Over the long run, Wall Street has been nothing short of a wealth-building machine. Although the stock market has its ups and downs, equities have handily outperformed other asset classes over the last century, including Treasury bonds, housing, oil, and gold.

But not all stocks are created equal. While artificial intelligence (AI) stocks and the “Magnificent Seven” have been given most of the credit for pushing the major indexes to new highs in 2024, dividend stocks have been Wall Street’s fuel source for the last half-century.

Dividend stocks are Wall Street’s unsung hero

In 2023, the investment advisors at Hartford Funds released a lengthy report that examined the ins and outs of what makes dividend stocks so great. In particular, “The Power of Dividends: Past, Present, and Future” compared the performance of dividend-paying companies to non-payers over a 50-year period (1973-2023).

The report found that dividend stocks more than doubled the average annual return of non-payers (9.17% vs. 4.27%). Moreover, this outperformance was achieved with dividend stocks being 6% less volatile than the benchmark S&P 500. By comparison, non-payers proved to be 18% more volatile than the widely followed S&P 500.

The Hartford Funds’ findings shouldn’t be too shocking. Companies that are profitable on a recurring basis, have proven they can navigate economic downturns, and are capable of providing transparent long-term growth outlooks are precisely the type of businesses that investors expect to increase in value over the long run.

Including exchange-traded funds (ETFs), there are well over 1,000 securities that investors can choose from that offer their shareholders/unitholders a dividend.

While income seekers would like the highest yield possible with the least amount of risk, finding this dynamic isn’t easy. In fact, studies have shown that the higher yields go (above and beyond 4%), the riskier the investment becomes. This is why double-digit-yielding stocks can sometimes be more trouble than they’re worth.

But this isn’t always the case.

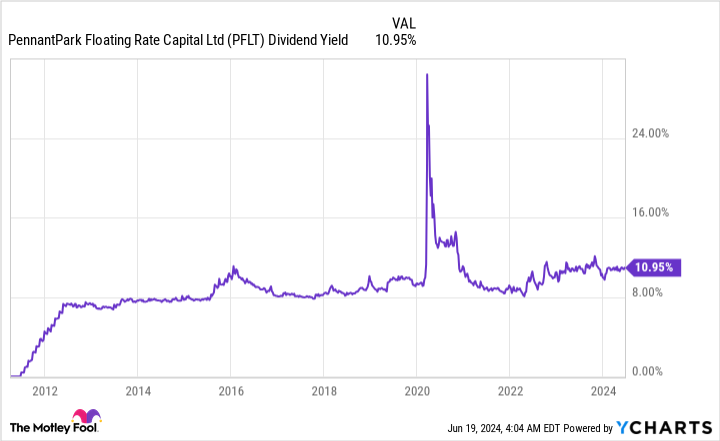

One little-known, small-cap, ultra-high-yield dividend stock — currently sporting an 11% yield — which doles out its payout on a monthly basis, might the safest double-digit-yielding stock on the planet. Investors, say hello to business development company (BDC) PennantPark Floating Rate Capital (NYSE: PFLT).

Meet the safest 11%-yielding monthly dividend stock on the planet

BDCs are businesses that invest in the equity (common or preferred stock) and/or debt of “middle-market companies.” Think of middle-market businesses as micro-cap or small-cap companies that are generally unproven.

Although PennantPark held $192.8 million in various preferred and common stock, as of the end of March 2024, the bulk of its investment portfolio ($1.285 billion) is tied up in debt securities. This makes PennantPark Floating Rate Capital a debt-focused BDC.

As a shareholder of PennantPark, I’m biased but not oblivious to the risks that small-cap BDCs contend with. For instance, the company depends on a strong U.S. economy to ensure that outstanding loans are repaid. If the U.S. economy were to dip into a recession, which is what the historic decline in U.S. M2 money supply suggests will happen, it might lead to a rise in non-accruals (i.e., delinquencies) among middle-market companies.

But even with these visible risks, PennantPark has continually demonstrated what a rock-solid foundation it’s built on.

To begin with, focusing on debt, as opposed to equity, has its advantages. Since middle-market companies often have limited financial solutions at their disposal, the loans PennantPark holds can generate market-topping yields. As of the end of March, its weighted-average yield on debt investments came in at 12.3%. For those of you keeping score at home, this is more than double the roughly mid-5% yields attached to short-term Treasury bills.

What really makes this small-cap, supercharged income stock tick (which may have been given away by its name) is that its entire debt-securities portfolio sports variable rates. Every time the Federal Reserve raises or lowers interest rates, it has a direct impact on the yield PennantPark generates from its outstanding loans.

Since March 2022, the nation’s central bank has undertaken its most aggressive rate-hiking cycle in 40 years. As a result, PennantPark’s weighted average yield on debt investments has expanded 490 basis points to 12.3% since Sept. 30, 2021. As long as shelter inflation remains stubbornly high, the Fed isn’t going to be in any rush to kick off a rate-easing cycle. This stalemate is lining PennantPark’s pockets.

Despite dealing with unproven businesses, PennantPark had only one company on non-accrual, as of March 31. This one delinquency represents just 0.4% of the company’s overall portfolio ($1.48 billion) on a cost basis and is a testament to the top-notch vetting process that’s in place.

This is a good time to point out that PennantPark Floating Rate Capital’s management team has also taken purposeful steps to protect its principal. For instance, its $1.48 billion portfolio, including equity positions, is invested across 146 companies. With an average investment size of just $10.1 million, no single investment is large enough to capsize its portfolio.

Furthermore, 99.98% of the company’s $1.285 billion debt-securities portfolio is held in first-lien secured loans. First-lien secured debtholders are first in line for repayment in the event that a borrower seeks bankruptcy protection.

The final piece of the puzzle is that PennantPark is trading at 2% below its book value. BDCs that generate steady interest income in an environment where the Fed’s monetary policy is incredibly transparent shouldn’t be trading below their book value.

While share-price appreciation is liable to be modest, at best, you’d struggle to find a safer double-digit-yielding stock right now than PennantPark Floating Rate Capital.

Should you invest $1,000 in PennantPark Floating Rate Capital right now?

Before you buy stock in PennantPark Floating Rate Capital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PennantPark Floating Rate Capital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $830,777!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 10, 2024

Sean Williams has positions in PennantPark Floating Rate Capital. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

This Little-Known, Small-Cap Company Might Be the Safest 11%-Yielding Dividend Stock on the Planet was originally published by The Motley Fool