues could grow from $5.3 billion in FY24 to $37.9 billion in FY27. But there’s a real chance this could be misallocated. LLMs went from a developmental software product to a mainstream AI tool in under 2 years (ChatGPT came out in November 2022). We really haven’t seen this speed before from development to production of such a revolutionary software tool. Odds are someone will misallocate capital in the AI Wild West. Will it be Microsoft? I’m not sure, but I’m a hold till we have more clarity from the earnings call.

Takeaway

For now, I’m downgrading my previous rating of Microsoft shares from a strong buy to a hold. Despite the promising growth in AI and cloud services, the current high valuation leaves me concerned. The elevated forward P/E ratio indicates that much of the future growth is already priced in, leaving little room for error. With this, compared to arguably their biggest competition, Google, Microsoft is trading at a much higher premium despite their EPS growth estimates being lower.

While there are still many reasons to be optimistic, such as potentially accelerating CoPilot demand from here and extensive investments in AI, these factors must translate into tangible results. I think the upcoming earnings call will give insight into determining whether Microsoft can meet these high expectations and justify their premium valuation. Until then, I place Microsoft as a hold.