If going solely by market capitalization, NVIDIA is now the most valuable publicly traded company in the world following its latest stock market rally. As of this morning, NVIDIA’s market cap is right around $3.35 trillion (with a ‘T’), which puts it ahead of several technology heavyweights including Microsoft ($3.17 trillion), Apple ($3.29 trillion), Google’s parent firm Alphabet ($2.17 trillion), and Amazon ($1.9 trillion).

It wasn’t a meteoric rise for NVIDIA, a company that CEO Jensen Huang co-founded along with Curtis Priem and Chris Malachowsky over three decades ago. But it also didn’t take long for NVIDIA make a mark in the industry after some initial growing pains before it went public in 1999, nearly six years after the company came into existence. NVIDIA launched its IPO (initial public offering) at $12 per share.

That same year saw the release of NVIDIA’s GeForce 256, its first officially branded GeForce product and, if you ask NVIDIA, also the world’s first GPU (graphics processing unit). We can nitpick the semantics of the claim, but at the very least, NVIDIA gets credit for coining the term GPU, which is now standard lexicon in the world of graphics chips, both discrete and integrated.

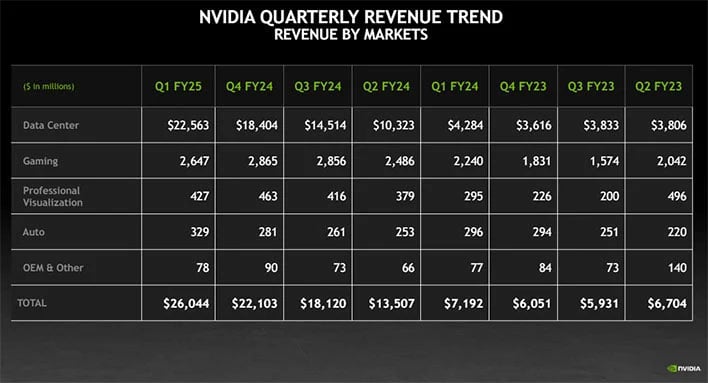

Shares of NVIDIA are up more than 170% since the beginning of the year, with the company topping the $3 trillion market cap market earlier this month. The more recent stock price ascension comes on the heels of an industry-wide AI (artificial intelligence) boom. Where at one time gaming GPUs were NVIDIA’s bread and butter, its data center solutions generate the most revenue and it’s no longer even close. Have a look at the most recent breakdown…

NVIDIA’s graphics chips for gaming still bring in billions of dollars in revenue each quarter, but it’s clear that its data center products are where the big money is coming from these days. And while the data center really took off earlier this year, it’s the result of long term investments that Huang put in place a long time ago, which allowed NVIDIA’s data center business to catch up with gaming before exploding past it.

Regardless of how that plays out, NVIDIA should still find itself in a strong position. Outside of the consumer space, NVIDIA’s GPU hardware for data centers are in high demand, and that should continue as more AI experiences powered by the cloud become commonplace. In the meantime, the race is on to see which publicly traded will be the first to reach a $4 trillion market cap.