artiemedvedev/iStock via Getty Images

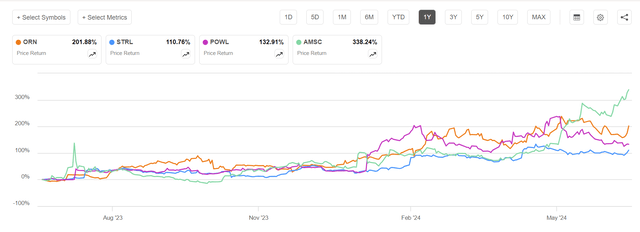

While doing some research on my recent analysis of a small cap growth stock, American Superconductor (AMSC), where I wrote about how their revenue growth is being fueled by demand in a variety of industries that they serve including data centers, I was reminded of several peer companies in the engineering and construction industry that are seeing incredible growth for similar reasons. Companies like Powell Industries (POWL) and Sterling Infrastructure, Inc. (STRL) are indirectly benefiting from the AI trend and what I see as the emergence of Industry 4.0 or the Fourth Industrial Revolution, which I first wrote about over a year ago: Powell Industries: A Growth Stock For The Fourth Industrial Revolution. I also recently upgraded my Buy rating on STRL in May of this year when I wrote (with apologies to Houston):

There is also the possibility that additional bad weather (e.g. flooding in Houston) could delay road and construction projects that STRL has been awarded causing further short-term pain. But even if those things do happen it will have only short-term impacts. I believe that STRL stock will be trading much higher a year from now. The Q1 report was even better than expected and the outlook for 2024 is wildly positive. STRL has momentum and is poised to continue higher.

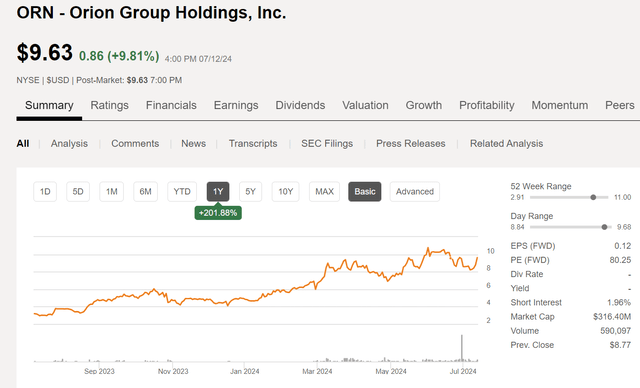

Another peer company in this industry that I like for similar reasons to STRL but operating more in marine operations and data center construction, is Orion Group Holdings (NYSE:ORN). ORN was formerly known as Orion Marine, however, they made several acquisitions and broadened their markets by adding concrete construction services. Today, ORN has a market cap of about $316M, the stock price has risen by more than 200% in the past year, and it gets Strong Buy ratings from both Wall Street Analysts and the SA Quant system.

This is how the company describes itself now (from a recent press release):

Orion Group Holdings, Inc., a leading specialty construction company serving the infrastructure, industrial and building sectors, provides services both on and off the water in the continental United States, Alaska, Hawaii, Canada and the Caribbean Basin through its marine segment and its concrete segment. The Company’s marine segment provides construction and dredging services relating to marine transportation facility construction, marine pipeline construction, marine environmental structures, dredging of waterways, channels and ports, environmental dredging, design and specialty services. Its concrete segment provides turnkey concrete construction services including place and finish, site prep, layout, forming, and rebar placement for large commercial, structural and other associated business areas. The Company is headquartered in Houston, Texas with regional offices throughout its operating areas.

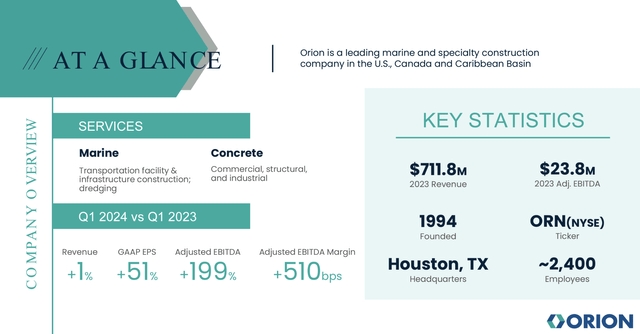

The slide below from the Q1 2024 earnings presentation summarizes key statistics:

ORN Q1 2024 earnings presentation

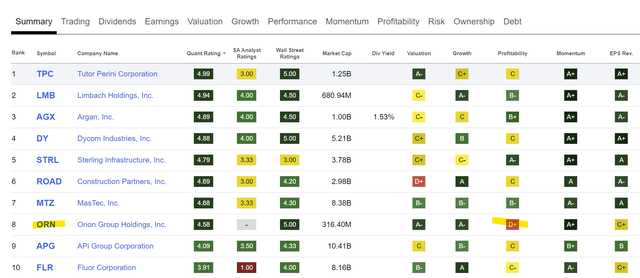

Currently, the SA Quant system ranks ORN #8 out of 32 companies in the same industry (which is broadly defined as “engineering and construction”). The top 10 are shown below. The stock gets good scores in all factors except Profitability, which is drastically improving in 2024.

