Sterling Infrastructure (STRL), a company with expertise in varied sectors like heavy civil construction, transport, and e-infrastructure, is well-positioned to flourish amid a U.S. infrastructure surge. The company’s successful growth-through-acquisitions strategy, increasing profitability, and steady cash flow make it a compelling prospect. The stock is up over 102% in the past year, with substantial growth prospects, making it an attractive Growth at a Reasonable Price (GARP) investment option in the thriving infrastructure sector.

E-Infrastructure Solutions Powering Sterling Infrastructure’s Growth

Sterling Infrastructure is a diversified construction and engineering company operating primarily across three main sectors: E-Infrastructure Solutions, Transportation Solutions, and Building Solutions. The company’s most prominent and fastest-growing segment is E-Infrastructure Solutions, accounting for 48% of total sales. In this segment, Sterling Infrastructure delivers tailor-made site development services for blue-chip clients in e-commerce distribution, data centers, and power generation.

The company tackles infrastructure projects in the Transportation Solutions segment, such as constructing and rehabilitating highways, roads, bridges, airports, and ports. Despite being a lower-margin sector with 6.6% operating margins, it represents 32% of total sales. The Building Solutions segment is the smallest revenue earner at 20%, but it is opportunistically positioned in high-growth markets for residential construction in Texas and Arizona.

The global smart infrastructure market, worth $187 billion, is forecasted to grow at a 23.1% CAGR to almost $1 trillion by 2032, with the AI vertical alone expanding at an 18.5% CAGR. This surge in demand was primarily catalyzed by the global pandemic, which underscored the critical need for resilient e-infrastructure.

Sterling Infrastructure’s Recent Financial Results & Outlook

Sterling Infrastructure outperformed top-and-bottom-line estimates for the first quarter of 2024. The quarter’s revenue stood at $440.36 million, exceeding analysts’ expectations of $412.83 million and marking 9% year-over-year growth. The gross margin increased to 17.5% from 15.3% in the same quarter the prior year. Net income of $31.0 million drove earnings per share of $1.00, a rise of 58% and 56%, respectively, and significantly above the consensus expectation of $0.77.

At the end of Q1, the project backlog was over $2.35 billion, a significant 45% increase from Q1 2023 levels, providing strong visibility for future operations. Management has offered 2024 full-year guidance, expecting revenue between $2.125 billion and $2.215 billion, net income of $160 million to $170 million, and EPS of $5.00 to $5.30. The company is also targeting to improve EBITDA by 16%.

What Is the Price Target for STRL Stock?

The stock has enjoyed a solid upward trend, climbing over 455% in the past three years. It trades at the upper end of its 52-week price range of $55.45 – $137.63 and shows ongoing positive price momentum, trading above the 20-day (117.83) and 50-day (116.13) moving averages. The EV to EBITDA of 11.74 compares favorably to the Engineering & Construction industry average of 13.55.

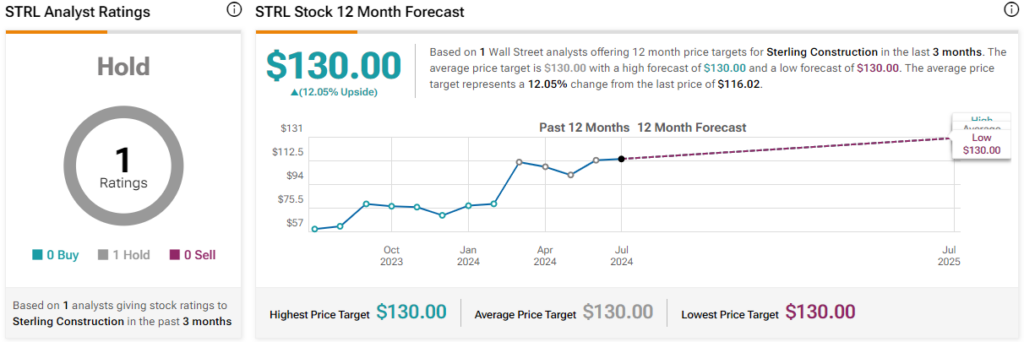

The company is thinly followed by Wall Street. However, DA Davidson analyst Brent Thielman, a five-star analyst according to Tipranks’ ratings, recently raised the share price target from $115.00 to $130.00 while maintaining a Neutral rating. He noted that existing business and backlog support growth while the company continues to explore transactions that could be additive to its growth profile.

Overall, Sterling Construction is rated a Hold. The average price target for STRL stock is $130.00, representing a potential upside of 12.05% from current levels.

STRL in Summary

Sterling Infrastructure is a compelling prospect in a flourishing U.S. infrastructure market. Its successful growth strategy, consistent cash flow, and increasing profitability have driven significant stock growth over the past year. Furthermore, a considerable project backlog gives a positive outlook for future operations. With shares demonstrating promising ongoing positive momentum while trading at a relative discount to industry peers, the stock appears to be an attractive opportunity for GARP investors interested in exposure to the infrastructure renewal story.