Thomas Northcut

By Shane Hurst, Portfolio Manager

Infrastructure Outperformance Doesn’t Need Falling Rates

Higher bond yields have weighed on infrastructure stocks of late, whose dividends must compete with bonds for income investor capital, and which typically require a lag in passing through higher costs from interest rates to allowed returns (for regulated assets such as utilities) or long-term contracts (for user-pays assets such as toll roads and airports). Yet infrastructure has historically outperformed global equities as interest rates have peaked, something to keep in mind as inflation indicators slow and allow major central banks to end their hawkish positioning and move toward easing.

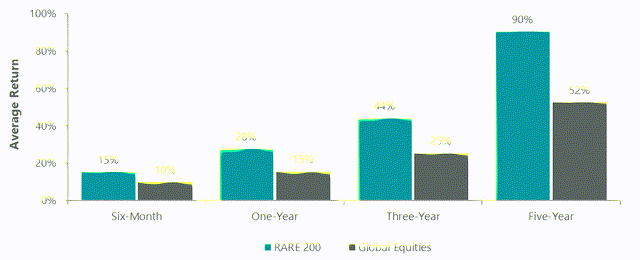

Outperformance of infrastructure over several time periods following the last rate hike in a cycle confirms our thesis that we don’t need bond yields to fall for infrastructure to outperform (Exhibit 1). Reduced volatility or greater certainty for rates could be supportive for infrastructure valuations and key thematic drivers. In fact, what infrastructure offers over bonds or term deposits is meaningful capital upside, with the sector having a number of multidecade thematic drivers, including decarbonization, significant network investment as well as AI and the powering of data growth.

The increasing outperformance of infrastructure versus global equities over time, following the last rate hike, likely reflects the lag as infrastructure assets increase their returns following rate hikes, as well as the increased relative attractiveness of their dividends amid lower bond yields.

What is also crucial to remember is that infrastructure assets are essential services, so the sustainability of their dividends is high. Unlike fixed interest securities, infrastructure dividends are expected to grow annually – in our estimates in the mid single digits – due to their ongoing investments and their growing asset bases.

Exhibit 1: Infrastructure Performance Following Last Fed Rate Hikes

As of March 31, 2024. Source: ClearBridge, FactSet, Bloomberg. The RARE 200 is the combination of the investment universes (updated on a quarterly basis) for ClearBridge Investments’ infrastructure strategies. Constituents as of March 31, 2024, measuring total return in local currency. Global equities: MSCI AC World Index, gross returns in local currency. Performance reflective of the six-month, one-year, three-year and five-year period following the last Fed rate hike prior to cutting cycles in 1989, 1995, 2001, 2007 and 2019.

It’s also important to note that most of the U.S. Federal Reserve rate cuts after the peak preceded recessions, underlining the defensive nature of infrastructure. We believe that, even in a soft landing scenario (without a recession), infrastructure’s defensive qualities will shine as economic activity slows.

Peaking interest rates in the current cycle have created a significant opportunity as listed infrastructure has underperformed broader equities, with the one-year returns for MSCI World of 18.39% (in USD) versus the S&P Global Infrastructure Index is -0.03% as of April 30, 2024. But we believe the future is bright, with the headwind of rising bond yields looking to subside and many reasons to be optimistic across infrastructure subsectors.

Regulated utilities continue to pass through inflation but are getting little credit for growth. We see the sector entering an elevated capex cycle over the coming decades, particularly electricity networks companies, which are building out infrastructure to support the energy transition, network resiliency and replacement of aging assets. We see higher investments, higher asset base growth and higher returns, which should translate to sustainably higher earnings and dividends for shareholders through the medium term.

Further, explosive data demand supercharged by AI is leading to increased power demand, increased capital spend in electric and power infrastructure and further growth in renewable power generation to meet the accelerating needs of hyperscalers.

Among renewable companies, many are now trading at levels that only give credit for the existing assets in operation and factor in no value for future growth, which we believe to be very conservative.

Among user-pays infrastructure, drops in volumes and traffic from the pandemic have weighed on valuations but these subsectors now look poised to complete their recovery. In toll roads, we continue to see strength across Europe and North America, with traffic now near or above pre-pandemic levels. There is also strong traffic momentum in the airport sector, particularly those companies with higher exposure to leisure-based and corporate travel as well as Chinese passengers.

Finally, the communications sector has derated in recent quarters, largely due to the inability of wireless communication tower companies to pass on the impact of rising interest rates in their long-term leasing structure. However, we believe that as interest rates stabilize, and if the Fed does indeed begin an easing cycle toward the back end of 2024, that will become a tailwind for the sector.

To sum up, while no two rate cycles are identical, periods of stabilizing interest rates have seen infrastructure outperform global equities. Add in a variety of growth drivers and attractive valuations across infrastructure subsectors, and there are many reasons to look to the asset class for outperformance today.

Keeping in mind infrastructure’s historical outperformance versus global equities following the last rate hike in the cycle, it is a good time to look at investing in infrastructure.