There is a bit of AI spending one-upmanship going on among the hyperscalers and cloud builders – and now the foundation model builders who are partnering with their new sugar daddies to be able to afford to build vast AI accelerator estates to push the state of the art in model capabilities and intelligence.

It looks like Amazon, through its Amazon Web Services cloud, is winning the AI budget bonanza game. On a conference call with Wall Street analysts going over the fourth quarter 2024 financial results for the Amazon conglomerate, chief financial officer Brian Olsavsky said this:

“Capital investments were $26.3 billion in the fourth quarter, and we think that run rate will be reasonably representative of our 2025 capital investment rate. Similar to 2024, the majority of the spend will be to support the growing need for technology infrastructure. This primarily relates to AWS, including to support demand for our AI services as well as tech infrastructure to support our North America and International segments.”

Later in the call, Olsavsky reiterated that the capital expenditure rate for Amazon in Q4 2024 would be sustained throughout 2025, and just in case you didn’t hear that right, that means that Amazon will spend north of $100 billion in property and equipment in 2025. Our best guess – and we have to guess because Amazon does not disclose this – is that more than 90 percent of that capital spending will go for AWS datacenters, and 90 percent of that spending will be for AI systems and the datacenters that wrap around them. If you do that math on that, it works out to $86 billion in AI datacenter spending in 2025, more or less.

As best we can figure from our own model, information technology has been an increasing portion of the Amazon capital budget since AWS was founded in 2006. It was tens of millions of dollars per quarter way back then, and quickly busted through hundreds of millions of dollars as the AWS cloud grew. Since the first quarter of 2008, Amazon has invested $469.7 billion in property and equipment, which is a staggering amount of money until you consider that this is the ballpark of what Amazon, Microsoft, Google, and Meta Platforms say they are going to spend on capital expenses in the current calendar year. (That’s $80 billion for Microsoft, $75 billion for Google, $65 billion for Meta Platforms, and $100 billion for Amazon.)

We think that Amazon shelled out $38.4 billion in IT infrastructure spending in 2023, and $30.1 billion of that was for AI servers and the datacenters that house them. The other $8.2 billion was for generic datacenters and the servers, storage, and switches inside of them. In 2024, we think this generic datacenter spending at Amazon (which means AWS) was up 13.2 percent to $9.3 billion, and AI datacenter spending at Amazon (again allocated to AWS) doubled to just under $60 billion. Amazon spent another $14.6 billion for fulfillment centers, transportation systems, and office space, which was down 4.7 percent.

This model has a bunch of witchcraft in it, we concede, and we made some assumptions about how to apportion this. If we ran the Securities and Exchange Commission, such disclosures would be done as a matter of course because you need such granularity in financials to make investment decisions.

The amazing thing about the size of the 2025 capital expense budget for Amazon is that it on the same order of magnitude as the company’s AWS cloud revenues in 2023, which came in at $90.76 billion. In 2024, annual revenues at AWS rose by 18.5 percent to $107.6 billion. Way back in February 2019, we were said that AWS would certainly break $100 billion in annual sales in 2026, which would have been the 20th anniversary of the launch of the bookseller’s cloud division, and thanks to the AI revolution and a strong push to move enterprises to the cloud, Amazon has beat that projection by two years.

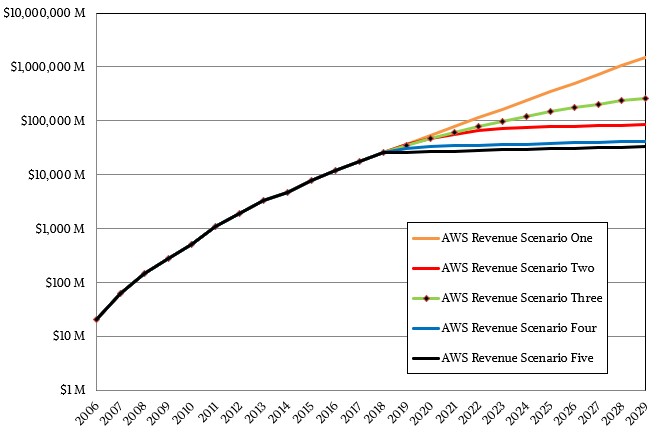

By the way, just for fun, here is the chart we did for revenue projections, and we said Scenario Three was the most likely, where growth would step down gradually:

In that model above, Scenario Three, which we chose as the most likely future path for AWS sales, had AWS revenue at $98.8 billion in 2023 and at $123.5 billion in 2024. So, Jeff and Andy, good job, you almost met our expectations. . . .

The thing that has us scratching our heads is that the investment in AI gear each quarter and each year is larger – and considerably larger at that – than the operating income of AWS for those times. The ratio of IT investments to operating income averaged 1.72X in 2024 and averaged 1.58X in 2023; sometimes, the ratio is twice as large. In Q4 2024, for instance, that ratio of IT spending for AWS to operating income for AWS was 2.3X, for instance.

How is this sustainable? Well, you have to spend money to make money.

For AI servers and the datacenters that wrap around them, as we have shown here, for every $1 you spend for an AI cluster and its datacenter (including its power and cooling), you get 87.8 cents back every year that you rent that AI cluster out to customers, assuming a reasonable mix of on-demand and reserved instance hours and a $9.40 per GPU-hour rate. In 410 days, you get your bait back on the entire AI datacenter investment if you rent all the GPUs out. The model we created (riffing on an Nvidia model) shows that for the three years after that, the 87.8 cents per year goes right into your pocket. After that, you have to pay some incremental power and cooling and operations cost outside of the five years. Call it 75 cents profit every year. Keep the GPU in the field for a decade – and there is no reason to believe this will not happen with Nvidia “Hopper” H100 GPUs – and you get to pocket about $6.25 for that $1 investment over a decade.

