hapabapa

Introduction & Investment Thesis

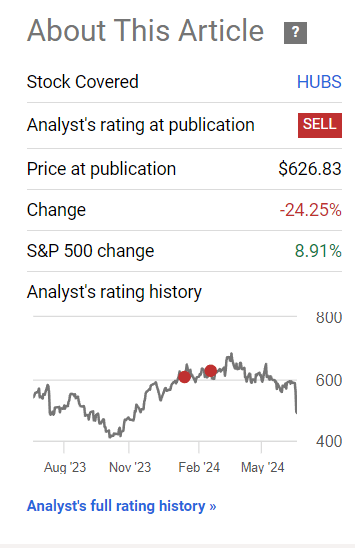

I last covered HubSpot, Inc. (NYSE:HUBS) in March, when I reiterated my “Sell” rating on this company that makes inbound marketing software.

In my March coverage, I stated why I was not encouraged by the revenue growth that HubSpot was demonstrating given its nosebleed valuation levels. At the same time, my previous coverage also had me “concerned as to the impact of the [latest] pricing change on the top line, especially in an uncertain macroeconomic environment.”

Since then, the stock has fallen 25%, justifying my previous Sell thesis on the company as shown below.

Seeking Alpha: Stock price movement since last writing

Google’s (GOOG) planned acquisition of HubSpot temporarily changed things for HubSpot’s valuation. However, with Google reportedly walking away from the deal, it’s back-to-business for HubSpot, where demand and deal progression have slowed, along with a weakening Average Selling Price (“ASP”) after its Q1 FY24 earnings. Although the management is optimistic about its long-term prospects as it continues to drive robust product innovation, I believe that selling pressure will likely continue, especially in the short term. After assessing both the “good” and the “bad,” I have decided to remain on the sidelines and rate the stock a “hold” at its current levels.

Deal progression is weakening, along with lower ASP’s from the recent pricing update.

In late May, Google began exploring a potential acquisition of HubSpot, with the idea that it would expand its products and applications to better position it in the customer relationship management sector to compete against Microsoft’s (MSFT) Dynamics 360 products. While Microsoft is focused on attracting big enterprise customers, acquiring HubSpot would have enabled Google to appeal to smaller businesses, which constitute the bulk of HubSpot’s current customer base. However, given the risks of possible antitrust regulators, Google has shelved its acquisition plans as of June 10.

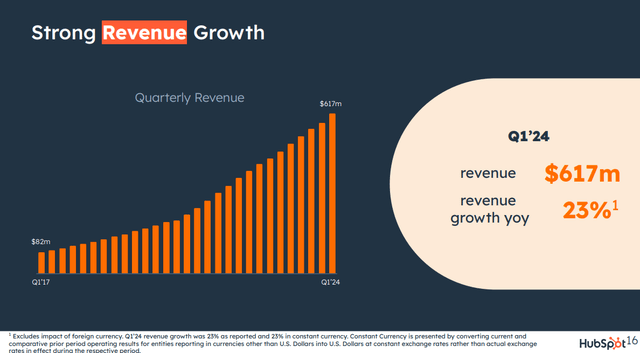

Meanwhile, HubSpot also reported its Q1 FY24 earnings, where its revenue grew 23% YoY to $617.4M, while non-GAAP operating income expanded 33% YoY to $92.6M. While the customer count grew 22% YoY to 216,840, what is concerning is that the Average Subscription Revenue per customer grew just 1% YoY to $11,447. Although I like its go-to-market strategy, where it uses a bi-modal approach to drive volume at the lower end of its customer segment while driving value in the upmarket segment with a multi-hub adoption approach, it faces the following challenges:

Q1 FY24 Earnings Slides: Revenue growth throughout the quarters

1) Demand is weakening with deal cycles getting longer.

2) Their pricing update is putting pressure on ASP.

Allow me to elaborate further.

During the earnings call, the management discussed weaker demand conditions in Q1 than expected, with buyer urgency fading from December onwards. In fact, Yamini Rangan, CEO of HubSpot, elaborated that deal cycles are indeed getting longer, with greater deal scrutiny and friction in the procurement process, which has pushed deals from Q1 into Q2. Along with that, the company is also seeing a decline in higher-quality inbound lead flows into lower-quality rep-sourced leads, which further delays deal progression.

I believe that this could be driven by macroeconomic factors, especially given the concentration of its customer base in small and midsize businesses, which are disproportionately impacted by tighter financial conditions, like we are today.

At the same time, its pricing change, which got into effect in March, has had a negative impact, leading to a lower ASP, and the company expects the weakness to continue for a couple of months. In March, the company rolled out its seat-based pricing model to all subscription tiers, where they introduced Core Seat and View-Only Seat, while removing seat minimums for Sales Hub and Service Hub. This gives customers more flexibility and greater control over their total cost of ownership. This has resulted in low ASPs for new cohorts; however, the management remains optimistic that this strategy will eventually lead to high customer volume and a higher rate of upgrades over the course of time.