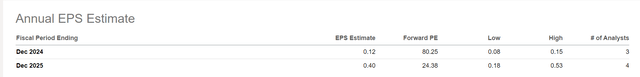

Because the company is turning the corner on profitability, the market has been rewarding the stock, driving up the price. The current forward P/E of 80 sounds high, but things are actually quite positive if you look at the expected growth in earnings over the upcoming quarters. I rate ORN a Buy given the recent good news of multiple contract awards worth more than $60 million.

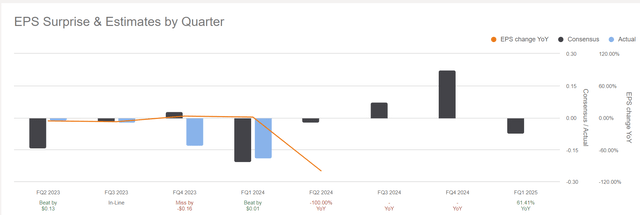

While a seasonally slower first quarter, poor weather in the US, and two project delays affected revenues more than expected the company still delivered an earnings beat. I expect them to have a positive report when they next report Q2 earnings given the optimistic tone from the CEO on the Q1 earnings report.

At this point, we have no concerns that these scheduling delays will have any material impact on total anticipated revenues and margins generated from these contracts. We expect to recover this work in upcoming quarters, with strong momentum in the back half of the year,” said Travis Boone, Chief Executive Officer of Orion Group Holdings, Inc. “Based on the activity level we are seeing for our services, especially in marine construction, we are reconfirming our full year 2024 guidance for revenue in the range of $860 million to $950 million and anticipated Adjusted EBITDA in the range of $45 million to $50 million.”

The company ended the quarter with a strong backlog of $756.6 million compared to $467.4 million at March 31, 2023. The balance sheet update from the Q2 report indicates a very strong company with very little short-term debt.

As of March 31, 2024, current assets were $217.5 million, including unrestricted cash and cash equivalents of $4.6 million. Total debt outstanding as of March 31, 2024 was $37.5 million. At the end of the quarter, the Company had less than $2,000 in outstanding borrowings under its revolving credit facility.

Although the company reported a net loss of ($0.12) for the quarter, EBITDA improved:

EBITDA for the first quarter of 2024 was $3.0 million, representing a 1.8% EBITDA margin, as compared to EBITDA of $(4.9 million), or a (3.1%) EBITDA margin in the first quarter last year. This represents an increase of $7.9 million or 493 basis points of improvement. Adjusted EBITDA increased to $4.1 million, or a 2.5% Adjusted EBITDA margin, which was on the high end of the Company’s Adjusted EBITDA guidance range of $0 to $4.0 million for the quarter. This compares to Adjusted EBITDA of ($4.1 million), or (2.6%) Adjusted EBITDA margin in the prior-year period.

One further bit of good news was their debt amendment to the loan agreement they have with White Oak Commercial Finance.

On April 24, 2024, the Company executed Amendment No. 3 to the Loan Agreement with White Oak Commercial Finance, LLC. This amendment, among other things, (i) replaces the Consolidated EBITDA covenant with a Consolidated Fixed Charge Coverage Ratio (“FCCR”) for the quarter ended March 31, 2024, (ii) lowers the FCCR covenant threshold from 1.10:1.00 to 1.00:1.00 through the quarter ended December 31, 2024, (iii) lowers the $15 million prepayment due June 30, 2024 to $10 million, (iv) extends the maturity of the Loan Agreement by one year to May 15, 2027, and (v) resets the make-whole provision to align with the extension. The Company was in compliance with all financial covenants under the amended agreement as of March 31, 2024.

All in all, the first quarter report was extremely positive and indicates that the company turnaround that began in 2022 (when Travis J. Boone was named President and CEO) is in progress and going well for the most part due to increasing demand for their services as Boone summarized on the earnings call:

In a little over a year, our opportunity pipeline has almost quadrupled from $3 billion to over $11 billion. The critical need to rebuild large parts of the U.S. infrastructure is driving a boom in demand for heavy civil and marine construction. This is especially true for the specialized services that Orion offers.

According to the Q1 earnings presentation, this completes Phase 1 of the company’s Strategic Plan.