It would be hard to find a better business. Which is why we see the tech titans all plowing so much money into AI hardware and the datacenters that wrap around them. They also want to make money selling AI models, which is a different (but related) story.

So let’s take the inputs from the Big Four and see what the outputs are. Microsoft’s $80 billion plus Meta Platforms’ $65 billion plus Google’s $75 billion plus Amazon’s estimated $86 billion (from our financial model) is $306 billion. The output, in terms of profits, over the next decade from renting that enormous AI server capacity, assuming there is not a collapse in pricing, is $1,912.5 billion. Assuming price cuts over time that are modest, call it $1.5 trillion of output. If you could increase your money by 5X over a decade on the AI gravy train, wouldn’t you?

This is why Amazon, and therefore AWS, has the aggressive attitude that it has.

“The vast majority of that CapEx spend is on AI for AWS,” Amazon chief executive officer Andy Jassy said on the call. “It’s the way the AWS business works. The way the cash cycle works is that the faster we grow, the more CapEx we end up spending because we have to procure datacenter and hardware and chips and networking gear ahead of when we are able to monetize it. But we don’t procure it unless we see significant signals of demand. And so, when AWS is expanding its CapEx, particularly in what we think is one of these once-in-a-lifetime type of business opportunities like AI represents, I think it’s actually quite a good sign medium-to-long term for the AWS business. And I actually think that spending this capital to pursue this opportunity, which from our perspective, we think virtually every application that we know of today is going to be reinvented with AI inside of it and with inference being a core building block just like compute and storage and database.”

See? All of this spending is a leading indicator of boom times to come.

A little later in the call, Jassy had this further to say about this humungous AI investment and the fact that AWS would be more aggressive if it were not for supply chain issues:

“It is hard to complain when you have a multi-billion dollar annualized revenue run rate business in AI like we do and it’s growing at a triple digit percentage year-over-year. It’s hard to complain. However, it is true that we could be growing faster if not for some of the constraints on capacity. And they come in the form of — I would say, chips from our third-party partners come in a little bit slower than before with a lot of midstream changes to take a little bit of time to get the hardware actually yielding the percentage healthy and high-quality servers we expect. It comes with our own big new launch of our own hardware and our own ships in Trainium2, which we just went to general availability at re:Invent, but the majority of the volume is coming in really over the next couple of quarters.”

So a lot of that capital spending in 2025 is to catch up on Nvidia “Blackwell” system orders and to pay for the Trainium2 ramp, which is happening to support AI model maker Anthropic as well as other customers using the AWS SageMaker and Bedrock AI model services.

Having said all of that, let’s drill down into the results for the fourth quarter.

In Q4, AWS revenues were 28.79 billion, up 18.9 percent year on year and up 4.9 percent sequentially. Operating income was $10.63 billion, up 48.3 percent compared to the prior period and representing 36.9 percent of the revenue stream, which is pretty good for an amalgam of a hardware manufacturer and a software supplier, which is what the AWS cloud is.

We think that thanks to the growth of cloud computing in general and AI training in particular, the compute portion of the AWS business is booming, and that the company’s fees for storage and networking have been going down and that spending on higher level software are also flattening. It might look something like this:

We concede that this chart is just a guess, not based on anything other than our hunches. In the absence of real data, guesstimations have to be made. Like this:

Kirk: Mr. Spock, have you accounted for the variable mass of whales and water in your time re-entry program?

Spock: Mr. Scott cannot give me exact figures, Admiral, so… I will make a guess.

Kirk: A guess? You, Spock? That’s extraordinary.

Spock: [to Dr. McCoy] I don’t think he understands.

McCoy: No, Spock. He means that he feels safer about your guesses than most other people’s facts.

Spock: Then you’re saying. . .

[pause]

Spock: It is a compliment?

McCoy: It is.

Spock: Ah. Then, I will try to make the best guess I can.

McCoy: Please do.

In any event, as companies embrace AI models curated by or created by AWS and use them to train AI models and put them into production on their actual workloads, you will see that compute revenue at AWS level off as price/performance curves are ridden down. You will also see that software revenue curve flex up again as the budget shifts more towards software and away from hardware.

These are temporary conditions for compute. Remember that. In the longest of runs, software always represents the majority of the IT value.

One last thing: There is an interesting interplay of depreciation for datacenters and warehouses happening at Amazon.

Olsavsky said that AWS increased the “useful life,” a technical accounting definition, for some of its servers in 2025, which boosted AWS operating margins by two points in Q4 2024. Interestingly, AWS took a hard look at the useful life of its AI systems and will be decreasing the useful life of older server and networking gear from six years to five years effective in 2025, which will decrease full-year 2025 operating income by $700 million. Olsavsky said that Amazon also records a Q4 2024 charge of $920 million from accelerated depreciation for other server and networking equipment, and that another $600 million charge on similar equipment will be taken by Amazon in 2025. To offset these charges, Amazon looked around its fulfillment warehouses and took a hard look at the useful life of heavy equipment used here and decided to extend the useful life of this gear from ten years to thirteen years, providing a $900 million operating profit benefit for 2025, more than offsetting the $600 million charge for the server and networking writeoffs coming this year.