Luis Alvarez

Infrastructure is what makes modern economies run. The systems and facilities that transport goods, people and energy, and facilitate communications and payments are the essential foundation upon which economic growth and social development are based. And there is a lot more infrastructure build out needed globally to support new technologies, and replace older structures. That’s why the SPDR S&P Global Infrastructure ETF (NYSEARCA:GII) makes a lot of sense.

GII seeks to provide investment results that, before fees and expenses, correspond generally to the performance of the S&P Global Infrastructure Index, which is designed to measure the performance of 75 of the world’s largest infrastructure companies. This index provides highly liquid exposure to well-established carriers of essential goods and services around the globe on a passive basis.

The index methodology allocates its maximum of 15 positions for emerging-market stocks based on float-adjusted market capitalization, no more than 10 emerging-market companies in each infrastructure sub-industry (transportation, utilities and energy infrastructure) and allocates the remaining 60 positions for developed-market stocks again based on float-adjusted market capitalization, with a balanced split across each of the three sub-industries.

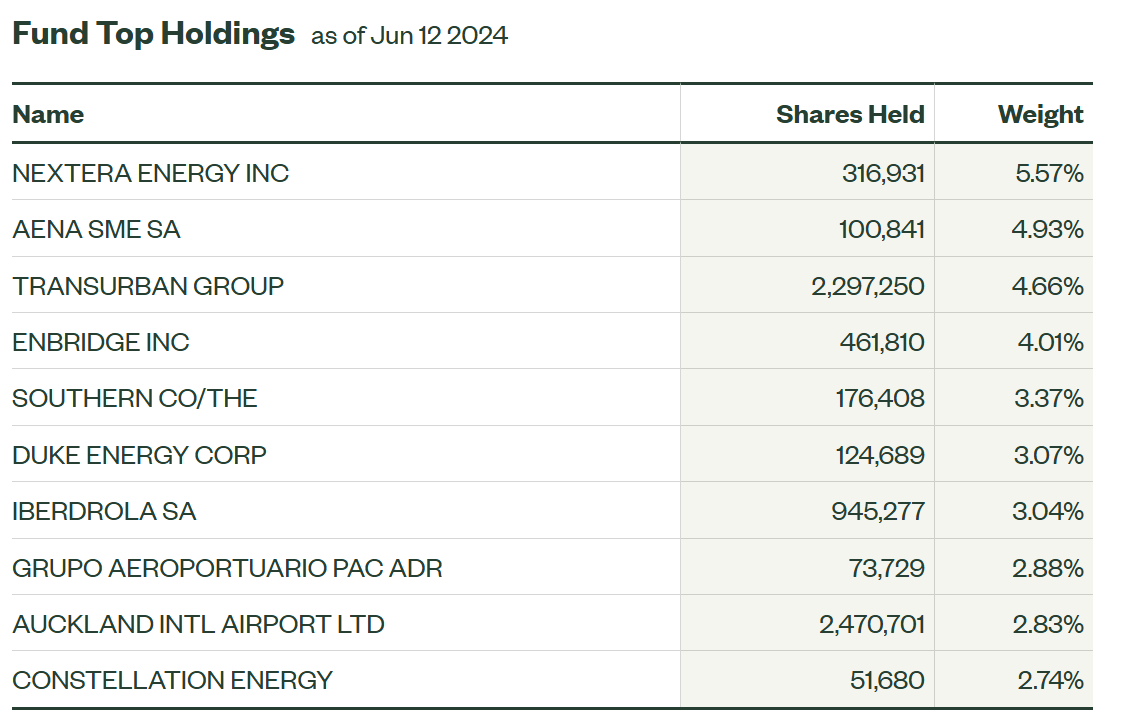

A Look At The Holdings

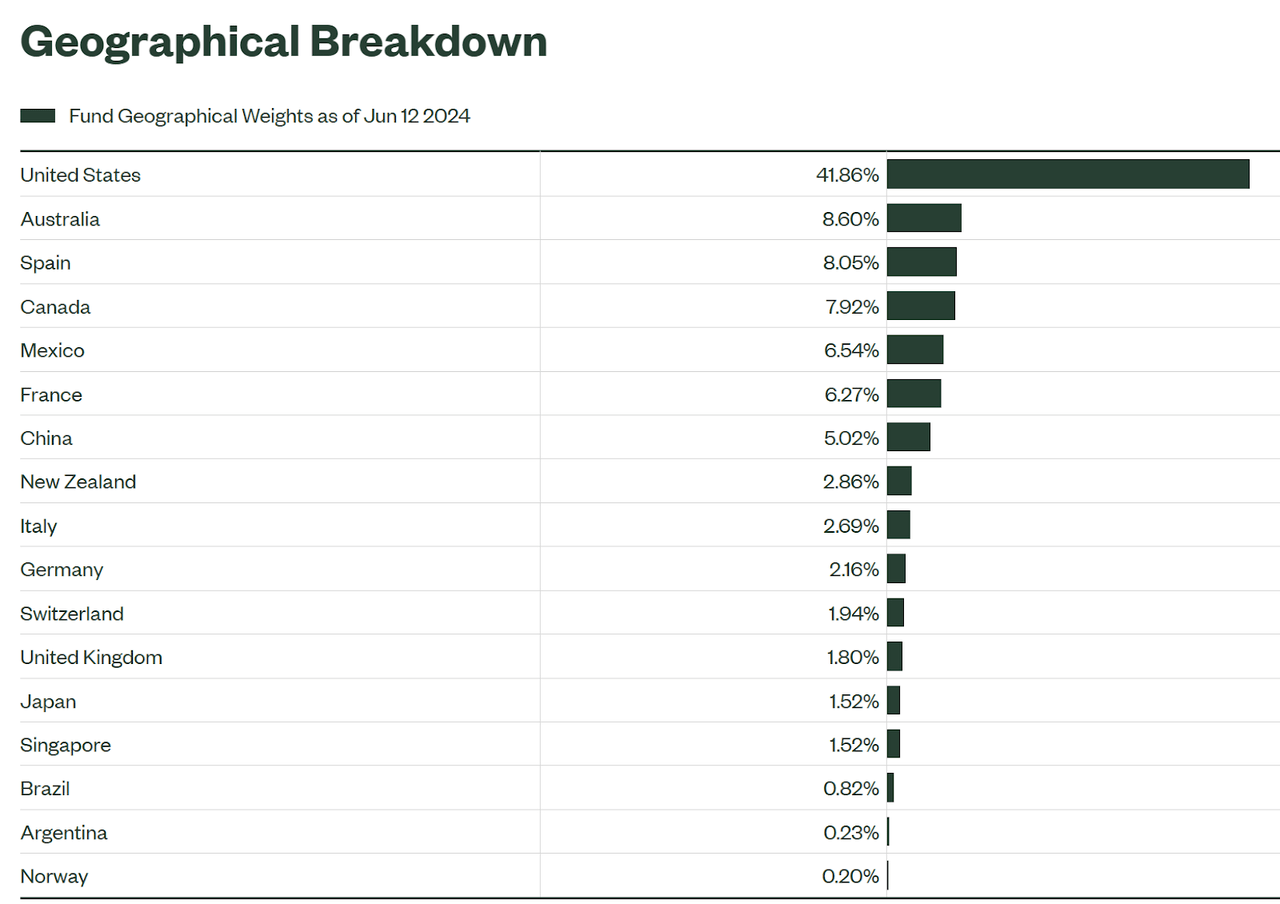

The geographic and holdings mix is interesting. No position naked up more than 5.57% of the fund, which isn’t bad from a diversification standpoint for something that is thematic.

ssga.com

On the country side of things, the US makes up the largest allocation at nearly 42% of the fund. This is also I think fairly reasonable. Too often I see global funds where the US makes up 70-80% of the holdings. I like that this has exposure to Australia, Spain, Canada, and other developed countries as well as emerging markets.

