pcess609

Transcript

Major infrastructure needs sit at the intersection of mega forces – the structural shifts driving returns now and in the future.

This week we spotlight investment opportunities where these structural shifts converge.

1) Demographic divergence

We see opportunities arise where capital investment has not kept up with population growth.

Emerging markets, like Saudi Arabia, will need more capital spending to support their growing working-age populations. Yet aging developed markets could see infrastructure demand shift away from industries tied to a growing population.

2) Artificial intelligence and digital disruption

Digital disruption and AI are already creating a massive and immediate need for power and data center infrastructure. AI-related data center investment could grow 60-100% annually in coming years. This buildout has investment implications that extend far beyond first-line tech beneficiaries – reaching beneficiaries further up the supply chain like utilities, energy, materials, industrial equipment and real estate, as well as those adopting the tech.

AI’s energy needs could magnify the already massive investment likely to be needed in the low-carbon transition.

3) Geopolitical fragmentation

Geopolitical fragmentation is powering infrastructure demand as supply chains rewire. We prefer countries like India and Mexico that boast valuable natural resources and benefit from reshoring.

Infrastructure sits at the intersection of most of the five mega forces we track. We have exposure to beneficiaries of the infrastructure boom on a tactical horizon of six to 12 months. We like infrastructure equity on a strategic horizon.

Infrastructure sits at the intersection of mega forces – the structural shifts driving returns now and in the future. Take artificial intelligence (AI): AI is driving capital spending partly due to technological competition among countries, and the buildout of power-hungry data centers is now affecting the energy transition, too. We stay overweight the AI theme. The rewiring of supply chains benefits countries like India and Mexico. In private markets, we like infrastructure equity strategically.

Investment-demographic link

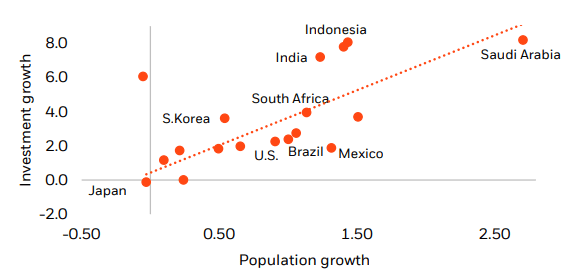

G20 population and investment growth, 2000-2019

Source: BlackRock Investment Institute, World Bank Development Indicators, UN, with data from Haver, March 2024. Note: The chart shows the relationship between average population growth and average real investment growth, as measured by the gross fixed capital formation component of GDP, between 2000 and 2019. The chart includes data up to 2019 to avoid the pandemic’s distortion of the data.

Demographic divergence – a mega force that most investors don’t think about from a capital spending perspective – shapes infrastructure needs across economies. Typically, the faster a population grows, the faster capital investment grows. See the chart. Opportunities arise where investment has not kept up with that growth. Emerging markets (EMs), like Saudi Arabia, will need more capital spending to support their growing working-age populations. In developed markets (DMs), how countries adapt to aging will dictate investment. Many are rolling out measures to help offset stagnating or even shrinking workforces, with countries such as South Korea investing in AI-driven automation. And infrastructure demand could shift away from industries tied to a growing population. We eye potential mispricings as markets can fail to price in even predictable structural shifts – until they hit.

Digital disruption and AI are already creating a massive and immediate need for power and data center infrastructure. AI-related data center investment could grow 60-100% annually in coming years, according to a mix of forecasters including the International Energy Agency. We don’t think broad valuations fully reflect this boom. The investment implications of this buildout extend beyond first-line tech companies – reaching beneficiaries further up the supply chain like utilities, energy, materials, industrial equipment and real estate, as well as those adopting the tech. We are overweight the AI theme broadly.

AI’s energy needs could magnify the already massive investment expected in the low-carbon transition. Many mega-cap tech firms doing the largest AI buildouts have net-zero targets – that could drive up demand for renewable energy. Our BlackRock Investment Institute Transition Scenario estimates energy system investment will hit $3.5 trillion per year this decade – and $4.5 trillion by the 2040s. Low-carbon investment would then account for up to 80% of energy spending, up from 60% now.

The geopolitical story

Geopolitical fragmentation is powering infrastructure demand across sectors and countries. Supply chains are becoming more complex as some countries increasingly act as intermediate trading partners. We get granular in EMs, preferring India and Mexico as they benefit from a rewiring of supply chains or companies bringing production closer to home.

We think private markets play an important role in the new regime marked by greater macro uncertainty and higher inflation. We see them bridging the gap between infrastructure needs and what governments can do on their own, given elevated debt levels in many countries coming out of the pandemic. We are overweight infrastructure equity on a strategic horizon of five years and longer. Compared with other pockets of private markets, infrastructure equity has reasonable valuations at higher interest rates, features steady earnings and offers cash flows often linked to inflation in what we expect will be a world of persistently higher inflation. Private markets are complex, with high risk and volatility, and aren’t suitable for all investors.

Our bottom line

Infrastructure sits at the intersection of mega forces. We stay overweight the AI theme, including beneficiaries of the infrastructure boom on a tactical horizon of 6-12 months. We like infrastructure equity on a strategic horizon.

Market backdrop

U.S. stocks were flat last week near record highs, with upbeat Q1 earnings for one key AI-related company supporting equities. We keep our overweight to the AI theme. Stock market volatility is easing, with the VIX index (VIX) of S&P 500 implied volatility hitting its lowest levels since 2019. U.S. 10-year Treasury yields (US10Y) ticked up to near 4.45% on a stronger-than-expected services PMI and a drop in weekly jobless claims – but are still down about 30 basis points from this year’s highs.

The release of April U.S. PCE data – the Federal Reserve’s preferred measure of inflation – is the main data event this week. We monitor the data for any signs that services inflation is easing. The U.S. CPI data for April showed core goods prices falling further, so recent upside surprises on the PCE measure may be one-offs. Yet, services inflation is proving volatile and remains well above a pace consistent with inflation settling at the Fed’s 2% target in the medium term.