Meanwhile, the company is seeing positive impact from multi-hub adoption of their Professional and Enterprise customers. It has 35% of Pro Plus customers on 3 or more hubs, especially as it continues to drive its product innovation roadmap with Content Hub, Service Hub, and HubSpot AI.

For now, given weaker than expected deal progression along with lower ASPs, this has pushed down further on the company’s net revenue retention rate (“NRR”), which now stands at 101%, compared to 103.9%. At the same time, the management kept its revenue guidance for the full year FY24 unchanged between $2.55-$2.56B, while increasing the range of its projections for non-GAAP operating income from a midpoint of $410M to $428M, an increase of 4.3% in expectations.

The product innovation roadmap remains robust as it positions for long-term, durable growth.

Although the company is seeing a slowdown in deal progression from weaker macroeconomic conditions as well as headwinds from its pricing updates, I believe it is looking at the bigger picture when it comes to its product innovation to drive durable growth, especially when these macro factors subside. During its Spring Spotlight, it featured over 100 new product releases with 70 AI features across three innovation areas that include Content Hubs, Service Hub and HubSpot AI.

Specifically, when it comes to Service Hub, the company is bringing together customer support and customer success teams with advanced SLAs, robust routing, and support management tools. It is also launching a new customer success workspace to help CSM track their pipeline and monitor customer health scores with AI-powered tools to speed up resolution. As for adoption trends, 50% of enterprise portals are using AI across use cases that include content generation, call summarization, and automating marketing campaigns to drive higher productivity. At the same time, I believe there is plenty of white space to drive deeper usage and adoption and unlock customer value, especially as we see the easing of macroeconomic conditions improving business conditions for small and midsize businesses.

Revisiting my valuation: HubSpot is trading at “fair” value

Looking forward, I believe that the company should reach its FY24 revenue target, especially as macroeconomic conditions stabilize with improvements in deal cycles and ASPs. Assuming that it grows in the high teens range over the next 3 years, followed by a slowdown in the mid-teens after that, as it continues to land and expand customers leveraging its bi-modal go-to-market strategy and product innovation, HubSpot should generate close to $4.87B in revenue by FY28.

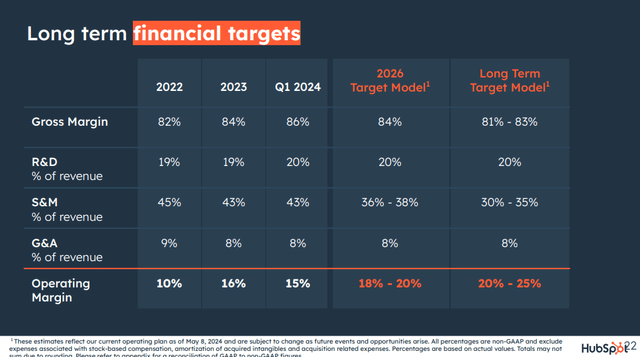

From a profitability standpoint, the management has provided a long-term financial model where it expects a non-GAAP operating margin of 18–20% by FY26 and 20–25% after that. Assuming that HubSpot can reach a non-GAAP operating margin of 25% from its projected 16.7% margin in FY24 as it can unlock operating leverage from higher ASPs and streamlining operating expenses, it should generate $1.2B in non-GAAP operating income by FY28. This would be equivalent to a present value of $833M when discounted at 10%.

Q1 FY24 Earnings Slides: Long term operating model

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15–18, I believe HubSpot should trade at least twice the multiple. That is because of the growth rate of its earnings during this period of time. This will result in a P/E ratio of 34, or a price target of $488, which represents an upside of 3-4% from its current levels.

My final verdict and conclusions

I believe that the recent volatility in the stock, especially after Google shelved its acquisition plans, has provided a much-needed haircut to the company’s valuation, which I had written about in my previous two posts. Even though the company is now trading more or less at “fair” value as per my valuation assumptions, I will choose to be on the sidelines. This is because I believe the short-term selling pressure may continue, especially as the company faces increasing weaker demand, increased deal scrutiny, and ASP headwinds from its pricing updates.

While I am optimistic about HubSpot, Inc.’s focus on growing its overall profitability while driving targeted product innovations to effectively position their customers in their AI roadmap, I think it is prudent to wait for further commentary. In particular true about how the new low-ASP cohorts are progressing along the upgrade cycle.

Plus, the S&P 500 is also trading at an extremely elevated level, with its P/E ratio far extended from its 5- and 10-year averages of 19.1 and 17.7, increasing the probability of at least a 10% pullback (if not more) in the near term. Given the high beta of HubSpot at 1.60, it increases the probability of a deeper correction. Therefore, after assessing both the “good” and “bad,” I will wait for a better entry point from a risk-reward standpoint and rate the stock a “hold” at its current levels.