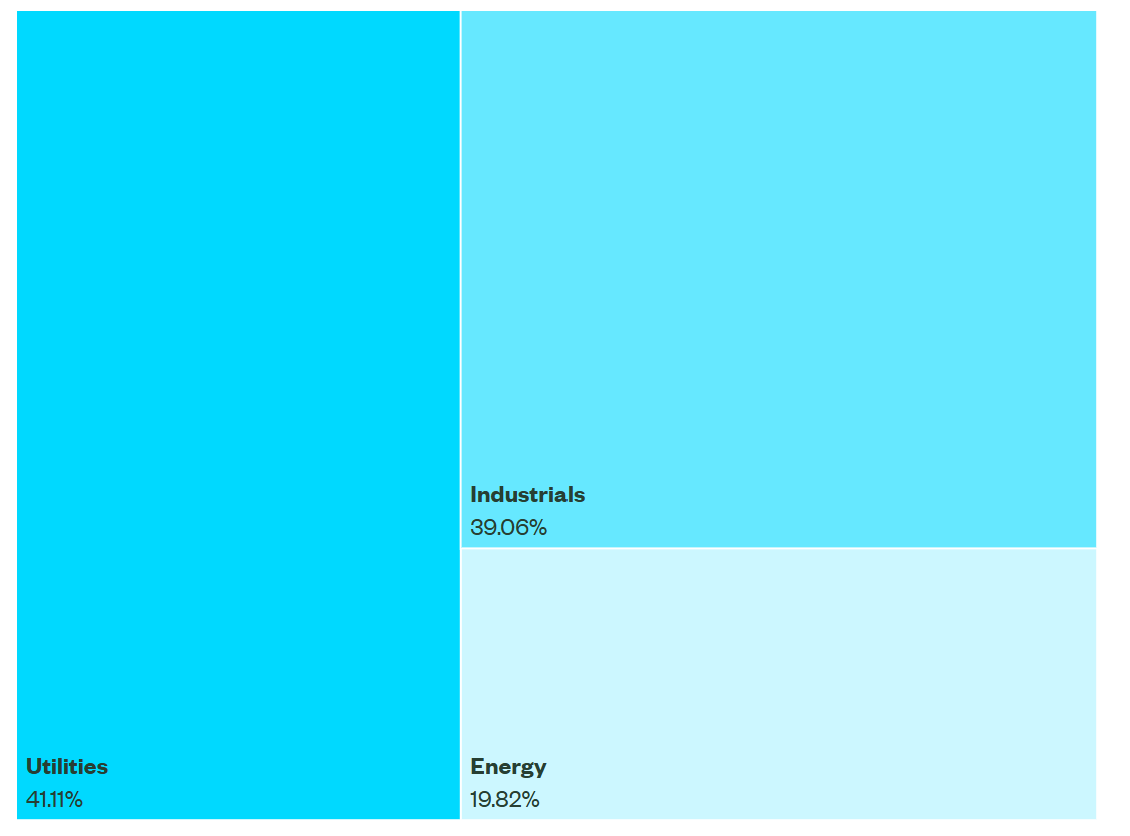

Sector Composition

When looking at infrastructure funds, the sector allocations are often where I see the most variability. To that end, I think this is actually fairly balanced where it matters the most. Utilities make up the biggest chunk overall, followed by Industrials slightly behind it and Energy third.

ssga.com

I’m a huge fan of the Utilities sector more broadly. As the world moves more towards electrification, the grid and support infrastructure around it needs a major overhaul not just in the US but globally. There’s a tremendous amount of untapped potential there, and it’s good to see this being the largest allocation of this as an infrastructure thematic fund.

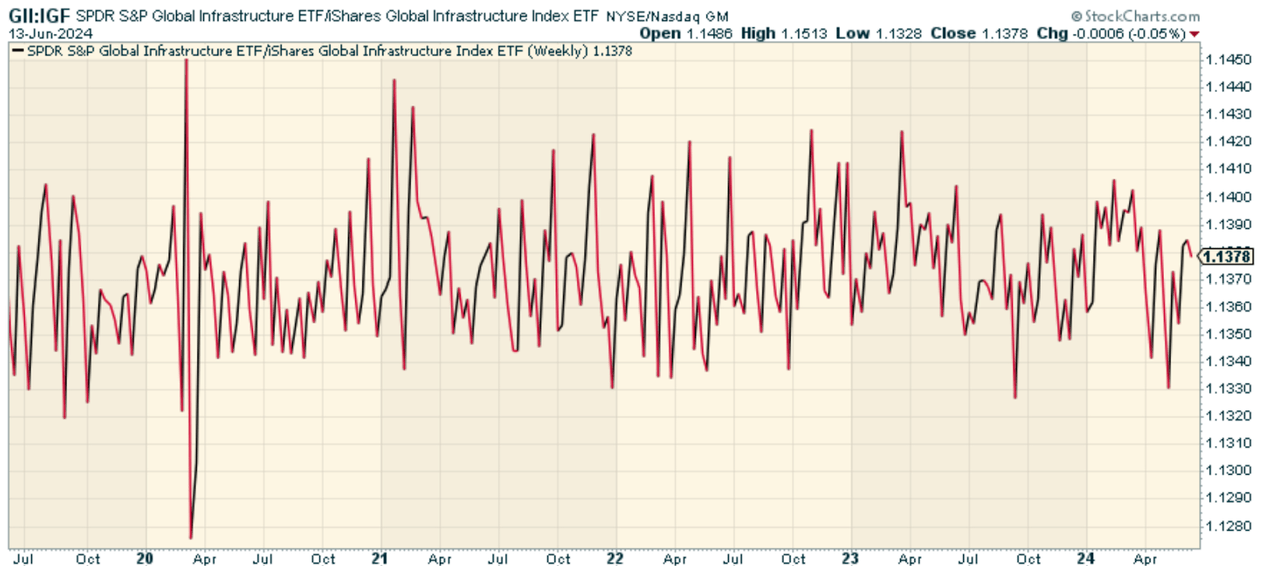

Peer Comparison

One fund worth comparing this against is the iShares Global Infrastructure ETF (IGF). This ETF also tracks the S&P Global Infrastructure Index. It’s very similar to GII. When we look at the price ratio of GII to IGF, we find that the two funds have pretty much performed in line with each other. No clear edge of one over the other at all.

Pros and Cons

On the plus side, infrastructure is an essential element of economic expansion and development and, therefore, exposure to this part of the economy can potentially offer investors strong profit from the growing need for increased infrastructure investment across the globe. Furthermore, most infrastructure companies tend to be relatively predictable in terms of providing steady streams of cash flows and dividends, making GII a potential investment choice for those yield-hungry investors (currently at 3.39% on the 30 Day SEC-Yield).

However, it is important to recognize the particular risks linked to the infrastructure sector. First, it is a capital-intensive sector that falls under regulatory control, leading to schedule delays and cost overruns. It is also a sector sensitive to the cycle, as a downturn results in reduced demand for infrastructure services and delay in projects that are pending approval. Furthermore, the non-US exposure of the fund means potential exposure to currency fluctuations, political risk and varying regulatory environments across countries.

Conclusion

GII tracks a broad list of the world’s biggest infrastructure companies. I’m a fan. The ETF has strong global exposure, the right sector weightings in my view, and checks all the boxes for something that should behave differently than most market averages while providing strong outperformance potential. This is a fund worth considering.

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.