ORN Q1 2024 earnings presentation

ORN Outlook for Next Five Years

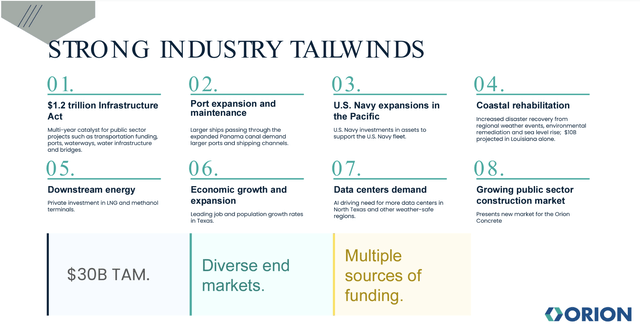

As the company continues to execute on its turnaround strategy, modernizing equipment and non-core assets such as IT infrastructure, industry tailwinds are likely to continue to propel the stock higher. Some of those tailwinds include growth in data centers due to the AI push, and also include multi-year catalysts from the recent Infrastructure Act. Downstream energy like growth in LNG terminals is another big potential growth opportunity as is US Navy expansion in the Pacific, countering threats from China and other adversaries.

ORN Q1 2024 earnings presentation

As the company increases gross margins, captures new work, and streamlines operations, the trend is encouraging for continued earnings growth in the years ahead.

While 2024 continues to be a “rebuilding” year for the company, the outlook for 2025 and beyond is even more compelling as explained by CEO Boone on the Q1 earnings call.

“We are actively bidding on a wide array of marine construction projects that have multiple sources of funding at federal, state, and municipal levels as well as privately funded projects. These projects range from US Navy investment in the Pacific, coastal restoration, LNG terminals, and port infrastructure. In Concrete, we are capitalizing on the booming data center market being fueled by artificial intelligence (‘AI’) build outs. Orion Concrete has the reputation and specialized skills to handle complex data center projects and the Dallas region has been a recent hotbed of new construction activity for data centers. Based on our backlog and pipeline, we expect momentum to increase throughout 2024 and believe that 2025 will be the year that Orion will harvest the full potential of our transformation,” concluded Boone.

Strong Management Team

Having worked in my own career for more than 15 years in engineering and construction related industries on the consulting side, I understand how deep the connections go between the handful of companies that offer specialized services on large multi-million-dollar construction projects. Companies like AECOM, Kiewit, Jacobs, and Fluor are some of the bigger players who have the general contract or the contracting connections to win those bigger jobs and then look to sub-contractors like Orion, Sterling, and Powell to execute the specialized sub-contracted work.

Boone was hired away from AECOM and most likely still has many connections there and with former clients of AECOM. Scott Cromack came to Orion from Sterling and formerly worked for Kiewit. Ardell Allred also worked for Kiewit before moving to Orion. Alan Eckman also came across from AECOM.

ORN Q1 2024 earnings presentation

Concluding Thoughts: Buy Now Before Q2 Earnings

Orion Group reached a milestone this year when the Russell 3000 index was reconstituted and ORN was added to the index as of July 1, 2024. As CEO Boone claimed on the press release announcing the news, that milestone reflects the significant progress that the company has made in its turnaround plans.

This milestone was achieved during an exciting time for Orion. With a strong foundation of operational discipline, a vastly improved business development team and a healthy balance sheet, we have set the Company up for success and are focused on driving growth for the remainder of 2024 and beyond.

Like the peer companies that I discussed in the introduction to this article, AMSC, POWL, and STRL, ORN has seen remarkable stock price performance over the past year that is likely to continue well into 2025 and beyond.

The company is due to report Q2 earnings results on July 24. With a strong management team in place, industry tailwinds and increasing demand propelling the backlog, recent contract wins, a healthy balance sheet and a successful turnaround plan in progress, I rate ORN a Buy ahead of earnings. Keep in mind that ORN is a small cap growth stock subject to lots of price volatility and some high expectations are already baked into the share price though. It is quite possible that the stock could pull back some even if they do report a strong quarter.

Also, if the currently bullish stock market should suddenly shift due to bad economic news or some black swan event, the stock price could suffer a hit for no other reason than investors being unwilling to buy shares of a high-risk growth stock regardless of the long-term potential. If you are willing to accept some risk of short-term price fluctuations, you may want to consider adding some shares of ORN under $10.

With a forward P/E of about 24x for 2025 based on the 4 Wall Street analysts who follow the stock, and estimated EPS of $0.53 on the high end, that gets you to a price of about $12 per share. However, I believe that those EPS estimates are going to increase as we get to the second half of 2024 and earnings expectations are exceeded. It would not surprise me to see annual EPS estimates closer to $1.00 per share by mid-2025 and with a conservative (for a growth stock) P/E of 20, a price target of $20 is not unreasonable in my view.