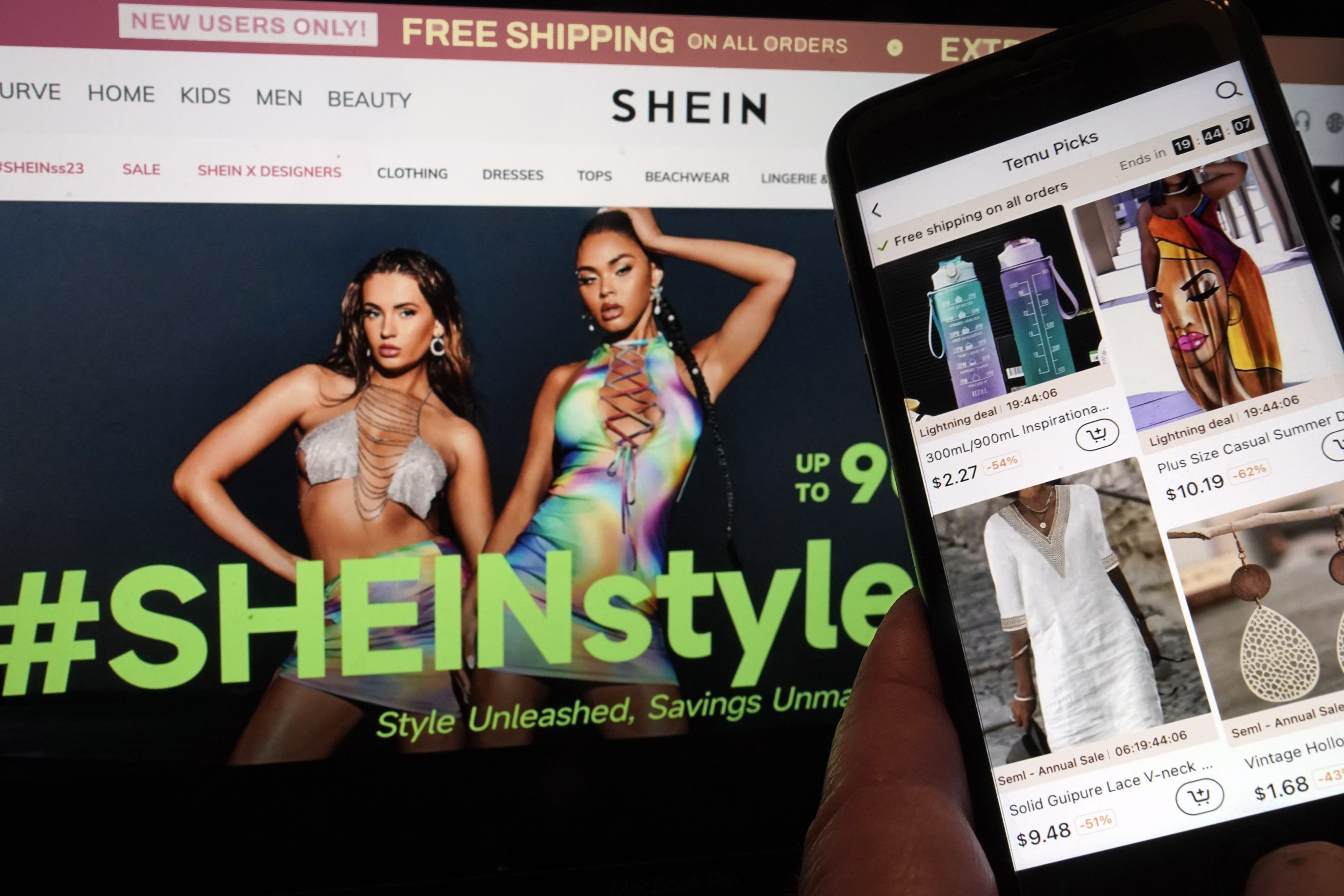

Online retail rivals Shein and Temu are transforming holiday shopping and challenging U.S. retailers by redefining consumer habits and turning holiday gifting into a colorful frenzy of bargains and impulsive clicks.

Holiday shopping has undergone several shifts over the years as many have turned away from traditional brick and mortar stores towards fast fashion and exclusively online shops.

However, with promises of unbeatable prices and endless choices, these exclusively online platforms have been shaking up Western retail markets drawing avid consumers and sharp criticism.

A Gamified Shopping Experience

Shopping on Temu often feels like playing a digital claw machine, with deals that entice shoppers to grab $2 camouflage balaclavas or $1.23 skeleton hand back scratchers before they disappear. Pop-ups, countdowns, and spinning wheels amplify the urgency, transforming browsing into an everyday Cyber Monday experience

Owned by China’s PDD Holdings, Temu pairs its gamified approach with a global inventory that meets demand at lightning speed.

Shein, its close rival, takes a slightly more polished approach. With roots in fast fashion, the Singapore-based company partners with influencers to target young women with an endless stream of trendy, budget-friendly clothing and accessories. Social media feeds light up with haul videos, but they also fuel debates about ethical sourcing and environmental concerns.

However, the business strategies of these platforms, amplified by relentless influencer campaigns and digital advertising blitzes, have positioned them as formidable challengers to Western retailers this holiday season.

Newsweek has reached out to Shein and Temu via email for comment.

Richard Drew/AP

A Billion-Dollar Disruption

This comes as both platforms are poised to rake in billions globally, with Salesforce estimating $160 billion in sales outside of China across major Asian marketplaces like Shein, Temu, TikTok Shop, and AliExpress this year.

Temu alone has become the second most-visited e-commerce site worldwide, challenging giants like Amazon, with competitive pricing and efficient delivery.

But their success hasn’t come without scrutiny. U.S. lawmakers have questioned whether Temu’s products are linked to forced labor, and the Biden administration has proposed tightening trade rules to curb duty-free imports of cheap goods.

President-elect Donald Trump is expected to impose high tariffs on goods from China, a move that would likely raise prices across the retail world.

In response, both platforms are establishing U.S.-based warehouses to reduce shipping times and mitigate regulatory risks.

As holiday shoppers are increasingly flocking to Shein and Temu for everything from stocking stuffers to statement furniture, the retail landscape continues to bring more dynamics.

For Lisa Xiaoli Neville, a Los Angeles nonprofit manager, who spoke to the Associated Press, she estimates she spends at least $75 a month on products from Shein. From quirky kitchen tools she barely uses to graphic tees for holiday gifting, she admits she has already picked out holiday gifts for family and friends from the site.

With most of the products in her online cart costing under $10, she said she plans to spend about $200 on gifts, significantly less than $500 she used to spend at other stores in prior years.

“The visuals just make you want to spend more money,” she told the AP, referring to the clothes on Shein’s site. “They’re very cheap and everything is just so cute.”

Meanwhile, Temu’s Black Friday promotions boasted discounts of up to 70 percent off retail prices, drawing in bargain-hunters with irresistible deals. However, completing a purchase often unlocks a flood of emails promising free giveaways—though there’s a catch: shoppers must buy more to claim them.

With offerings ranging from $25 dining chairs to $3,500 dining tables, shoppers like Dallas-based blogger Ellen Flowers, who spoke to the AP, said she plans to buy stocking stuffers on Temu as it offers a mix of practical finds with whimsical gifts.

However, looking beyond their bargain-focused origins, Shein and Temu are branching out. Shein has inked partnerships with brands like Forever 21 and The Children’s Place, aiming to diversify its offerings and bolster its credibility. Temu, on the other hand, is facilitating local inventory storage, positioning itself to sell bigger-ticket items like furniture.

This article includes reporting from The Associated Press